By launching a competitive savings account for Apple Card holders, Apple has made its most substantial FinTech push yet. With Big Tech getting into BigBank, and how Apple is perceived as too big to fail, are smaller banks in for tough times?

Apple’s Launches Savings Account with Goldman Sachs

On Monday, Apple crossed the milestone by becoming the first Big Tech firm to offer savings accounts to US customers. The interest rate is initially set at 4.15% annual percentage yield (APY). This is 10x higher than the national average of 0.39% APY, according to the Federal Deposit Insurance Corporation (FDIC).

Apple Card customers will have their savings deposits insured by the FDIC at a standard $250,000 per depositor account. That’s because Goldman Sachs is managing this latest Apple Card feature, just as it issued Apple Card in the first place.

The Apple-Goldman Sachs partnership for this specific feature was sealed in October 2022.

Interestingly, Marcus by Goldman Sachs offers lower savings yield at 3.9% APY, with no minimum balance required, which is in line with Apple Card as well. According to the BankRate aggregator, only five other banks are offering above 4.15% APY yields. CIT Bank offers the highest, at 4.75%, but requires a substantial minimum balance of $5,000.

In stark contrast, Bank of America has an abysmal savings APY under 0.04%. As the gadget provider of choice for most Americans, Apple is certainly setting a new APY threshold that customers should expect. In turn, this could create more instability in the financial sector.

On Tuesday, the Financial Times already reported a near-$60 billion pullout from three US banks as Apple’s latest feature hit the public spotlight.

Apple Card Still Reserved for the US

As of January 2023, there are nearly 1.8 billion iPhone users. However, since Apple Card launched in August 2019, it hasn’t expanded beyond the US borders. Nonetheless, the user count growth has been respectable, having more than doubled last year, at 6.7 million, compared to 3.1 million in 2020.

American iPhone users have primarily opted to use Apple Card as their source of credit, at 60%. Moreover, as Wallet app users receive cashback rewards at 2% via Apple Pay, they can now funnel those rewards into a savings account.

While Apple Pay is a digital wallet for convenient online purchases, Apple Card is a true credit card with all the perks and benefits, now with a savings account as the latest. In terms of popularity, Apple Pay even exceeded PayPal as the top mobile payments app, with 507 million global users.

Apple’s FinTech Play Already Dominates the US

According to Global Market Insights, the US mobile wallet market is expected to reach a $970 billion valuation by 2030. This is unsurprising as smartphones have become the center of people’s social and financial life.

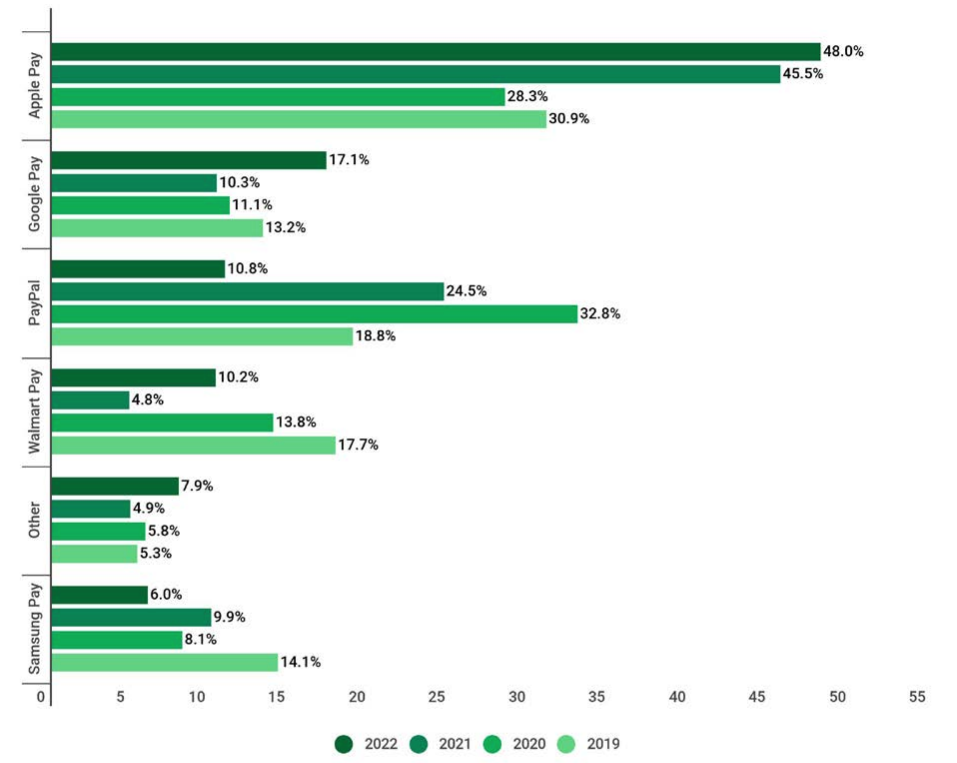

In addition to Apple Pay and Apple Card, the company paved the payments road with Apple Pay Later service, allowing users to fragment their purchases into four payments across six weeks. Apple’s FinTech expansion has been exceedingly successful, already achieving mobile market dominance, with Apple Pay at 48%.

This reflects Apple’s smartphone market share in the US, at 52.5% as of December 2022, according to Counterpoint. However, it bears noticing that debit and credit cards still make for the bulk of purchases, at 44.2% and 27%, respectively. But as generational habits shift, that is inevitably going to change.

From the same PYMTS report, when respondents were asked if they would change merchants based on their acceptance of mobile wallets, generation Z responded affirmatively at 68.9%. In comparison, baby boomers and Generation X consider this 3x less important, at 23.6% and 34.5%, respectively.

Considering this trend, it is clear that Apple is betting big on cornering the payments market. With the latest savings account addition, Apple users are further incentivized to join the emerging BigTech-BigBank conglomerate. All that is left is Apple’s take on investment apps.

Do you think users will become more vulnerable as big companies take the role of both finance and tech? Let us know in the comments below.

tokenist.com

tokenist.com