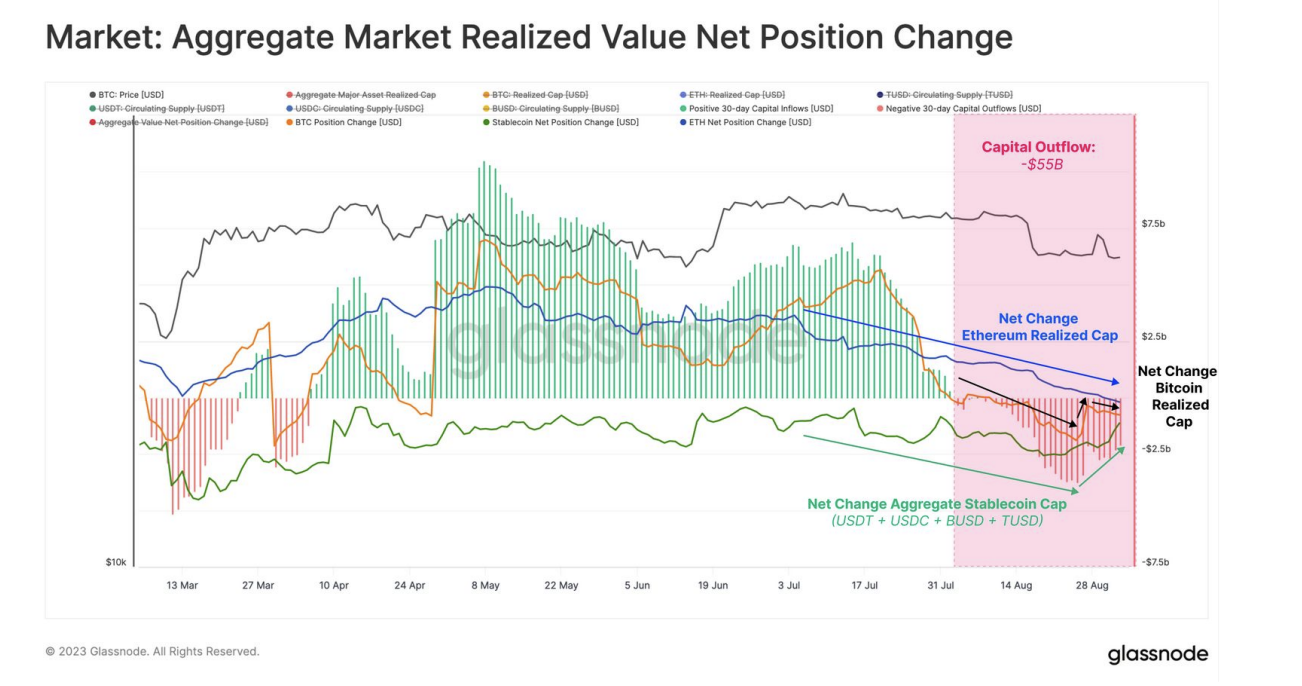

In August, the price of Bitcoin (BTC) decreased by over 10%, the largest monthly decline since November 2022. Along with that, over $55 billion worth of capital was drained out of the market, according to reports.

August was a highly volatile month for the crypto market, as Bitcoin fell from the highs of nearly $30,000 to $25,200. Mainly, the volatility during August was news-driven.

Capital Outflows Worth $55 Billion

According to a Bitfinex report, roughly $55 billion was withdrawn from the market in August across Bitcoin, Ethereum (ETH), and five major stablecoins. The crypto exchange used the Aggregate Realized Value metric to derive the result.

Click here to learn more about stablecoins.

Bitfinex explained the metric:

“It analyses the realized capital of BTC and ETH, with the combined supply from the top five stablecoins: USDT, USDC, BUSD, DAI, and TUSD.”

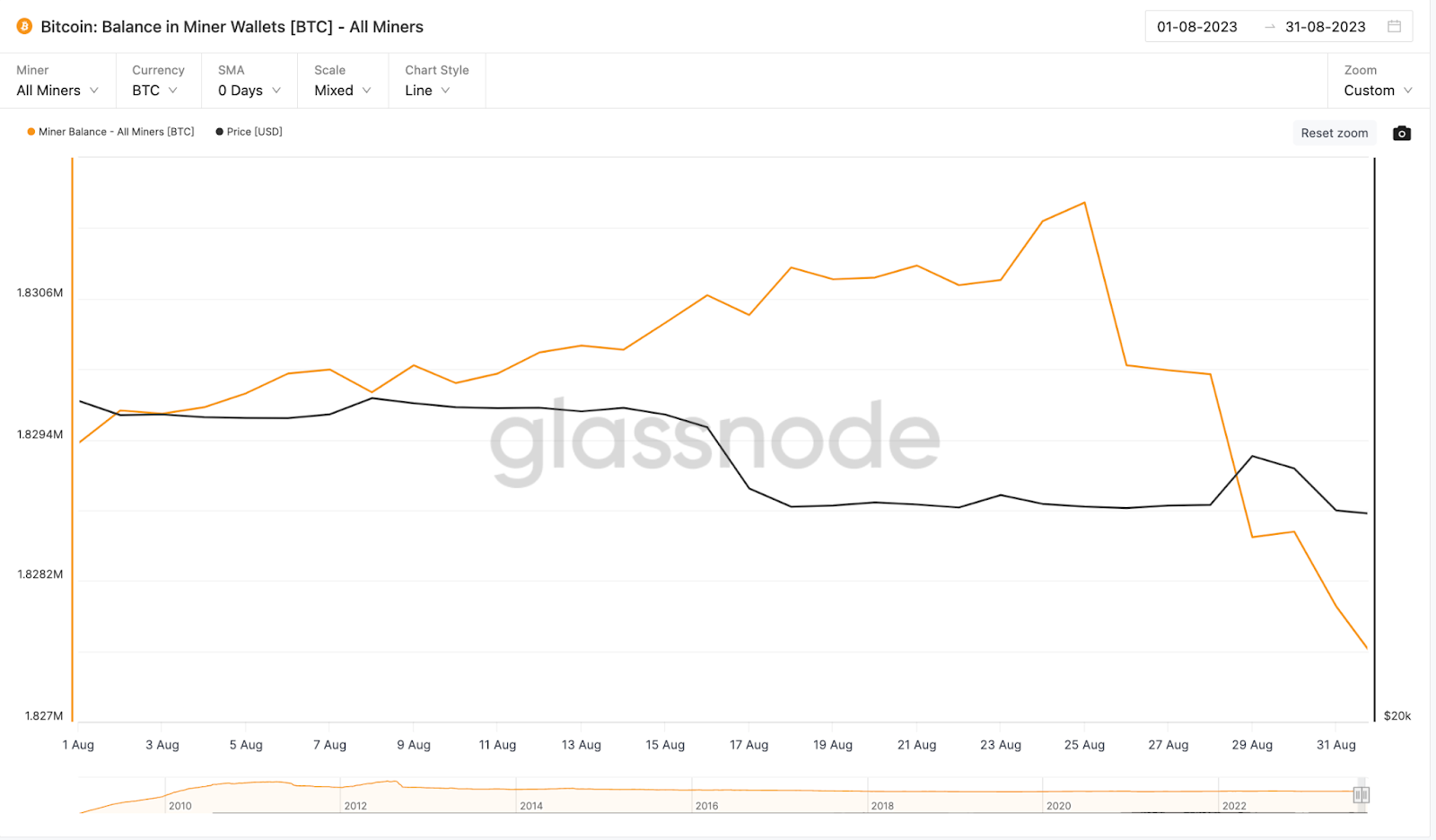

Bitcoin Miners Contributed Heavily to Selling Pressure

While the supply of Bitcoin in the long-term holders’ wallet is nearly at its all-time highs, the miners have been selling. The report mentioned that Bitcoin miners are the only long-term cohorts exiting their on-chain positions.

Click here to learn more about the eight best on-chain analysis tools in 2023.

According to the crypto exchange’s estimates, Bitcoin’s cost of production is nearly $24,287 per BTC. Bitfinex believes that the miners have been selling because the production cost is nearly equal to the market price of Bitcoin.

Moreover, the data from Glassnode shows that the Bitcoin balance in the miner wallet has plummeted sharply since Aug. 25.

Lastly, the report mentions that the crypto market is experiencing event-based volatility. It takes the example of Bitcoin’s crash to $25,200 on Aug. 17, and Grayscale’s victory against the Securities and Exchange Commission (SEC) on Aug. 29, which caused an 8% pump.

Do you have anything to say about crypto August data or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

beincrypto.com

beincrypto.com