The cryptocurrency market has entered a volatile "de-leveraging" phase in early 2026. After a turbulent January, the $ethereum coin has seen its valuation sliced as a massive liquidation cascade wiped out over $1.9 billion in $ETH long positions across major derivatives exchanges.

As of February 7, 2026, the Ethereum price is hovering around $1,950, attempting to stabilize after a swift drop from yearly highs of $3,300. This analysis breaks down the technical "trap doors" and recovery zones for Ethereum as the market navigates this 2026 crypto crash.

Can Ethereum Recover in 2026?

Yes, a recovery is technically possible, but the path is currently obstructed by heavy overhead resistance. Technical data suggests Ethereum is entering a short-to-medium term consolidation phase. While long-term targets for the ethereum coin remain bullish due to institutional ETF inflows, the immediate outlook is neutral-to-bearish until the $2,300 resistance is flipped back into support.

The Liquidation Cascade

In the context of the current crypto crash 2026, a "liquidation cascade" occurs when the price drops to a level that forces leveraged traders to sell their positions automatically. This creates a feedback loop of selling pressure, which is exactly what we observed on the $ETH chart between $2,150 and $1,820.

Ethereum Price Chart Analysis: The $1,800 Floor

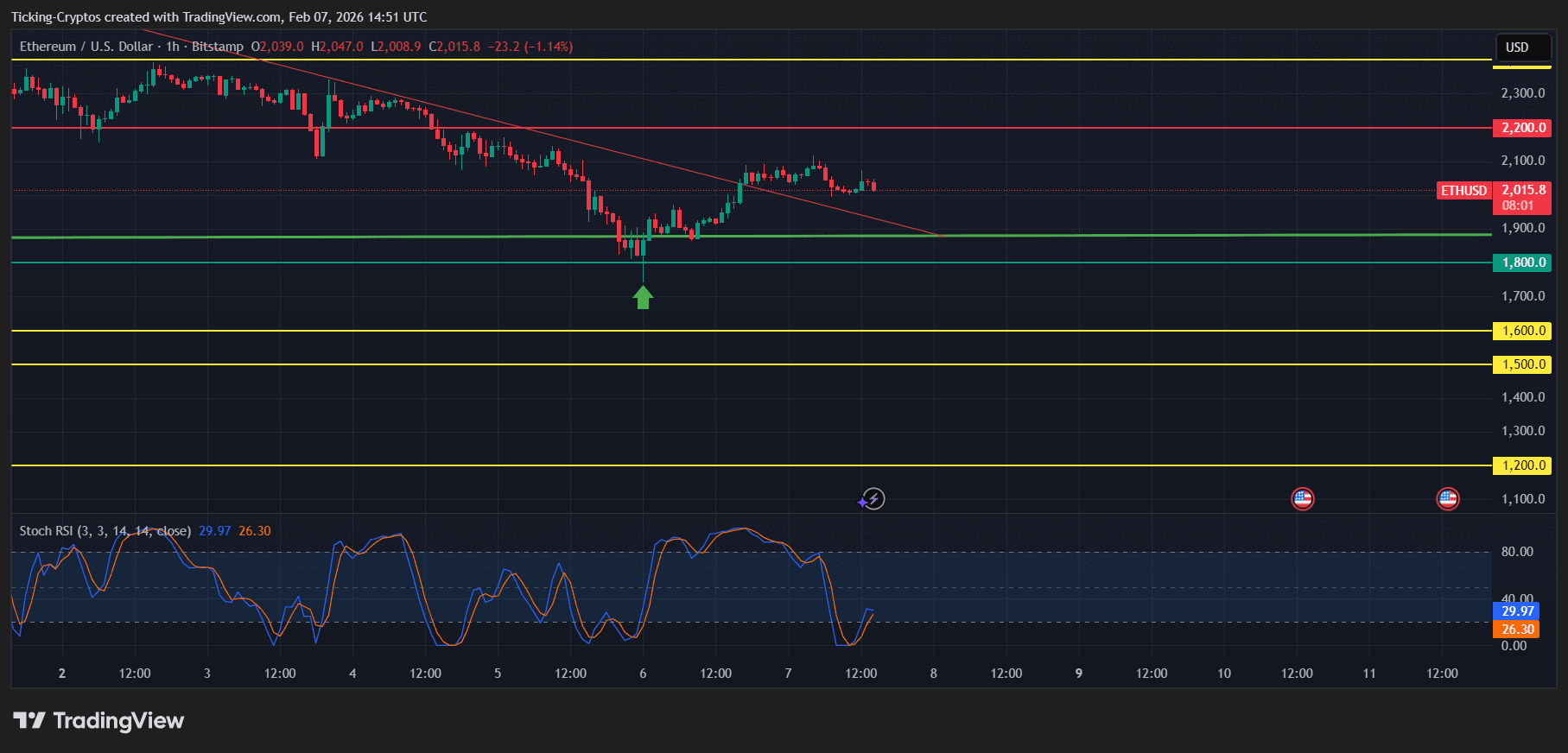

The provided chart illustrates a sharp "V-shaped" attempt at $1,823. This level is crucial because it aligns with the mid-2025 accumulation zone and the 0.618 Fibonacci retracement level.

Key Technical Observations:

- The Liquidation Gap: The rapid drop from $2,400 to $1,800 created a "liquidity void." Price action tends to "fill" these gaps with sideways movement before a definitive trend resumes.

- RSI Oversold Bounce: The 14-day Relative Strength Index (RSI) touched 28 on February 5, marking an oversold condition that typically precedes a relief rally.

- Volume Profile: High selling volume during the crash suggests a "climax" event, which often marks a local bottom.

Ethereum Price Prediction 2026: Lower Targets and Bear Case

If the $1,800 support fails to hold on a weekly closing basis, the technical structure for the ethereum coin shifts toward a deeper correction. Macroeconomic headwinds continue to pressure risk assets globally.

Future Lower Targets:

- $1,600 (Primary Support): This represents the bottom of the long-term uptrend channel. A touch here would be a 50% correction from the recent peak.

- $1,450 (Macro Demand): A historical pivot point from early 2024 that acted as a launchpad for the previous bull run.

- $1,200 (Capitulation Target): The "worst-case" scenario if broader market contagion continues.

Ethereum Future: The "Boring" Middle Ground

Our primary Ethereum price prediction for the next 4–8 weeks is a consolidation range between $1,850 and $2,250.

- The Resistance: The $2,400–$2,600 zone is now saturated with "trapped" buyers who may sell on any relief rally, creating a ceiling.

- The Support: Massive buy orders are sitting between $1,750 and $1,850, providing a temporary floor.

External analysis from major financial outlets like Reuters suggests that institutional interest in Ethereum remains high despite the price drop, which could provide the necessary liquidity to end the crash.

Conclusion

Ethereum is currently at a crossroads. While the crypto crash of 2026 has been painful, the technical defense of the $1,800 level provides a foundation for stability. Investors should watch for a breakout above $2,300 to confirm a trend reversal.

You can track the live $ETH price here to see if the support levels mentioned in this analysis are tested in real-time.

cryptoticker.io

cryptoticker.io