-

Ethereum price falls near $1,948 as whale wallets reduce overall $ETH supply control share.

-

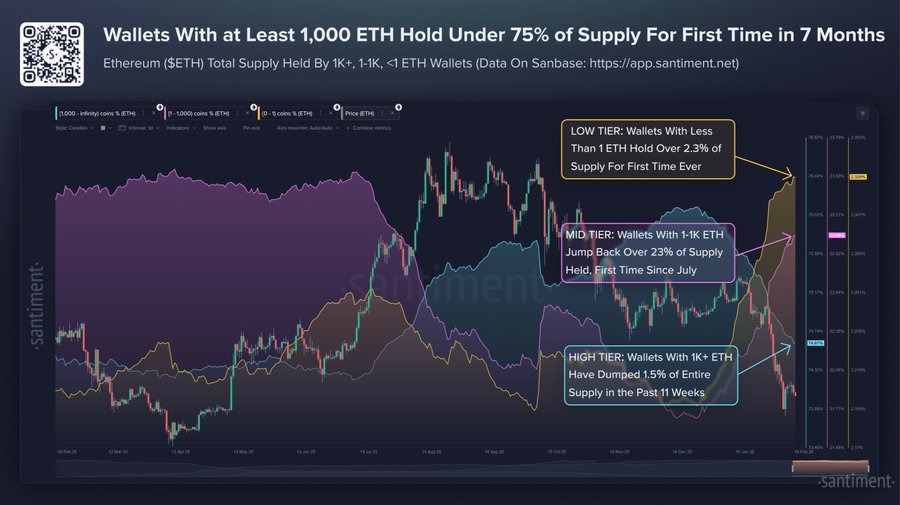

Santiment data shows large $ETH holders dropped below 75% supply ownership after months dominance.

-

Over 220,000 $ETH withdrawn from exchanges, reducing short-term selling pressure across crypto markets.

Ethereum price today is trading around $1,948, down 3.5% and nearly 14% over the past week, showing strong selling pressure. At the same time, major shifts are happening behind the scenes.

Meanwhile, big whale wallets are losing control over supply, and millions of $ETH are leaving exchanges. These changes suggest that while the $ETH price remains under pressure.

Ethereum Big Holders Reduce $ETH Supply Control

According to Santiment, wallets holding at least 1,000 $ETH now control less than 75% of Ethereum’s total supply, the first time in seven months this level has dropped so low.

However, since December, these large holders have sold or redistributed about 1.5% of the supply, suggesting profit-taking and reduced exposure during market uncertainty.

Meanwhile, mid-sized wallets holding between 1 and 1,000 $ETH have increased their share to over 23%, showing quiet accumulation.

Smaller wallets are also growing, with addresses holding less than 1 $ETH now owning a record 2.3% of supply. Santiment believes this growth among small holders is likely linked to staking activity.

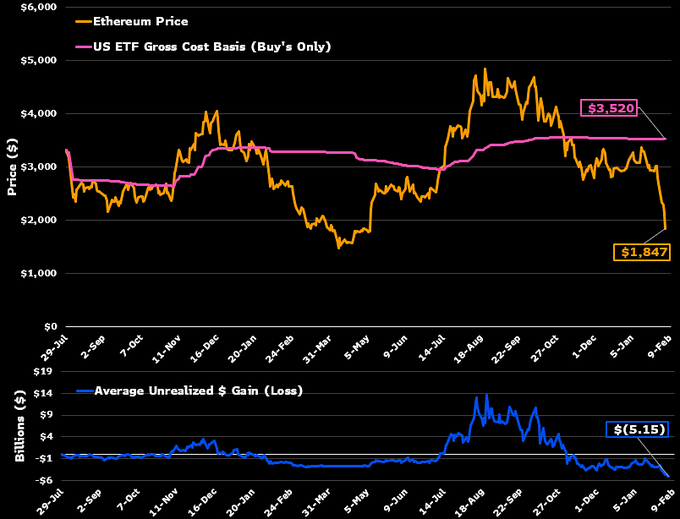

$ETH Is Now Below Whale Cost Basis

Ethereum is now trading below the average price at which large holders bought their $ETH, meaning many whales are currently in a loss. This could be easily visible among Ethereum ETF investors, who are in a tougher position than Bitcoin ETF holders.

With $ETH trading near $1945, it remains far below the estimated average ETF entry price of around $3,500. For many investors, this is a painful situation.

However, despite these losses, ETF holders continue to accumulate more $ETH.

In fact, Ethereum spot ETFs have also seen fresh inflows, with $57 million on February 9 and $13.8 million on February 10, signaling continued institutional interest.

220K $ETH Leaves Exchanges

While the Ethereum price has been struggling recently, on-chain data shows strong signs of accumulation. CryptoQuant data shows that more than 220,000 $ETH have been withdrawn from exchanges in recent days, marking the largest net outflow since October.

On February 5, Binance alone saw about 158,000 $ETH in withdrawals, the highest since last August.

Large exchange withdrawals usually reduce selling pressure, as coins moved to private wallets are less likely to be sold quickly.

Ethereum Price Outlook

As of now, $ETH is trading inside a well-defined descending channel, confirming continuous selling pressure. Price recently broke below the key $2,000 support level, which has now turned into resistance. $ETH is currently trading near $1,945, close to a critical demand zone around $1,800.

For recovery, $ETH must first reclaim $2,440, followed by $2,800. If price fails to hold above the $1,750 support, further downside toward $1,600 is likely.

However, the RSI is near 28, indicating oversold conditions, which suggests a short-term bounce is possible.

coinpedia.org

coinpedia.org