Crypto mining stocks are soaring as bitcoin price rebounds to a new multi-month high above $21,000 after a prolonged bear market.

According to a Tuesday report by Bloomberg, several Bitcoin mining stocks have recorded their best monthly performance in at least a year.

Bitcoin Mining Stocks Rebound

As per the report, the MVIS Global Digital Assets Mining Index is up by 64% since the beginning of this month, a stark contrast to the 88% drop recorded last year. Bloomberg also pointed out that this is the Index’s best month since its launch at the end of 2021.

Bitfarms, one of the biggest Bitcoin mining firms in the industry, recorded an increase of more than 140% in the first two weeks of January. It is closely followed by Marathon Digital Holdings Inc., which has surged over 120%. Hive Blockchain Technologies Ltd. also saw the value of its stocks more than double during the same period.

The report further noted that the Luxor Hashprice Index is up 21% this year, which is partly a reflection of bigger rewards from a surge in bitcoin’s price. The Index seeks to estimate how much a miner can expect to earn from the computing power used for the Bitcoin network.

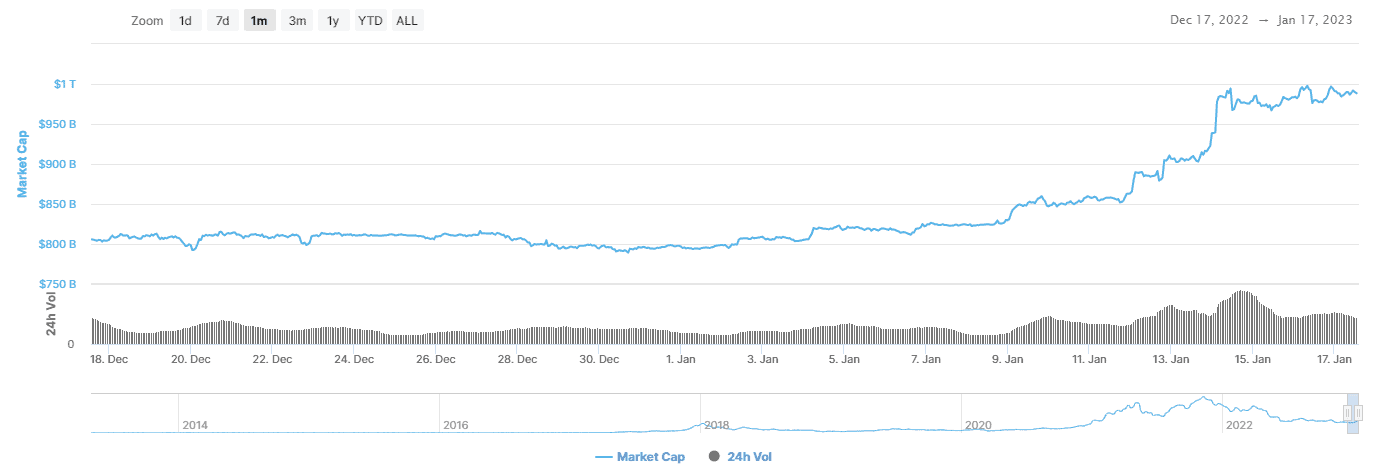

The upward movement in Bitcoin stocks comes amid a broader market rally, which has added more than $100 billion to the crypto market’s total capitalization over the past two weeks. Bitcoin is up more than 28% since the beginning of this year, fueling the demand for mining stocks.

Soaring Prices Relieve Miners from Prolonged Bear Market

Soaring stock values have relieved struggling crypto mining firms since the prolonged 2022 crypto winter, and energy worries pummeled the shares last year.

The 2021 bull run spurred several crypto mining companies to invest heavily in pieces of equipment and expansion plans. These firms had borrowed huge sums to fund their expansion plans, which hurt their finances during the 2022 bear market.

The crypto winter forced several top mining firms to shut down operations. In December, Core Scientific Inc., the largest Bitcoin miner by computing power, declared bankruptcy.

Other cash-strapped miners, such as Riot Platforms Inc. and Bitfarms Ltd., started selling a significant amount of their reserves last year to boost liquidity.

cryptopotato.com

cryptopotato.com