Crypto markets whipsawed in reaction to the latest inflation data, which indicated a mild decline in line with analysts expectations.

The Consumer Price Index (CPI) declined 0.1% in Dec., according to the latest inflation report from the U.S. Bureau of Labor Statistics. This was the biggest monthly decline since April 2020. Although year-on-year CPI continued to rise by 6.5%, it still represents progress in terms of inflation reduction.

The Dec figures are an improvement over the Nov. monthly increase of 0.1% and year-on-year jump of 7.1%. The latter figure peaked at 9.1% in June last year. But while last month’s figures came in below expectations, this month they were exactly as analysts had predicted.

Market Reaction

As the Dec. consumer prices report demonstrated that inflation is cooling, it garnered a mixed reaction from stock futures. Futures linked to the Dow Jones Industrial Average gained 72 points, rising 0.2%. But while S&P 500 futures were also up 0.2%, Nasdaq-100 futures trailed off 0.1%.

Stock indices took well to the news, with the S&P 500 rising 4% and the Nasdaq Composite up 6%. These figures were taken over the past five days in anticipation the report would show a slowing inflation trend. “No surprise here,” said Nancy Davis, founder of Quadratic Capital Management. “A weaker CPI was already priced-in by the bond market even before Thursday’s number.”

Crypto Reaction

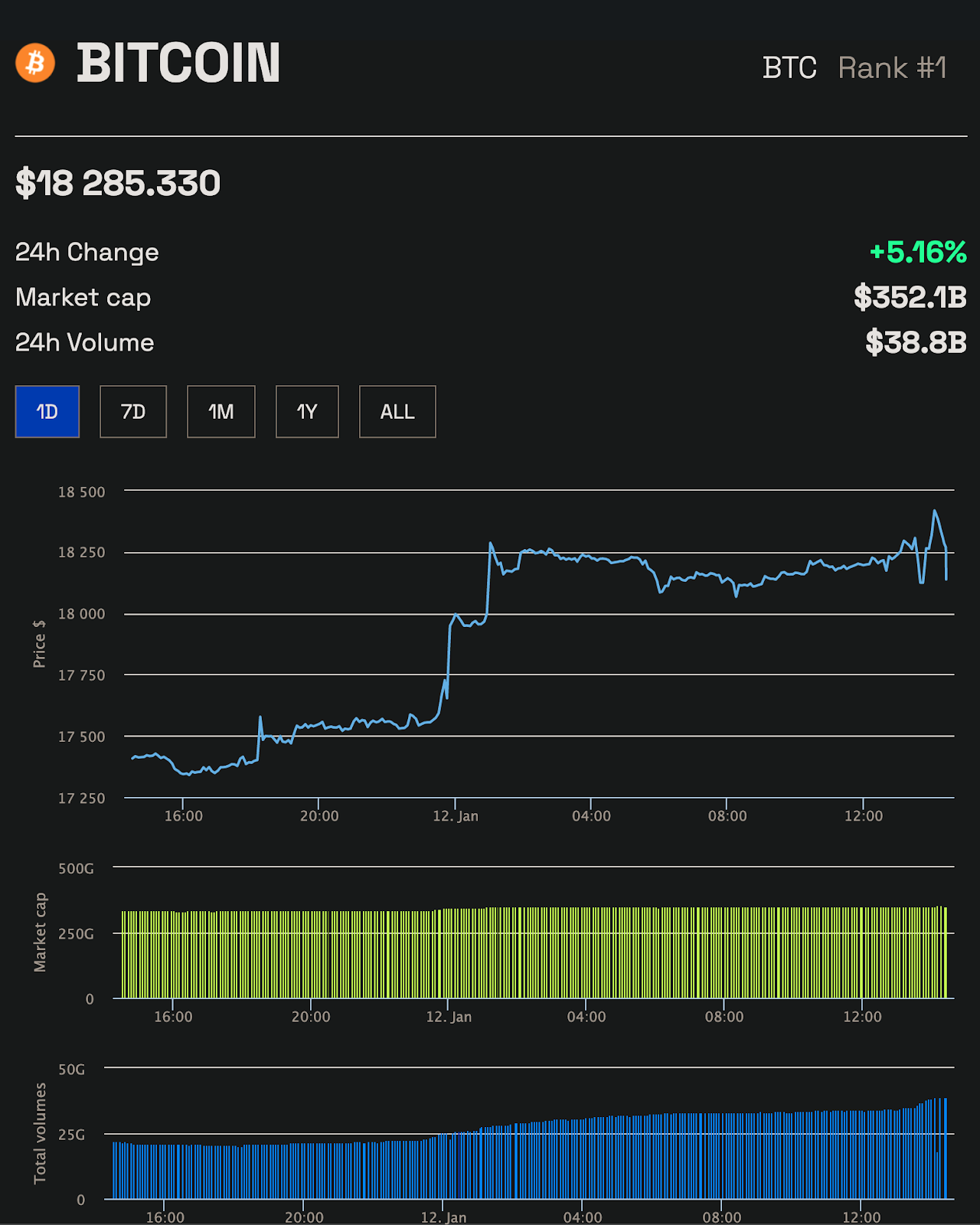

Similar to stock futures, crypto markets whipsawed considerably following the news inflation had declined. In the minutes following the announcement, Bitcoin slid from roughly $18,300 to just above $18,000. However, from there, buying pressure seemed to return pushing Bitcoin back up to $18,350. From there it sold off once again and is now trading around $18,150.

beincrypto.com

beincrypto.com