This week, crypto-asset prices show strength, with Bitcoin going to nearly $39,500 and Ether climbing to almost $2,900. While the price action is green, it remains range bound still.

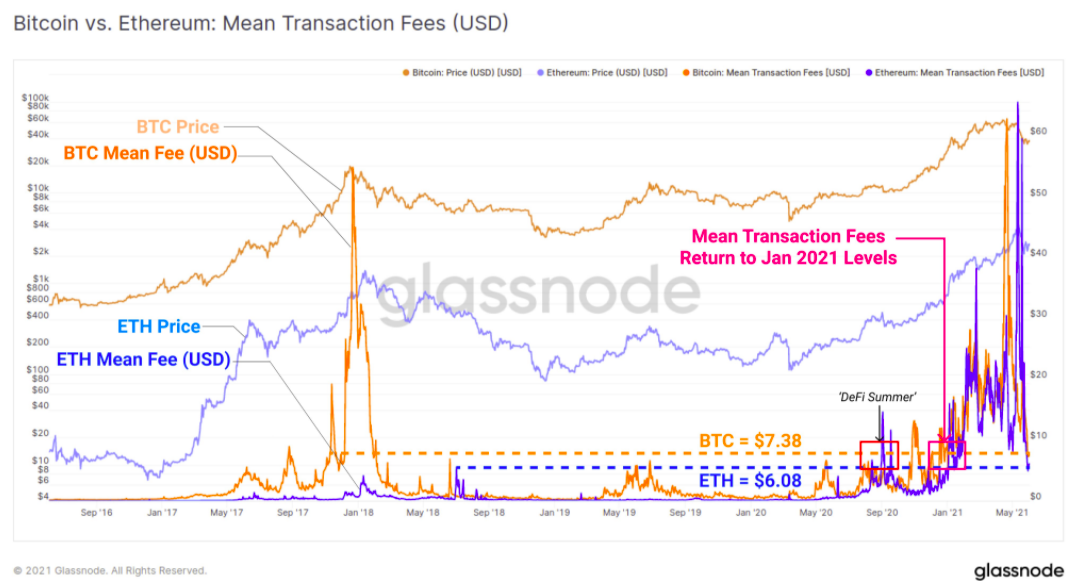

As the prices crash severely from their all-time high, so have the fees on both networks. For Bitcoin, some of this drop could be attributed to layer 2 solution Lightning Network, and for Ethereum, the rise of Polygon and Arbitrum are also helping bring the fees down.

The average transaction fees for both Bitcoin and Ethereum, as we reported, have returned to levels not seen since Jan 2021 and Aug-Sept 2020 during 'DeFi Summer.'

The average transaction fee paid on each network is currently $7.38 for BTC and $6.08 for ETH.

While some feel this signifies the end of the bull market, others speculate this could be the beginning of another DeFi season. It remains to be seen which scenario will play out.

[caption align="alignnone"] Source: Glassnode[/caption]

While fees have come down drastically, Ethereum is still generating 4x of Bitcoin’s fees daily. At their peak, Ethereum did $117.2 million on May 11, 2021, compared to Bitcoin’s $21.4 million on December 22, 2017. On each others’ ATH day’s, Bitcoin did $4.6 million, and Ether did $1.11 million.

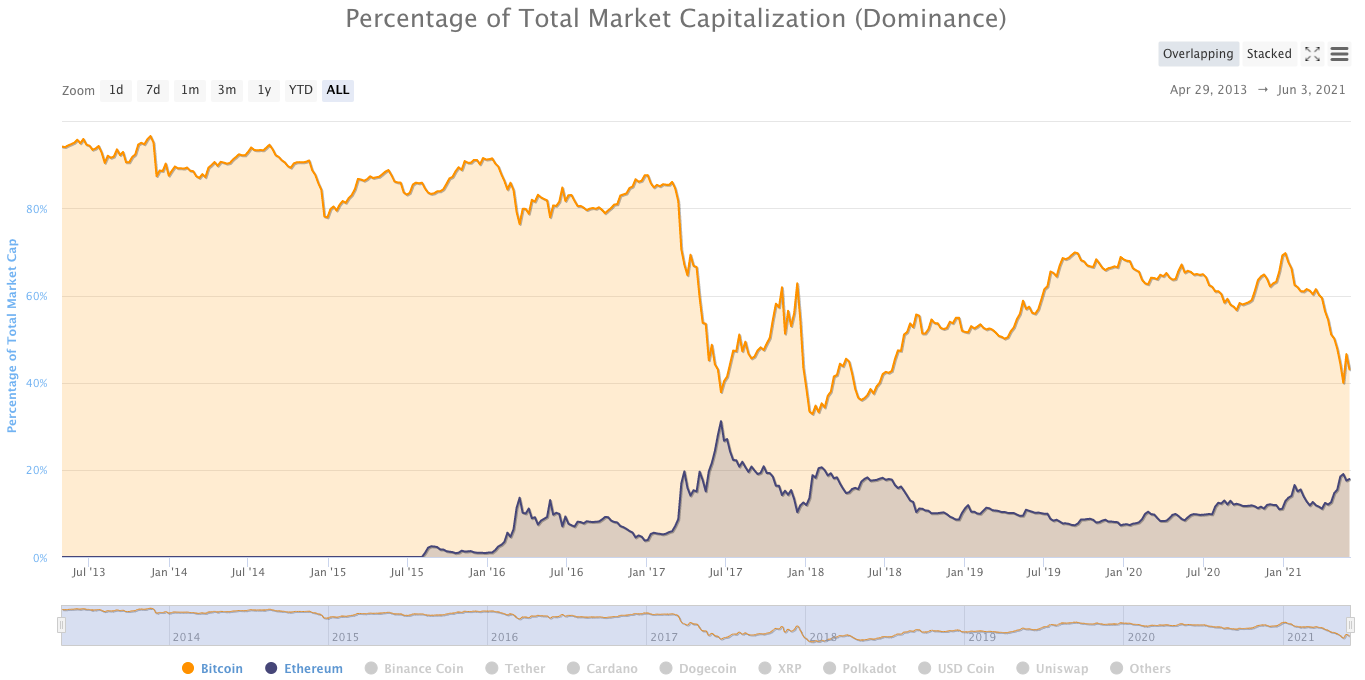

Much like fees, a growing number of people in the crypto community expect the Ether market cap to flip BTC at some point in this cycle. Given that Ether outperforms Bitcoin in the bull market, it is possible that Ether can capture the first spot, at least temporarily.

Already, Bitcoin’s dominance is declining as more and more altcoins get launched while Ether’s going upwards.

Source: Glassnode[/caption]

While fees have come down drastically, Ethereum is still generating 4x of Bitcoin’s fees daily. At their peak, Ethereum did $117.2 million on May 11, 2021, compared to Bitcoin’s $21.4 million on December 22, 2017. On each others’ ATH day’s, Bitcoin did $4.6 million, and Ether did $1.11 million.

Much like fees, a growing number of people in the crypto community expect the Ether market cap to flip BTC at some point in this cycle. Given that Ether outperforms Bitcoin in the bull market, it is possible that Ether can capture the first spot, at least temporarily.

Already, Bitcoin’s dominance is declining as more and more altcoins get launched while Ether’s going upwards.

While some expect an extended period of flipping to negatively affect Bitcoin, others believe that both are different assets with their own narratives, and ranking doesn’t matter. However, it might be too soon for that, and it’s anyone’s guess what will happen in the future.

For now, the Ethereum network, which is the base of the majority of DeFi and NFT space, is recording much-heightened activity than Bitcoin, which is primarily used for “HODLing."

In the month of May, while BTC miner revenue decreased by 15% to $1.45 billion, ETH miner revenue increased by 42.8% to a new ATH of $2.35 billion. This is the first time since June 2017 that ETH miner revenue exceeded BTC miner revenue.

For some time now, Ether has been outpacing Bitcoin in the futures market as retail and institutions alike went for the second-largest cryptocurrency. Compared to BTC futures volume’s increase of nearly 30% to a new ATH of $2.47 trillion, ETH futures’ volume surged much sharply by 94.7% to a new ATH of $1.7trn.

Eth yet again saw increased interest in the options market and is now up to 60% of BTC volume.

On the leading option platform, Deribit, 581,578 BTC options contracts traded on the platform, down 0.8% versus April 2021. Meanwhile, over 4.89 million ETH options contracts were traded in May 2021, up 43% versus April 2021.

[deco-beg-single-coin-widget coin="ETH"]

[deco-beg-single-coin-widget coin="BTC"]

While some expect an extended period of flipping to negatively affect Bitcoin, others believe that both are different assets with their own narratives, and ranking doesn’t matter. However, it might be too soon for that, and it’s anyone’s guess what will happen in the future.

For now, the Ethereum network, which is the base of the majority of DeFi and NFT space, is recording much-heightened activity than Bitcoin, which is primarily used for “HODLing."

In the month of May, while BTC miner revenue decreased by 15% to $1.45 billion, ETH miner revenue increased by 42.8% to a new ATH of $2.35 billion. This is the first time since June 2017 that ETH miner revenue exceeded BTC miner revenue.

For some time now, Ether has been outpacing Bitcoin in the futures market as retail and institutions alike went for the second-largest cryptocurrency. Compared to BTC futures volume’s increase of nearly 30% to a new ATH of $2.47 trillion, ETH futures’ volume surged much sharply by 94.7% to a new ATH of $1.7trn.

Eth yet again saw increased interest in the options market and is now up to 60% of BTC volume.

On the leading option platform, Deribit, 581,578 BTC options contracts traded on the platform, down 0.8% versus April 2021. Meanwhile, over 4.89 million ETH options contracts were traded in May 2021, up 43% versus April 2021.

[deco-beg-single-coin-widget coin="ETH"]

[deco-beg-single-coin-widget coin="BTC"]

Ether Is Already Flippening Bitcoin in Several Metrics

bitcoinexchangeguide.com

03 June 2021 13:49, UTC

bitcoinexchangeguide.com

03 June 2021 13:49, UTC