One crypto trader earned $427,000 in profits within a month after buying the native tokens of major decentralized finance(DeFi) projects, including Uniswap’s $UNI, Lido’s $LDO, and Aave’s $AAVE.

According to Lookonchain, the trader made these profits without trading memecoins by simply capitalizing on the bull run of the crypto assets during the past month.

Crypto Trader Nets 40% Profit in 30 Days

Using the Ox123d address, the trader spent $942,000 to buy 71,891 $UNI at $4.34, 6,371 $AAVE at $50, and 189,255 $LDO at $1.64 on June 16.

As of July 15, $UNI’s price had reached $5.85, while $AAVE was worth $79, and $LDO traded at $2.37. This meant the trader made a 40% gain on his transactions, selling all the tokens for $1.37 million.

While this trade is a perfect example of smart money moves, it also highlights how well the DeFi tokens performed in the past 30 days. On July 10, blockchain analytical firm Kaiko reported that blue-chip DeFi tokens had performed phenomenally over the past month.

Crypto Market Maintains Positive Outlook Over Past Month

However, this positive price performance was not restricted to just DeFi tokens, as the broader crypto market rallied within that period too. According to BeInCrypto data, the top two flagship digital assets, Bitcoin and Ethereum, rallied to their yearly highs during this period.

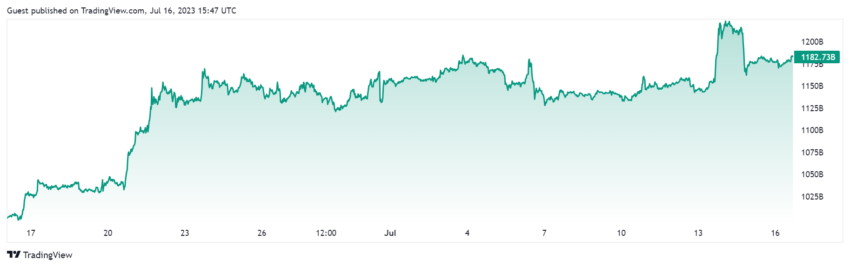

Meanwhile, several medium-cap digital assets like Bitcoin Cash, Solana, and others also saw their values spike to uncharted territories. During the period, all crypto assets market capitalization rose by 17% to $1.18 trillion at the time of writing, according to Tradingview data.

This positive price performance is not entirely surprising considering the several positive developments in the crypto industry during the last 30 days.

Towards the end of June, several traditional financial institutions, spearheaded by BlackRock, applied for a spot Bitcoin exchange-traded fund (ETF). Around this period, an institution-facing crypto exchange, EDX Markets, backed by Wall Street giants, began its operations.

The positive market sentiment continued into July, with crypto payment company Ripple scoring a significant victory against the US Securities and Exchange Commission (SEC) over its classification of XRP as a security.

However, the momentum has cooled, with the market seeing slight declines over the past two days. Still, most digital assets remain green due to their positive runs over the last 30 days.

beincrypto.com

beincrypto.com