Bitcoin is on track to continue its 8-week-long losing streak, which is its longest losing track record in history. Should the price of Bitcoin (BTC) be unable to reclaim $30,300 in the next three days, then the world could see the downwards trend in its prices continue.

The second biggest crypto project by market cap, Ethereum (ETH), is trading at the lowest level relative to BTC in seven months.

Currently, the ETH/BTC ratio is approximately 0.061. This is the lowest it has been since October 2021. Additionally, ETH has slumped 37% in the last 30 days, while BTC slid 23% in the same time period.

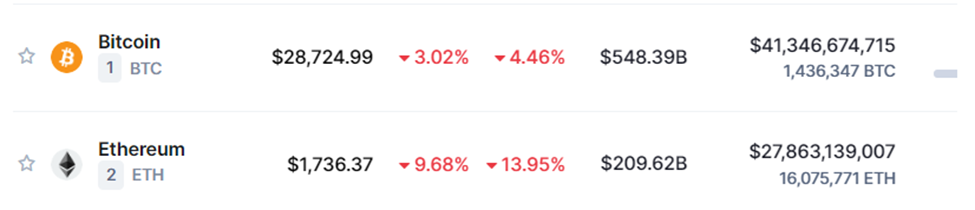

As can be seen from the snapshot of CoinMarketCap above, ETH currently trades at $1,736.37 while BTC trades at $28,724.99. Furthermore, ETH has dropped by 9.68% in the last 24 hours and 13.95% in the last week. This is the lowest level that ETH has slid to since July 2021.

Traders are flocking to the first and largest crypto amid the current broad market sell-off as they become more risk-averse following the U.S. Federal Reserve’s plans to continue raising interest rates.

Nelson Lim from Nansen stated that he thinks people are taking shelter in safer bets [rather] than focusing on things other than Bitcoin now. “When crypto falls, BTC falls the least compared to ETH and other L1. So the volatility to the downside is lesser.”

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of CoinQuora. No information in this article should be interpreted as investment advice. CoinQuora encourages all users to do their own research before investing in cryptocurrencies.