With the rise in popularity of cryptocurrencies such as Bitcoin (BTC), as well as their underlying technology, many organizations around the world now issue blockchain stocks, which provide investors with exposure to the crypto market without having to buy any digital assets directly.

Although not all blockchain stocks are necessarily crypto stocks, they are closely related to digital assets, be it in the form of crypto exchanges or Proof-of-Work (PoW) miners, whereas others belong to large financial institutions or technology businesses developing blockchain.

With this in mind, Finbold has scoured the market and assembled a list of some of the best blockchain stocks that are worthy of keeping an eye out for in May as the fifth month of 2023 unfolds.

Marathon Digital Holdings (NASDAQ: MARA)

In March, Marathon Digital Holdings (NASDAQ: MARA) was one of the Bitcoin mining stocks that witnessed a major surge in price thanks to the rising interest in the flagship decentralized finance (DeFi) asset. Furthermore, in early April, the miner firm declared a record BTC production in Q1 2023.

At press time, the price of MARA stood at $8.78, indicating a whopping 145.25% growth since the beginning of the year, according to the latest charts retrieved by Finbold on May 2.

Notably, out of five analysts offering projections for Marathon Digital, two are giving a recommendation of a ‘strong buy,’ while three are in the ‘hold’ position, giving the stock its ‘buy’

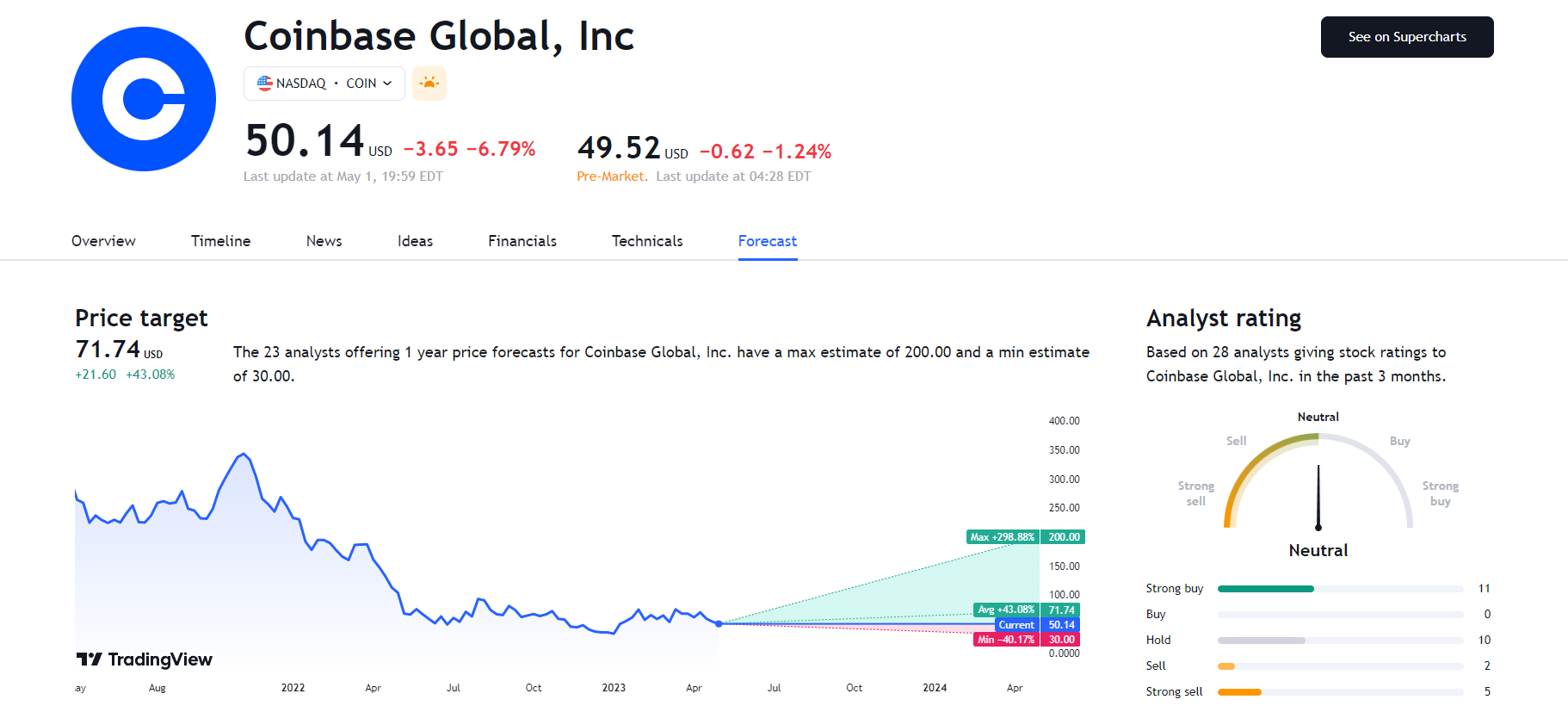

Coinbase (NASDAQ: COIN)

A popular crypto trading platform, Coinbase Global (NASDAQ: COIN), has gotten a lot of attention in recent weeks over its widely publicized opposition to the United States Securities and Exchange Commission (SEC) over its threats of enforcement action, as well as the exchange’s brewing legal battle against the regulator.

Amid all these developments, the COIN stock has been trading at the price of $50.14, recording an increase of 41.68% since the markets’ opening on January 3, 2023.

Interestingly, 11 out of 28 analysts recommend a ‘strong buy’ for Coinbase, 10 suggest to ‘hold,’ whereas two argue to ‘sell,’ and five are in the ‘strong sell’ position, giving the COIN stock an overall ‘neutral’ rating.

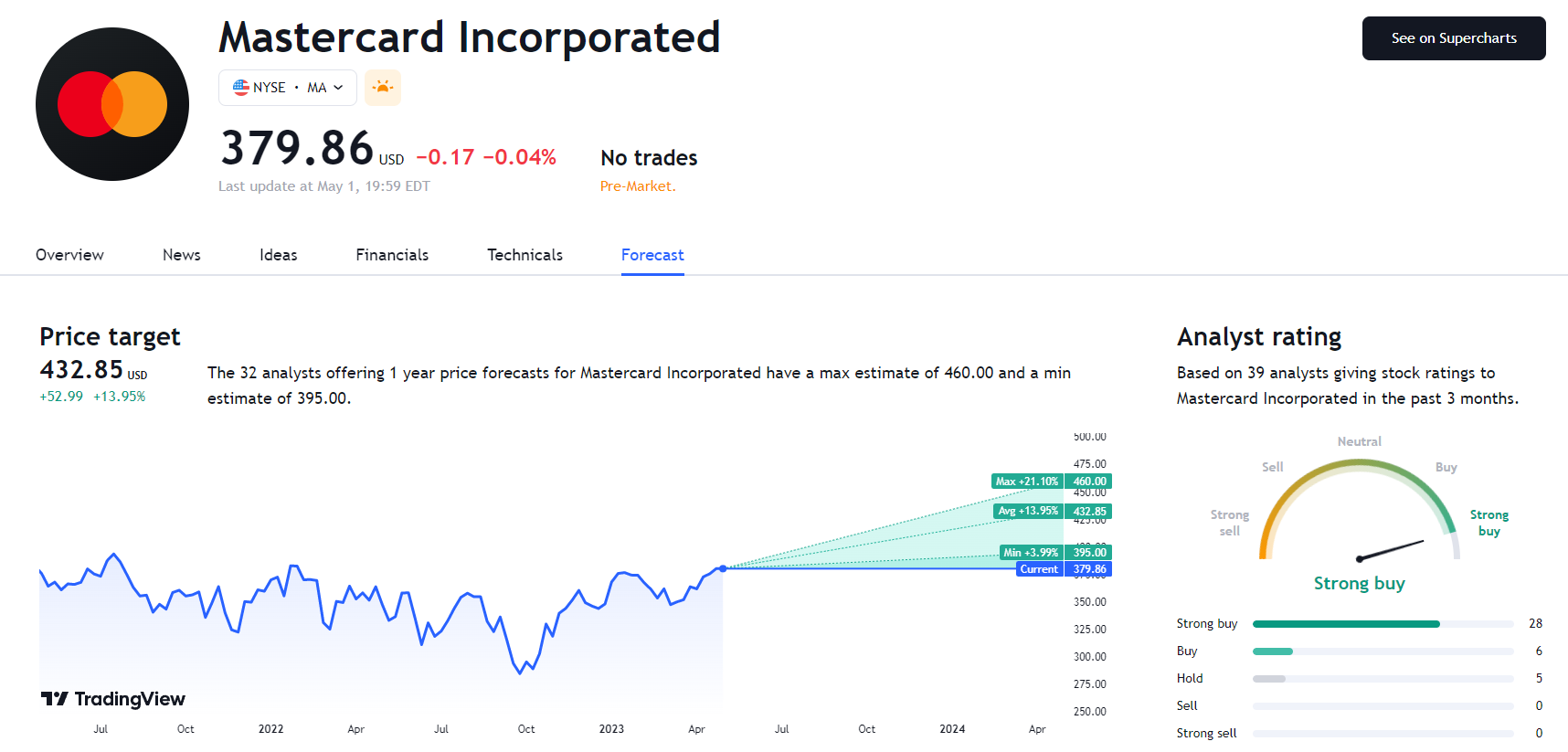

Mastercard (NYSE: MA)

Despite devoting a significant amount of its attention to building crypto partnerships, the finance behemoth Mastercard Incorporated (NYSE: MA) has recently announced an increased focus on developing blockchain technology to underpin more efficient payment systems instead.

Since the year’s turn, MA is up +29.9 or 8.54%, changing hands at the price of $379.86 at the time of publication, as the charts indicate.

At the same time, 28 out of 39 analysts giving stock ratings to Mastercard in the past three months have declared it a ‘strong buy,’ with six suggesting a ‘buy,’ five recommending to ‘hold,’ and no ‘sells’ or ‘strong sells.’

Having said that, it is important to do one’s own research when choosing stocks to invest in, as well as stay vigilant – and the same goes for blockchain stocks, as the stock market, like its crypto counterpart, sometimes has a habit of surprising an unsuspecting investor, be it in a positive or negative way.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com