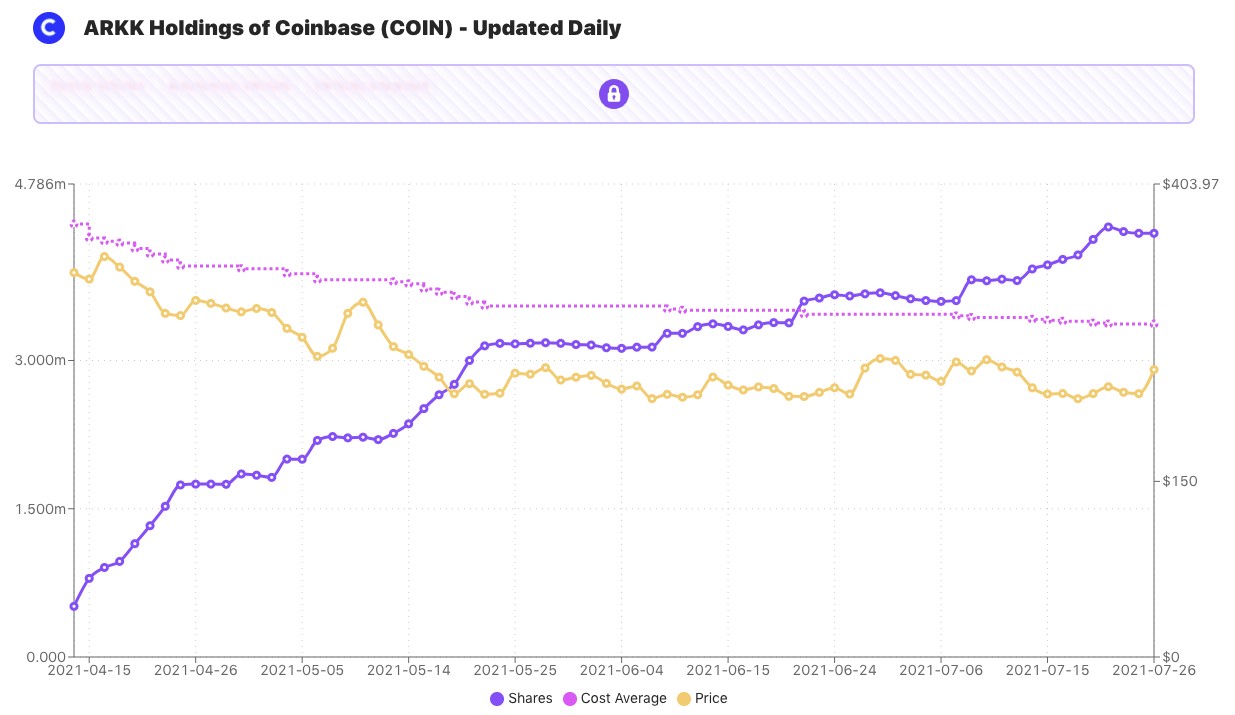

Cathie Wood’s Ark Investment started this week by adding to its COIN shares stash. On Monday, Ark bought another 113,043 shares of cryptocurrency exchange Coinbase. Ark made a sizable purchase right on the first week of Coinbase's direct listing on Nasdaq, and since then, the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF) have been gradually adding shares. For the past two weeks, Ark has been continuously buying COIN shares, increasing its exposure to the largest crypto exchange in the US.  This week, COIN shares were added to the ARK Fintech Innovation ETF (ARKF) that invests primarily in up-and-coming fintech stocks. Some of its biggest holdings include Square and PayPal — both of which offer cryptocurrency services, along with Zillow, Pinterest, and Alibaba. The fund currently has $4.2 billion in net assets. With this, Coinbase now accounts for 4.59% of ARK Innovation ETF (ARKK) Holdings, as of July 27, 2021. Coinbase is currently the top 10-holding, 7th largest, in ARK's flagship Innovation fund that invests primarily in disruptive innovation across multiple industries. Tesla is ARKK’s biggest holding with a 10.28% share, the only company with a share in double digits. The next biggest holding of 6.63% is Roku. The electric car maker holds Bitcoin on its balance sheet and its CEO Elon Musk also personally owns BTC, ETH, and DOGE. Musk recently revealed that his other company SpaceX is also a long-term holder of Bitcoin. [coin_stats_table symbol="BTC"][coin_stats_table symbol="ETH"][coin_stats_table symbol="DOGE"] As of writing, COIN shares are trading at $245.45, up from $220.61 a week back but still way off of its debut high of $429.54. Meanwhile, a class-action lawsuit has been filed against Coinbase, its executives, and investors over the company's Nasdaq listing. The lawsuit claims that the statements made by the company before its IPO were false and misleading. The lawsuit is on behalf of investors concerning the company’s possible violations of federal securities laws.

This week, COIN shares were added to the ARK Fintech Innovation ETF (ARKF) that invests primarily in up-and-coming fintech stocks. Some of its biggest holdings include Square and PayPal — both of which offer cryptocurrency services, along with Zillow, Pinterest, and Alibaba. The fund currently has $4.2 billion in net assets. With this, Coinbase now accounts for 4.59% of ARK Innovation ETF (ARKK) Holdings, as of July 27, 2021. Coinbase is currently the top 10-holding, 7th largest, in ARK's flagship Innovation fund that invests primarily in disruptive innovation across multiple industries. Tesla is ARKK’s biggest holding with a 10.28% share, the only company with a share in double digits. The next biggest holding of 6.63% is Roku. The electric car maker holds Bitcoin on its balance sheet and its CEO Elon Musk also personally owns BTC, ETH, and DOGE. Musk recently revealed that his other company SpaceX is also a long-term holder of Bitcoin. [coin_stats_table symbol="BTC"][coin_stats_table symbol="ETH"][coin_stats_table symbol="DOGE"] As of writing, COIN shares are trading at $245.45, up from $220.61 a week back but still way off of its debut high of $429.54. Meanwhile, a class-action lawsuit has been filed against Coinbase, its executives, and investors over the company's Nasdaq listing. The lawsuit claims that the statements made by the company before its IPO were false and misleading. The lawsuit is on behalf of investors concerning the company’s possible violations of federal securities laws.

Cathie Wood’s Ark Investment Buys Another Batch of Coinbase (COIN) Shares

bitcoinexchangeguide.com

27 July 2021 09:25, UTC

bitcoinexchangeguide.com

27 July 2021 09:25, UTC