Despite the latest market downturn, more than 50% of India’s survey respondents intend to expand their investments in crypto in the coming six months – indicating an optimistic approach to the market, according to a report by crypto exchange KuCoin.

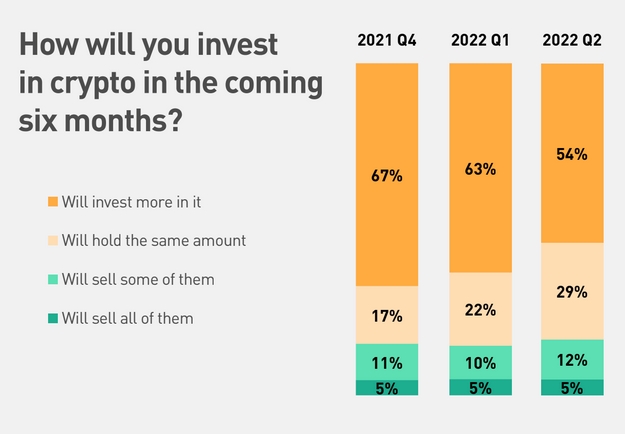

Data from the report shows that, in the second quarter of 2022, 54% of Indian investors were planning to invest more of their funds in crypto in the coming six months. This said, the figure was lower than the one reported in the preceding quarter when 63% of the polled expressed the same position.

Among the respondents from the second quarter of 2022, 29% said they intended to preserve their existing crypto holdings, 12% replied they planned to sell some of them, and only 5% wanted to sell all of them, according to the report.

As “of June 2022, there are roughly 115 million crypto investors in India who either currently hold crypto or have traded crypto in the past six months, which account for 15% of the Indian population aged 18 to 60,” KuCoin said.

A further 10% of Indian adults comprise crypto-curious consumers who are aiming to invest in crypto in the next six months, according to the report.

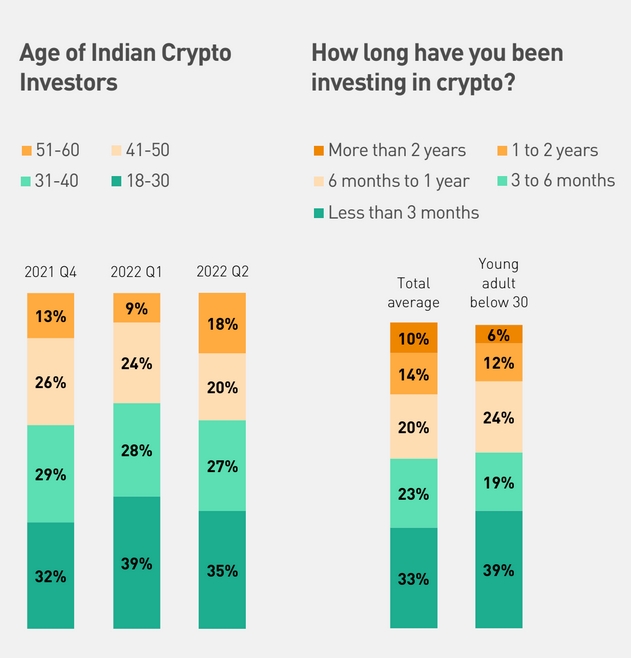

India’s crypto landscape is dominated by young investors, with 39% of them below the age of 30. Per the report, young Indian crypto investors believe that crypto is more of a long-term investment than a hype, and about 26% of such investors plan to launch a business with the use of their crypto gains.

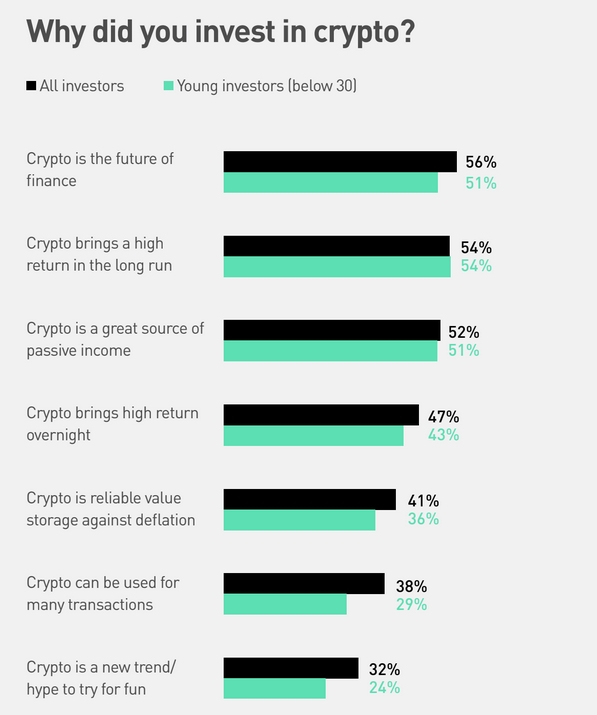

Furthermore, the majority of the respondents said that they invested in crypto because it is "the future of finance," it "brings high return in the long run," and it's "a great source of passive income."

The Indian crypto market is forecast to reach some USD 241m by 2030, and its growth is not expected to be hampered by the latest fiscal decisions taken by the Indian authorities, the exchange said.

“Despite the ambiguity in regulations and extreme volatility, young Indian investors prefer to buy crypto as assets over gold,” according to KuCoin. “In April 2022, the Indian government imposed a 30% tax on income from virtual digital assets, which many industry experts took as a sign that crypto trading won't be banned after all. The government also said it would launch a digital rupee in the coming months, which is set to give a big boost to the digital economy.”

It is noteworthy that, at a rate of 30%, the tax on cryptoasset gains is higher than the nation's tax rate on stock trading which ranges from 0% to 15%. The government’s approach to crypto is the main reason deterring potential investors, with 33% declaring that government regulation is a source of concern when considering investing in cryptocurrencies.

Per KuCoin, the report is based on a total sample of 2,042 Indian adults aged 18 to 60. The survey respondents were polled from October 2021 to June 2022 and included 1,541 self-identifying crypto investors (who currently own crypto or have traded crypto in the past six months and will continue to trade in the coming six months) and 501 crypto-curious consumers (who were interested in investing in crypto in the coming six months).

____

cryptonews.com

cryptonews.com