Bitcoin looks like it wants to catch up with Ethereum after the number two crypto’s bullish price action over the past three days. While ETH has outperformed BTC, the top crypto appears to be on the brink of a breakout.

Ethereum Takes the Lead

Ethereum is leading the revival in the cryptocurrency market after slicing through a crucial area of support.

The world’s second-largest cryptocurrency by market capitalization jumped to the $1,350 level over the weekend and has since rallied to almost $1,500. Improving sentiment surrounding Ethereum’s forthcoming “Merge” to Proof-of-Stake is one of the likely factors behind ETH’s recent upswing. Last week, Ethereum Foundation member Tim Beiko suggested a provisional launch date of September 19, 2022 for the blockchain’s crucial Proof-of-Stake update in the latest Consensus Layer Call, hours before ETH started to rally.

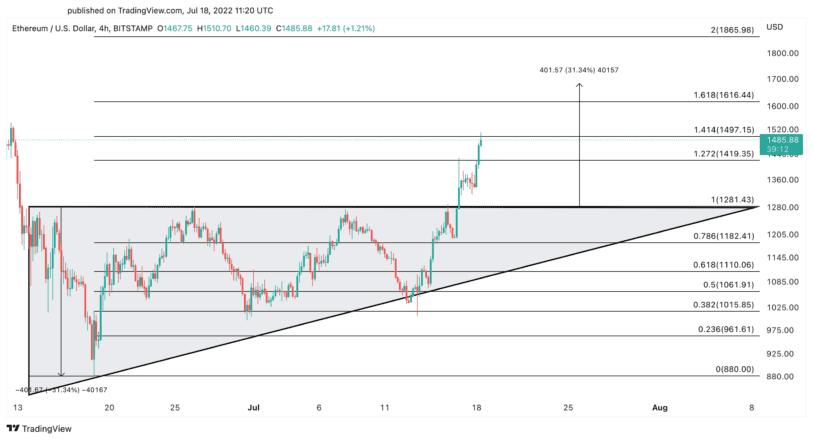

As speculation mounted, ETH printed a four-hour candlestick close above the $1,300 resistance level on Jul. 16 and has since risen by more than 16%. The formation of an ascending triangle on its four-hour chart projects a target of $1,700 in the near-term future. Still, ETH must first slice through the $1,500 supply wall.

Bitcoin appears to be following Ethereum’s path as the top cryptocurrency rose by more than 8% Monday. It’s now testing the X-axis of an ascending triangle that developed on its four-hour chart. A decisive close above this crucial area of resistance could trigger a 22% upswing toward $27,500. This bullish outlook derives from adding the height of the triangle’s Y-axis to the breakout point.

While the odds appear to favor the bulls, a break of vital support levels could signal an invalidation of the bullish thesis. ETH needs to hold the $1,400 level as support to avoid a downswing to $1,300. Similarly, if BTC suffers a rejection at $22,600, it could suffer a correction to $21,400.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.

cryptobriefing.com

cryptobriefing.com