All eyes were on the US Federal Reserve yesterday, but the expected interest rate hike didn’t result in any substantial volatility for bitcoin, which remains stuck between $29,000 and $30,000.

The altcoins are slightly in the green, with ETH nearing $1,900 and XRP reclaiming $0.7.

BTC Still Stuck Despite Fed’s Hike

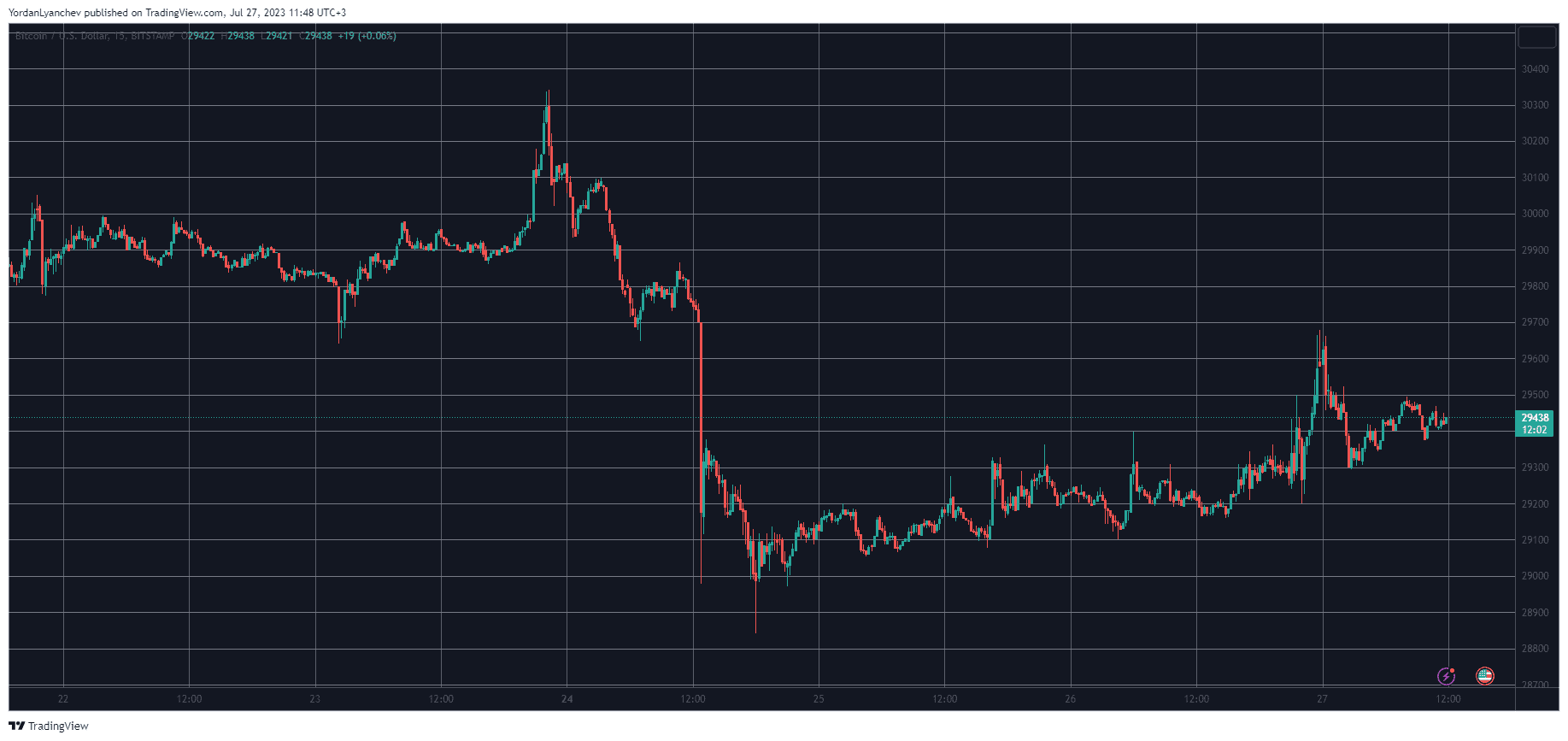

Bitcoin spiked above $30,300 on Sunday after several calm days, but the bears were quick to intercept the move and halt it in its tracks. Shortly after, BTC found itself slipping back to $30,000 before another retracement brought it all the way down to just under $29,000, which became its lowest price level in over a month.

The bulls stepped up at this point and tried to reverse BTC’s trajectory. As a result, the cryptocurrency reclaimed $29,000 and added a few hundred dollars by Wednesday.

Then came the US FOMC meeting in which Fed Chair Jerome Powell announced a fresh wave of increasing interest rates (25 bps). Historically, such hikes have affected BTC’s price performance, but this time the asset remained relatively quiet.

It spiked to $29,700 by Thursday morning but failed there and retraced by a few hundred dollars. Consequently, its market cap is still around $570 billion, but its dominance over the alts has taken a slight hit and is down to 48.2% on CMC.

XLM, SOL on the Rise

Stellar’s native token has emerged as the top performer from the larger-cap alts today. XLM has soared by more than 13% on a daily scale, and trees well above $0.15.

Solana and Chainlink follow suit, as both assets are up by 6%. Consequently, SOL has reclaimed $25, while LINK stands at $8.

More gains come from the likes of MKR, AAVE, and OP – all of which have increased by similar percentages as SOL and LINK.

ETH, XRP, and BNB are also in the green but in a more modest fashion. All three have jumped by about 1-2%.

The total crypto market cap has added just over $10 billion in a day and stands above $1.180 trillion on CMC.

cryptopotato.com

cryptopotato.com