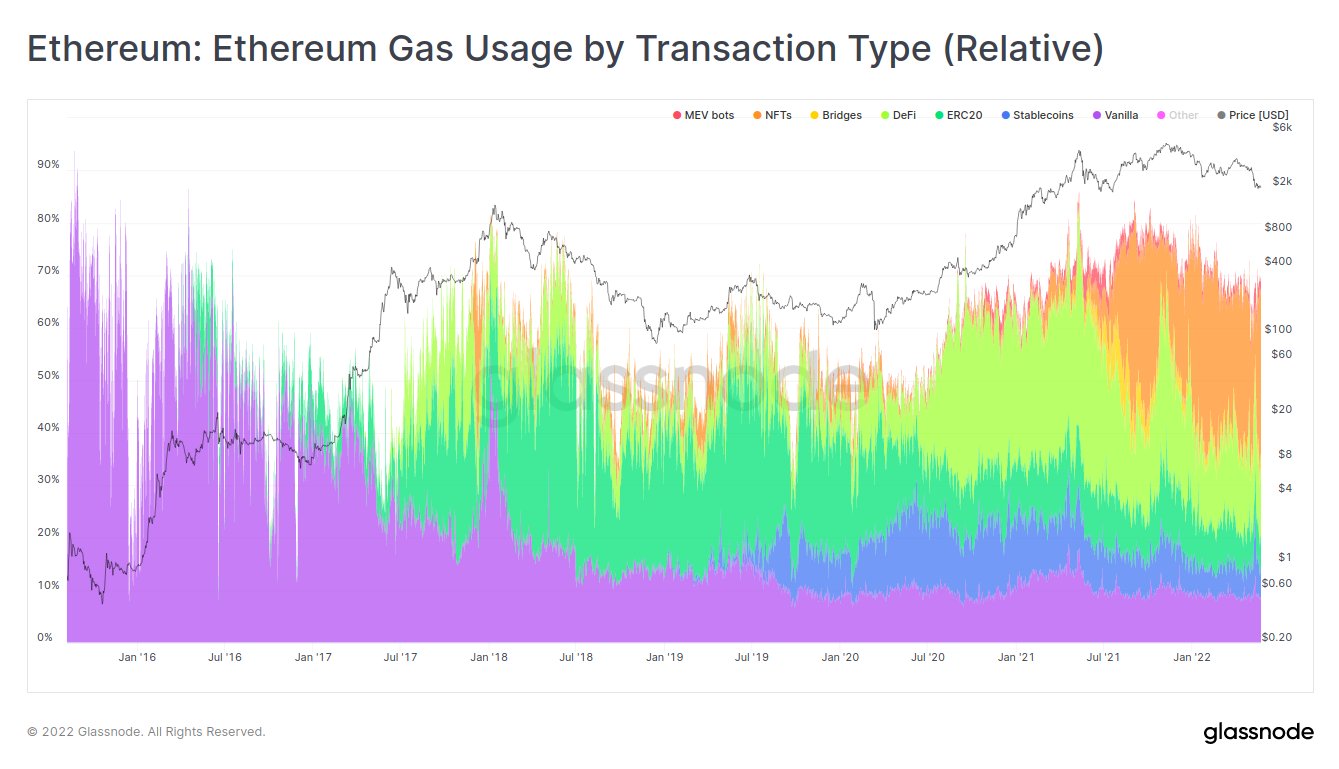

Ethereum (ETH) gas consumption trends paint a picture of what sectors of the crypto market have been expanding, according to the analytics firm Glassnode.

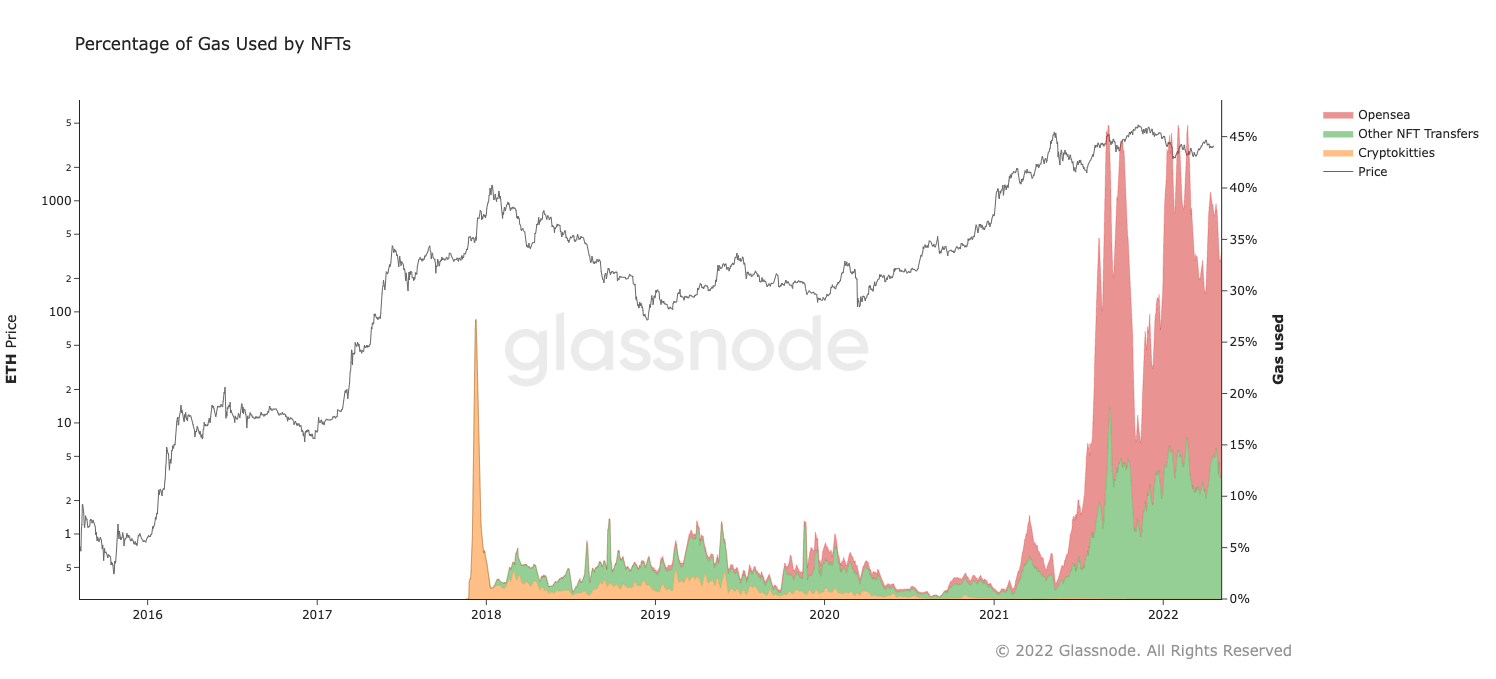

In a new analysis, Glassnode says non-fungible tokens (NFTs) now represent 30% of Ethereum’s gas consumption dominance, far outweighing decentralized finance (DeFi).

“Through observation of Ethereum network usage, we can identify shifting market preferences. The chart below clearly demonstrates the expansion of the NFT trend, taking off in mid-2021, and absorbed market share relative to DeFi.”

Glassnode also discusses vanilla transfers, referring to pure Ethereum transfers between externally owned accounts (EOAs), with no contract being called.

“Conceptually, vanilla transfers represent Ethereum being used as a currency. From a gas consumption perspective, this use case declined from being the most dominant one in the early days (80% of gas in 2015), to ~10% range in the last two years. In other words: empirically, Ethereum is not primarily – or even prominently – used to transfer ETH between users.”

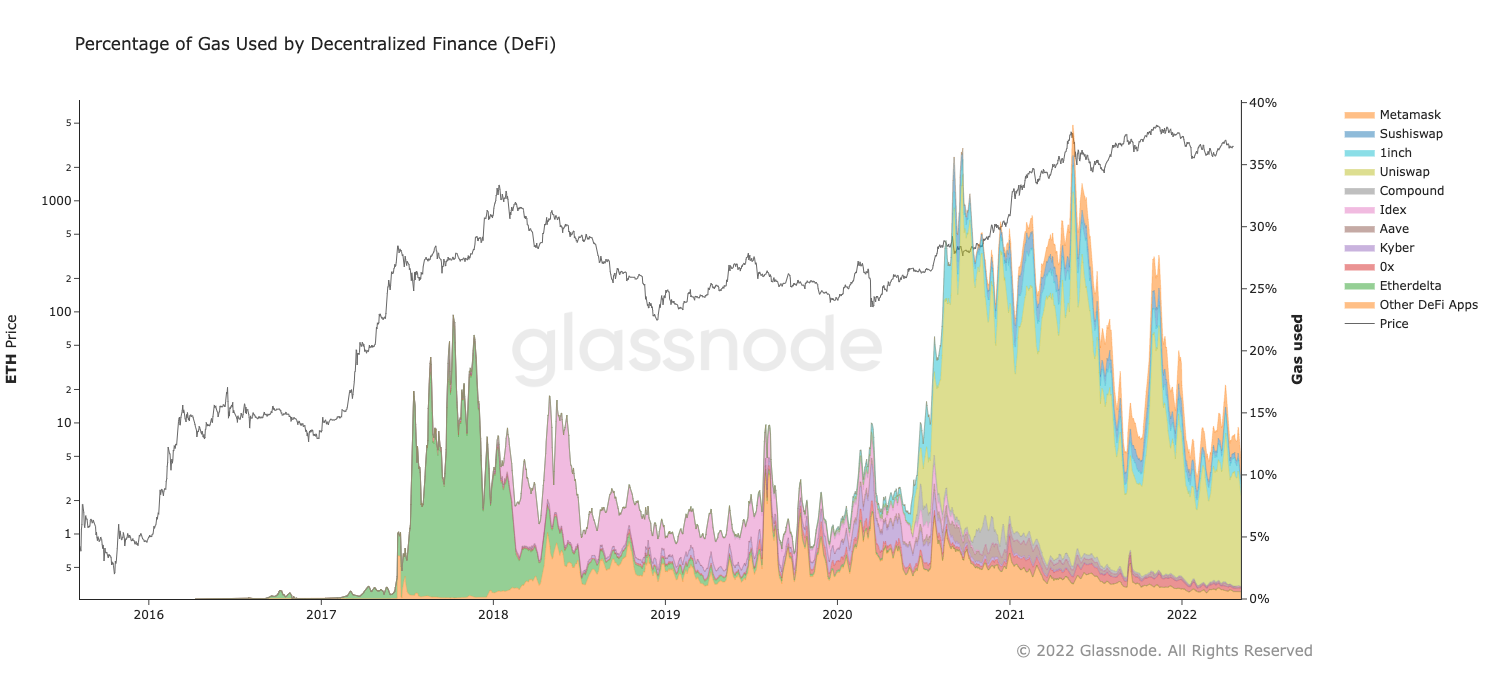

Glassnode notes that most of the gas consumption related to DeFi comes from decentralized asset trading.

“As liquidity is both provided by traders and attracts them, there is a natural centralizing force in play – at most points in time, just one or two platforms dominate this category, with Uniswap currently leading the pack (peaking at 88% of DeFi gas consumption, and currently being at ~60%).”

NFT marketplace OpenSea consumes more than 60% of the non-fungible token gas, according to the analytics firm.

dailyhodl.com

dailyhodl.com