Ethereum was trading between $2,014 and $2,028 per coin on Feb. 10, while derivatives markets told a far louder story beneath the surface. Futures open interest remains elevated, options positioning is heavily skewed toward calls, and max pain levels across major exchanges cluster uncomfortably close to spot.

Ethereum Derivatives Flash Mixed Signals Across Binance, OKX, Deribit

Ethereum futures open interest continues to sit near cycle highs, with aggregate exchange data showing billions of dollars in leveraged exposure spread across centralized venues. While price has drifted lower from recent highs, traders have not meaningfully reduced risk, suggesting conviction remains intact—at least for now.

Among futures venues, Binance holds the largest share of ethereum open interest at roughly $5.32 billion, representing more than 2.63 million $ETH. Short-term positioning on Binance leaned cautiously constructive, with one-hour and four-hour open interest rising, even as 24-hour figures softened, hinting at active repositioning rather than wholesale exits.

CME ranked next, carrying approximately $3.48 billion in $ETH futures exposure. Unlike offshore venues, CME’s futures market showed steady growth across all tracked time frames, reinforcing the presence of institutional flows rather than fast-money churn.

OKX and Bybit followed closely, each maintaining between $1.7 billion and $2 billion in open interest. OKX stood out with a sharp 24-hour increase exceeding 10%, signaling renewed speculative interest despite mild pullbacks over shorter intervals.

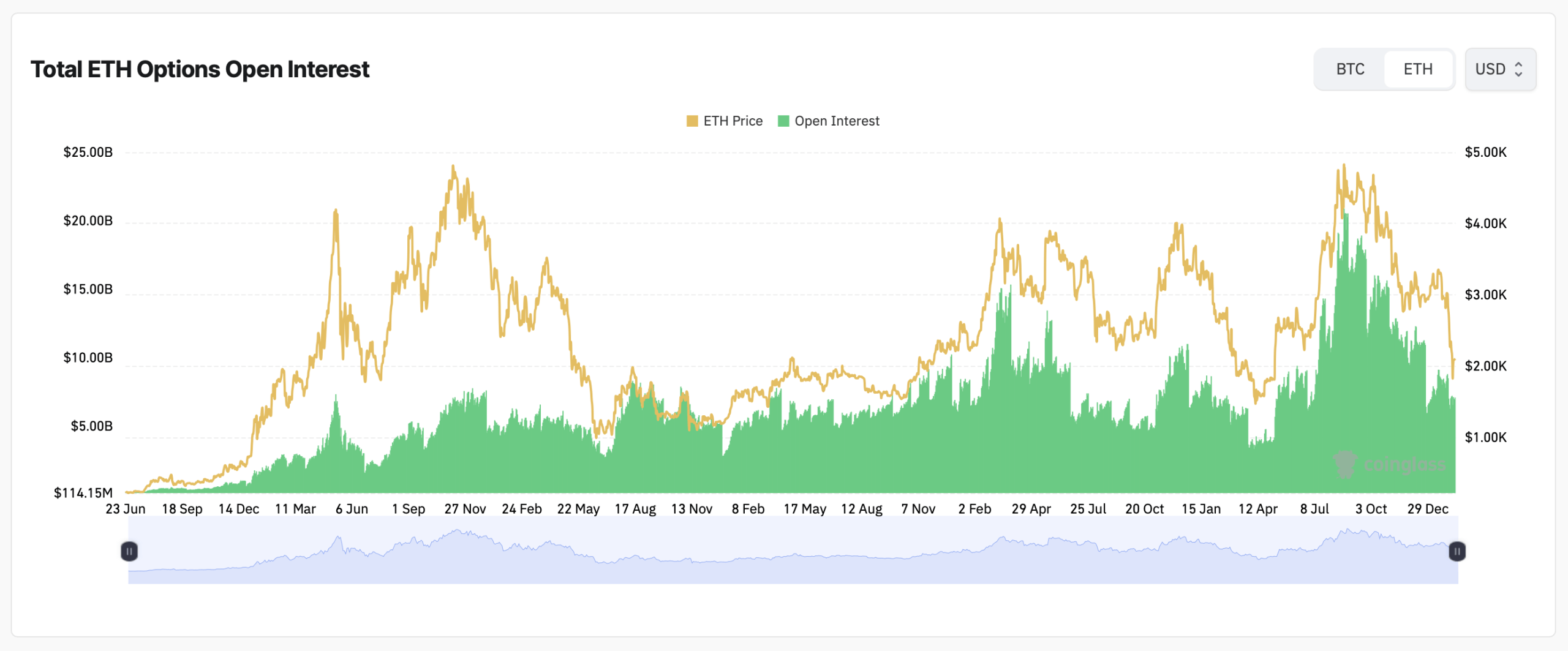

Ethereum options markets painted a similarly busy picture. Total options open interest has expanded alongside price over the past year, climbing to multi-month highs even as ethereum retraced toward $2,000. That combination—falling spot with sticky derivatives exposure—often sets the stage for sharp directional moves.

Calls continue to dominate positioning. Options open interest showed 57.41% allocated to calls versus 42.59% in puts, totaling more than 1.8 million $ETH in calls. Volume data echoed that bias, with calls capturing 53.12% of 24-hour options trading, indicating traders are still leaning upward rather than bracing for collapse.

The most heavily traded contracts cluster around near-term expiries, particularly February and March. Large open interest concentrations appeared in strike ranges spanning $1,800 to $3,500, suggesting traders are hedging broadly while leaving room for volatility.

Max pain data sharpened the picture further. On Deribit, the dominant options venue, near-term max pain levels hovered around $2,000 to $2,200 for February expiries, before jumping toward $2,800 in March and near $3,000 for June, aligning uncomfortably close to current spot.

Binance’s max pain curve showed a flatter structure, with pain levels clustered between $2,200 and $2,600 across upcoming expirations. That range implies limited directional mercy for overconfident traders leaning too far in either direction.

On OKX, max pain levels remained lower in the near term, hovering around $2,100 to $2,400, before spiking sharply toward $3,400 later in the year. The curve suggests traders expect turbulence first, clarity later.

Essentially, ethereum’s derivatives markets appear quite crowded, opinionated, and impatient. With spot pinned near $2,000 and leverage still piled high, the setup leaves little room for complacency.

FAQ ⏱️

- What is ethereum’s current price?Ethereum traded at prices between $2,014 and $2,028 per coin on Feb. 10.

- Are traders more bullish or bearish in options markets?Calls dominate both open interest and volume, signaling a bullish lean.

- Which exchange holds the most ethereum futures open interest?Binance leads with more than $5.3 billion in $ETH futures exposure.

- Where are max pain levels clustered?Near-term max pain sits close to $2,000–$2,400, depending on the exchange.

news.bitcoin.com

news.bitcoin.com