The final testnet (pictured) for the ethereum upgrade to full Proof of Stake (PoS), known as the Merger, has been launched earlier today.

“We spun up the Kiln testnet to test ethereum’s upcoming move to proof-of-stake,” Marius van der Wijden, a developer at the Ethereum Foundation, said before adding:

“The network is still in Proof of Work (PoW) at the moment and the merge on kiln will happen most likely mid next week. So get in while the network is still in PoW and verify that your nodes/software/defi-protocol/NFTs survive the transition!”

Which means we’ll get to see the merger happening, the Proof of Work network transforming into Proof of Stake with all the dapps, NFTs, and everything else running on it so ditching miners to take consensus ‘orders’ only from stakers.

If you’re currently staking on the Beacon chain therefore, especially if you’re an entity like Coinbase of Bitcoin Suisse, you’ll probably want to see how this transition will happen and what might affect you.

They’ve put up a guide to running your own node in addition to numerous block explorers and stats pages for the testnet.

So there’s everything one might need with not much time left for the testnet Merge, afterwhich the testnet should keep running for at least three months without any serious problems.

The actual live launch then follows this summer when the entire ethereum network, including DAI, Curve, Aave, as well as things like Decentraland or OpenSea, start running on validation from stakers rather than GPUs from miners.

That should make gamers happy who thereafter can stop complaining, though maybe not AMD, as the market potentially gets flooded with GPUs which will no longer be of any use towards mining eth unless they keep running their own PETH Proof of Work eth network despite all dapps and devs transforming onto the ETH Proof of Stake Network.

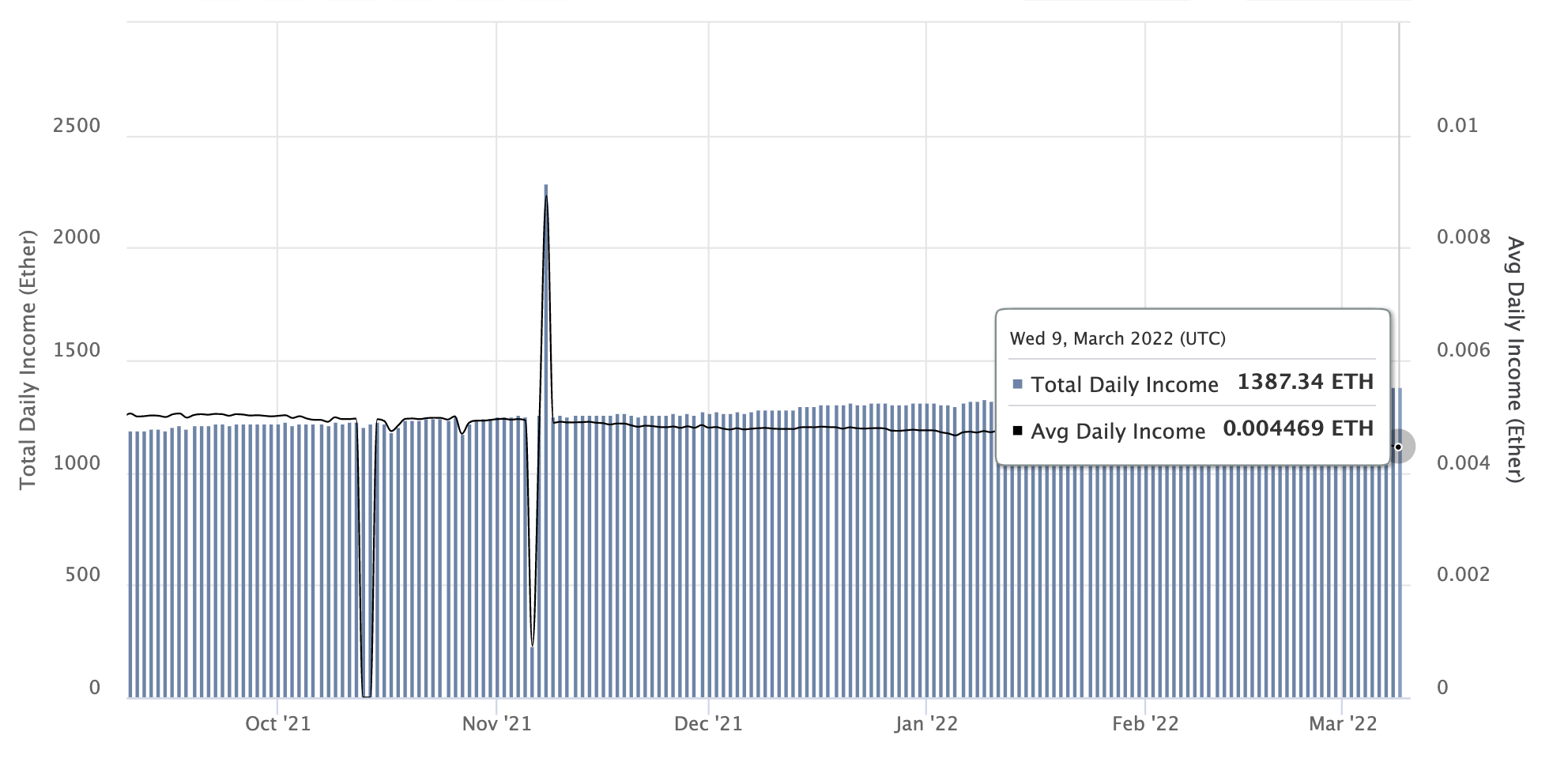

That should also make eth investors very happy because the cost to run the network, which they pay, will reduce from about 14,000 eth a day, or $36 million, to just 1,387 eth a day, or $3.6 million.

That’s a huge 90% drop in new supply to instantly occur in just over a couple of months now with ethereum’s inflation rate to plunge to circa 0.4% from currently 4%.

Making eth a deflationary asset that reduces in supply due to some of the fee in each transaction being burned.

So we’re going to get a halving 2x this summer, at which point ethereum’s tokenomics will also be fixed as there will no longer be any difficulty bomb to delay with bargains on how much mining rewards should be reduced as we saw fairly frequently a couple of years ago.

Instead, seven years on, and after so many setbacks on the way, this time it is actually happening whereby ethereum will achieve one of its main goal in becoming an environmentally friendly global financial network with fixed monetary parameters.

trustnodes.com

trustnodes.com