Relevance up to 09:00 2022-06-21 UTC+2 Company does not offer investment advice and the analysis performed does not guarantee results. The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Crypto Industry News:

Tether, the largest stablecoin and the third largest cryptocurrency in the world, fell victim to a massive DDOS attack on June 18.

According to a tweet by Paolo Ardoino, the company received a ransom note from hackers who attacked its system. He explained, however, that this was by no means new. Tether has dealt with similar situations in the past.

As a result of the attack on the stablecoin site, 8 million queries were recorded in 5 minutes. On a normal day, she only receives 2 inquiries per 5 minutes. The company first reported the attack about 2 hours after it was launched.

While tether has been losing market share in the past few weeks, other stablecoins, such as USD Coin (USDC), have been gaining in value. USDC's market capitalization has risen from approximately $ 48 billion in mid-May to $ 55 billion today.

The dwindling market cap of the tether is taking place in the face of ongoing panic in the market. The aggregate value of the entire cryptocurrency market has recently dropped below $ 1 trillion for the first time since February 2021.

Technical Market Outlook:

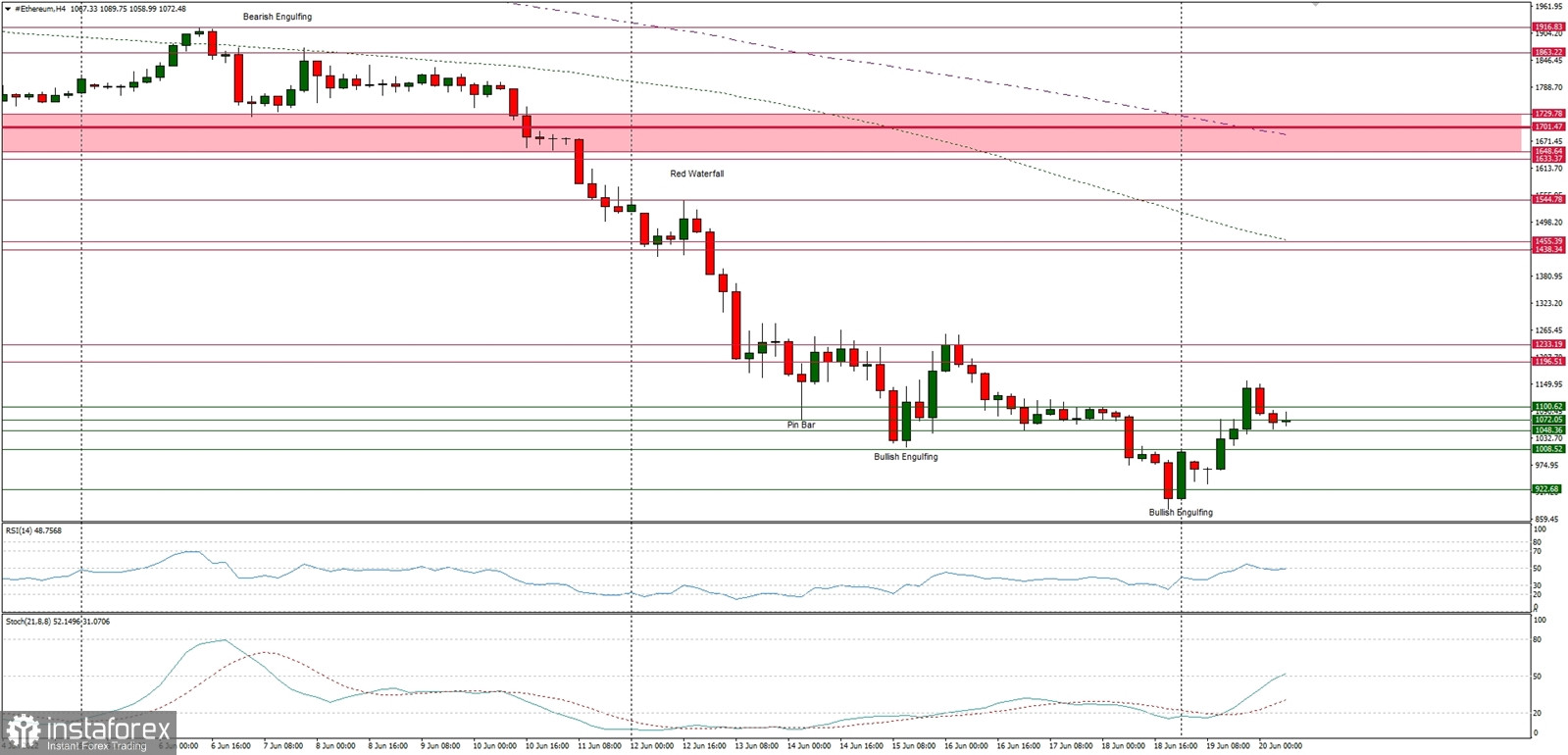

The ETH/USD pair had made the Bullish Engulfing candlestick pattern at the H4 time frame chart and is continuing the up move. The recent local high was made at the level of $1,156, however, it is still not enough to terminate the down trend just yet. The next target for bulls is seen at the level of $1,233, which is the technical resistance. The intraday technical supports are seen on the levels of $1,048, $1,008 and $1,000. The larger time frame chart trend remains down and as long as the key short-term technical resistance is not clearly violated, the outlook remains bearish.

Weekly Pivot Points:

WR3 - $2,249

WR2 - $1,737

WR1 - $1,420

Weekly Pivot - $1,161

WS1 - $818

WS2 - $551

WS3 - $206

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,420 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,000. Please notice, the down trend is being continued for the 11th consecutive week now.

Read more: https://www.instaforex.eu/forex_analysis/280793

fxmag.com

fxmag.com