We are pleased to announce our new Future Winners Portfolio, our first pure crypto portfolio.

Regular readers know about our Blockchain Believers Portfolio (a mix of stocks, bonds, and crypto, up +101% since it started three years ago), as well as our Health and Wealth Portfolio (all stocks, up +93% since it started at the beginning of the pandemic).

Even though we preach that blockchain is no more than 10% of our overall investments, people still ask us for more blockchain investing ideas. "Beyond bitcoin," they ask, "what do I buy?"

After much analysis and discussion, we created the Future Winners Portfolio as our top four picks in the crypto space.

Bitcoin (50%)

Bitcoin is the bellwether of blockchain. It’s been around the longest. It’s the largest by market cap. It has the most brand recognition.

Bitcoin was designed as a cryptocurrency, but very few actually use it as currency (apparently even in El Salvador). It’s instead more of a “digital gold,” a scarce digital asset that is designed to increase in value over time.

While day-to-day bitcoin prices are volatile, it’s quadrupled the performance of the S&P 500 in the last three years. And since bitcoin is a new type of investment, we don’t know how high it can go. (We do know how low it can go: zero. Never invest more than you’re willing to lose.)

There are risks, to be sure: perhaps the biggest risk is that government(s) will make bitcoin illegal. (China has already done so.) Still, bitcoin has survived any number of crises since its launch in 2009, and has always rebounded higher and stronger than before.

Blockchain investors don’t want to put all their eggs in one basket, but in our view, one of the eggs better be bitcoin.

Ethereum (30%)

We believe that Ethereum has even more room to grow than bitcoin, simply because it is becoming the backbone of blockchain, the “operating system” upon which the next generation of decentralized apps are being built.

Like bitcoin, Ethereum has problems. It’s slow. It’s expensive. It’s hard to scale. But it also has the most active and engaged developer community, and we believe smart developers will figure it out. (See the list of Layer 2 solutions, designed to make it cheaper and faster.)

The biggest problem with investing in Ethereum has been its continual minting of new ETH (thus diluting your investment), but this was changed in the recent EIP-1559 upgrade, which allows ETH to be taken out of circulation (thus strengthening your investment).

The biggest threat to Ethereum is simply that it loses out to a competing blockchain platform -- and there are plenty trying to knock it off its throne. The history of technology is filled with examples of early leaders who were overtaken by competitors (MySpace, Netscape, Yahoo!).

Still, the Value Per User for Ethereum (i.e., the cost you’ll pay per Ethereum user) is considerably cheaper than any of the hot new digital assets, making it a good deal on a VPU basis.

Uniswap (10%)

We published the origin story of Uniswap a year ago, and we’ve only grown more impressed since then.

The leading decentralized trading protocol, Uniswap makes it easy for users to “swap” (or buy and sell) one token for another, without going through a centralized exchange like Binance. Connecting to the website is fast and easy, and swaps are fast and efficient.

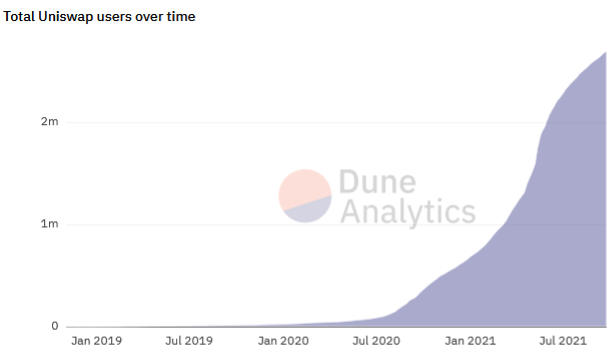

The rollout of Uniswap V3 in May 2021 provided more flexibility to Lending Partners (the users who are funding the “swaps” on the other side of the marketplace). So far it has been a success, as Uniswap has grown from 1.6 to 2.7 million users in just four months.

One of our favorite investing principles is to look for products that solve a real need, and that actually work. Uniswap wins on both counts: it is much faster and easier than centralized exchanges, and it just works.

That said, Uniswap is perhaps the riskiest asset in this portfolio, if only because it is so young. Competitors abound: Metamask was quick to introduce its own swap functionality, built right into the wallet. To maintain its lead, Uniswap will need to continue relentlessly innovating.

Binance Coin (10%)

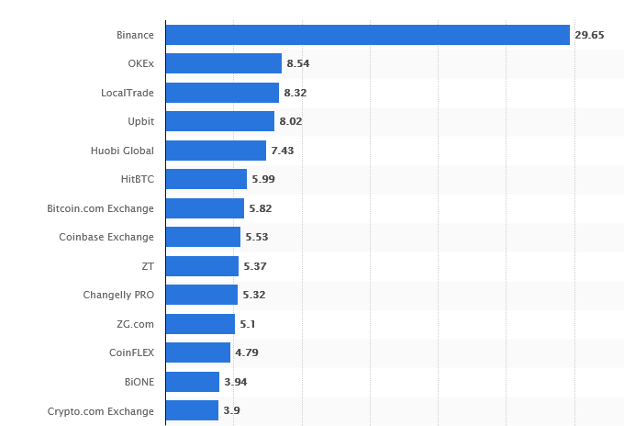

Binance is currently the largest crypto exchange in the world, so Binance Coin can be viewed a bit like investing in the “stock” of Binance itself. It is not a stock, but its fortunes have mirrored the fortunes of the Binance company, which is miles ahead of the rest of the industry in trading volume:

Binance Coin also functions something like an “in-game currency” that allows users to get better prices on their trades when they pay with BNB. This gives the token real-money value, and also serves as a “lock in” for traders using the platform: why would they go anywhere else?

The company has risks aplenty: governments around the world have opened investigations or outright banned the company, but Binance has nimbly moved between jurisdictions and found clever workarounds (when Binance.com was shut down in the U.S., the company created Binance.US, which is more compliant with U.S.-specific federal laws).

The company has also shown a remarkable willingness to disrupt itself. When decentralized exchanges like Uniswap began threatening its business model, it launched Binance Smart Chain, a fork of Ethereum that allows for faster, cheaper transactions and allows developers to build new decentralized products – including products that may take customers away from the centralized Binance exchange.

Despite the host of legal and regulatory uncertainty facing the company, we are most impressed with its ability to pivot quickly, and to execute on building great products that customers and developers love. Long-term, our money is on CZ and his team at Binance.

HODL the GODL

As long-term blockchain investors, we don’t dip in and out. We don’t try to time the market. We buy and HODL.

We think of these four projects as great “companies” (though only one is a company), making powerful products, led by terrific teams. Most important, we believe they are building the future of finance. These four projects will be the juggernauts of tomorrow.

These, we believe, are the Future Winners. Invest in them wisely.

bitcoinmarketjournal.com

bitcoinmarketjournal.com