Standing still is not an option in the FinTech industry. One only has to recall Blockbuster’s missed chance to invest in Netflix to see how fast trends can change. Despite Visa’s global market dominance in payments, the company is now preparing to transition into digital payments.

Visa Moving Ahead with Digital Currencies

Although VisaNet can handle up to 65,000 transactions per second, it is still beholden to the Society for Worldwide Interbank Financial Telecommunications (SWIFT) as the baseline payment infrastructure between banks. At the recent StarkWare Sessions 2023 event in Tel Aviv, Visa aims to bridge that gap by experimenting with digital assets.

“We set all over Swift, so we can’t move money as frequently as we’d like because there are a number of limitations that exist in those networks. And so, we’ve been experimenting, we publicly announced. We’ve been testing how to actually accept settlement payments [with stablecoins],”

Cuy Sheffield, Head of Crypto at Visa

StarkWare Sessions is an Ethereum-oriented community event focused on the latest developments, round tables, and workshops. In March 2021, Visa became the first significant payments network to settle USD Coin (USDC) stablecoin settlement on the Ethereum network, thanks to Visa’s partnership with Crypto.com.

Still in the pilot stage, Sheffield said that Visa integrates blockchain transactions on top of the Swift network.

“The same way that we can convert between dollars in euros on a cross-border transaction, we should be able to convert between digital tokenized dollars and traditional dollars.”

For crypto exchanges and other companies, relying on digital assets alone means they don’t have to hold traditional fiat in treasuries for their settlements. For example, Crypto.com uses Anchorage, a federally chartered digital asset bank. As Visa’s partner, Anchorage can settle USDC transactions sent to Visa as a part of the Crypto.com Visa card program.

Why USDC and Ethereum?

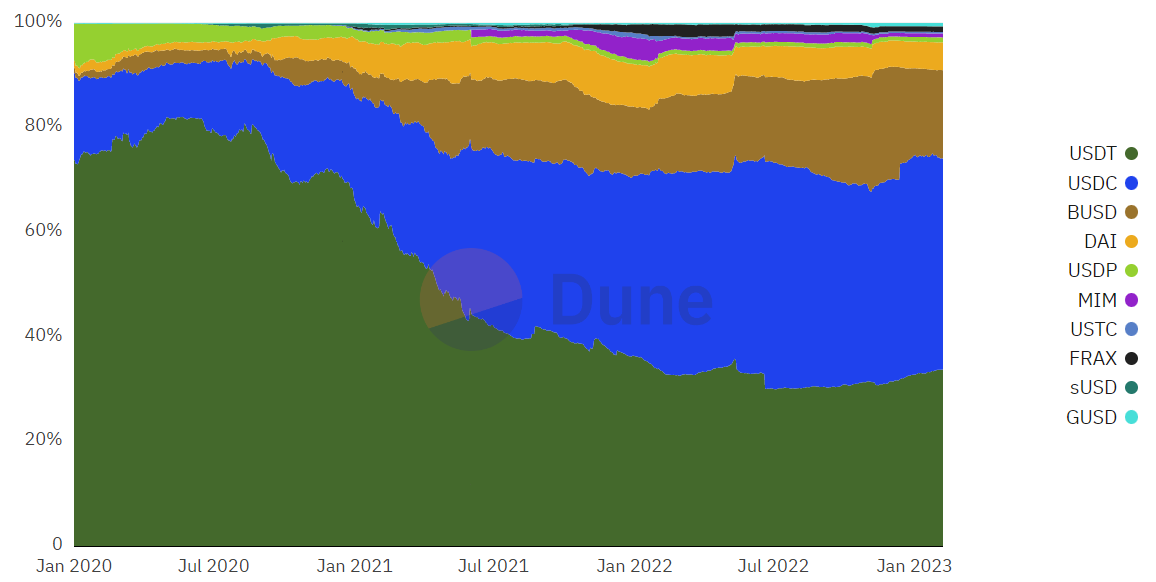

Although USDC is second by market cap, at $41B vs. USDT’s $68B, it is one of the most regulated stablecoins, issued by Circle and Coinbase through the Centre Consortium. Moreover, USDC has a more significant market share on Ethereum, at 40.4%, vs. USDT’s 33.7%.

In Visa’s words, “USDC was selected based on our due diligence efforts, which included an examination of client demand, stability, and security.”

Last month, Circle announced that USDC reserves would be audited by Deloitte, one of the Big Four accounting firms, which also services Coinbase. Despite Circle’s $9 billion SPAC being terminated after the FTX crash, the company is still moving ahead to bolster user confidence by proofing USDC reserves.

“We are disappointed the proposed transaction timed out, however, becoming a public company remains part of Circle’s core strategy to enhance trust and transparency, which has never been more important,”

Circle CEO Jeremy Allaire

In turn, Ethereum is the largest public blockchain for the decentralized finance (DeFi) ecosystem. On average, Ethereum handles 1.1 million daily transactions, which is far ahead of competing chains. Whether Aptos or other L1 chains will change Ethereum’s positioning will depend on the success of Ethereum’s further scaling.

Visa Wants a Cashless Society

Visa’s core business model relies on more people ditching physical banknotes, as the company takes a cut on each transaction it processes. In the US, Visa holds market dominance at 52.8% at 335 million credit cards in use, according to Shift Processing. Interestingly, American Express is the least popular, at 7.5% share, with Mastercard second at 31.6%.

In early 2018, Visa completed its Cashless Challenge campaign, offering $10,000 in rewards to small businesses that went cash-free. One of the winners, Thomas Nguyen, owning Peli Peli Kitchen, said that going cashless speeds up day-to-day operations, makes the food environment cleaner, and makes the business less of a target for theft.

Moving forward from electronic to digital, Visa distinguishes three types of digital currencies:

- Cryptocurrency – Bitcoin (BTC), Ethereum (ETH)

- Stablecoins – USD Coin (USDC), Tether (USDT)

- Central bank digital currency (CBDC) – 86% of the world’s central banks are developing CBDCs

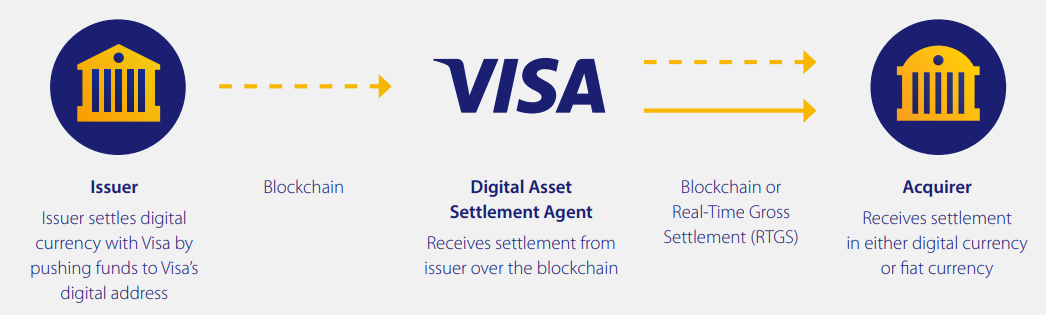

To facilitate the emerging digital landscape, Visa will integrate blockchain networks as the intermediary settlement agent between banks.

To make that happen, Visa launched the Universal Payment Channel (UPC) project in September 2021, published on Cornell University. This interoperability hub would connect multiple blockchain networks, including for CBDCs. In other words, Visa’s upcoming UPC is a universal adapter among blockchains, much like USB is for electronic devices.

From the end-users’ perspective, little will change as e-commerce platforms and merchants onboard Visa’s digital payment system.

As an additional layer, carbon tracking is also in the works. Just like Mastercard, Visa will offer CO2 emissions monitoring from purchases. In Canada, Vancity Visa credit card holders can already tally their monthly carbon emissions from the start of this year. A company called ecolytiq made that happen by offering a novel sustainability-as-a-service business solution.

In May 2022, Visa helped ecolytiq raise $14.5 million to expand operations. When CBDCs come online, we will likely see further integration between CBDCs as programmable tokens and carbon counting. This will be another tool to “encourage and incentivize sustainable consumption behavior,” as expressed by ecolytiq.

Do you think anonymity, as the core feature of cash, is heading for the dustbin of history? Let us know in the comments below.

tokenist.com

tokenist.com