TL;DR:

- Trend Research, led by Jack Yi, has permanently closed its $2.1 billion leveraged Ethereum long position.

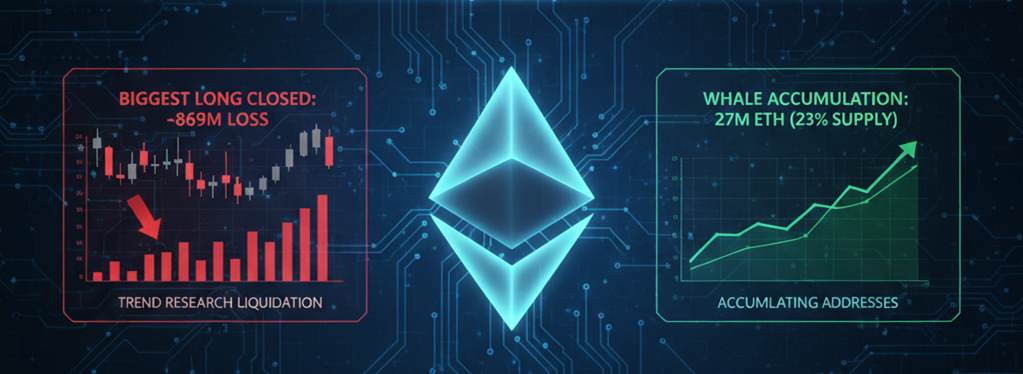

- The trading firm recorded total losses of $869 million following the price drop toward the critical $1,750 level.

- Despite the leverage collapse, accumulating addresses now control 23% of Ether’s circulating supply.

The crypto sector witnessed a massive Ethereum liquidation in Asiaafter Trend Research, the firm led by Jack Yi, completely exited its $ETH exposure. Data from Arkham reveals that the company executed its final position closure this Sunday, culminating a risk reduction process that intensified amid a lack of liquidity and extreme volatility.

This move was surprising given that, just days before the total shutdown, Jack Yi posted optimistic messages predicting Ether above $10,000. However, market pressure and the cost of leverage forced a brutal exit that resulted in million-dollar losses, demonstrating how even the largest players can succumb to fluctuations in the spot market.

On-chain Resilience: Whales Capitalize on Capitulation

Despite the forced institutional closure, the network’s fundamental indicators show a narrative of long-term strength and confidence. So-called “accumulating addresses”—which maintain balances exceeding 100 $ETH without making withdrawals—now hold 27 million units, equivalent to nearly a quarter of the asset’s total capitalization.

Recent analysis from CryptoQuant suggests that the current price is in a historically attractive zone for spot capital entry. In fact, this is only the second time in Ethereum’s history that it has traded below the realized price of these accumulation wallets, a pattern that has previously preceded significant market recoveries.

In summary, while leveraged traders face painful liquidations, strategic investors continue to absorb the available supply within a multi-year timeframe. The market will now monitor whether this capitulation of long positions in Asia marks the ultimate floor necessary to initiate an upward trajectory driven by organic accumulation.

crypto-economy.com

crypto-economy.com