Ethereum struggles at key support levels but continues to see strong long positions, suggesting potential for a rebound if resistance is cleared.

Ethereum ($ETH) is facing a turbulent time, with the price down by 1.88% in the last 24 hours, trading at $2,280. Despite the recent dip, Ethereum has seen notable volatility, with its price fluctuating within a narrow range between $2,117.03 and $2,329.

Trading volume remains high, with spot volume sitting at $8.2 billion, while futures have clocked $104.8 billion, suggesting heightened participation from leveraged traders.

Looking at Ethereum’s broader performance, it has struggled over the past week, down about 24.5%, and 33.4% over the last 90 days. Despite this, Ethereum still holds a strong market presence, with a $274 billion market cap.

With key levels like $2,300 acting as short-term resistance, the coming days will be crucial in determining whether $ETH can break out of its current downturn. However, the question remains: Can Ethereum overcome this recent downtrend, or will the bearish momentum continue?

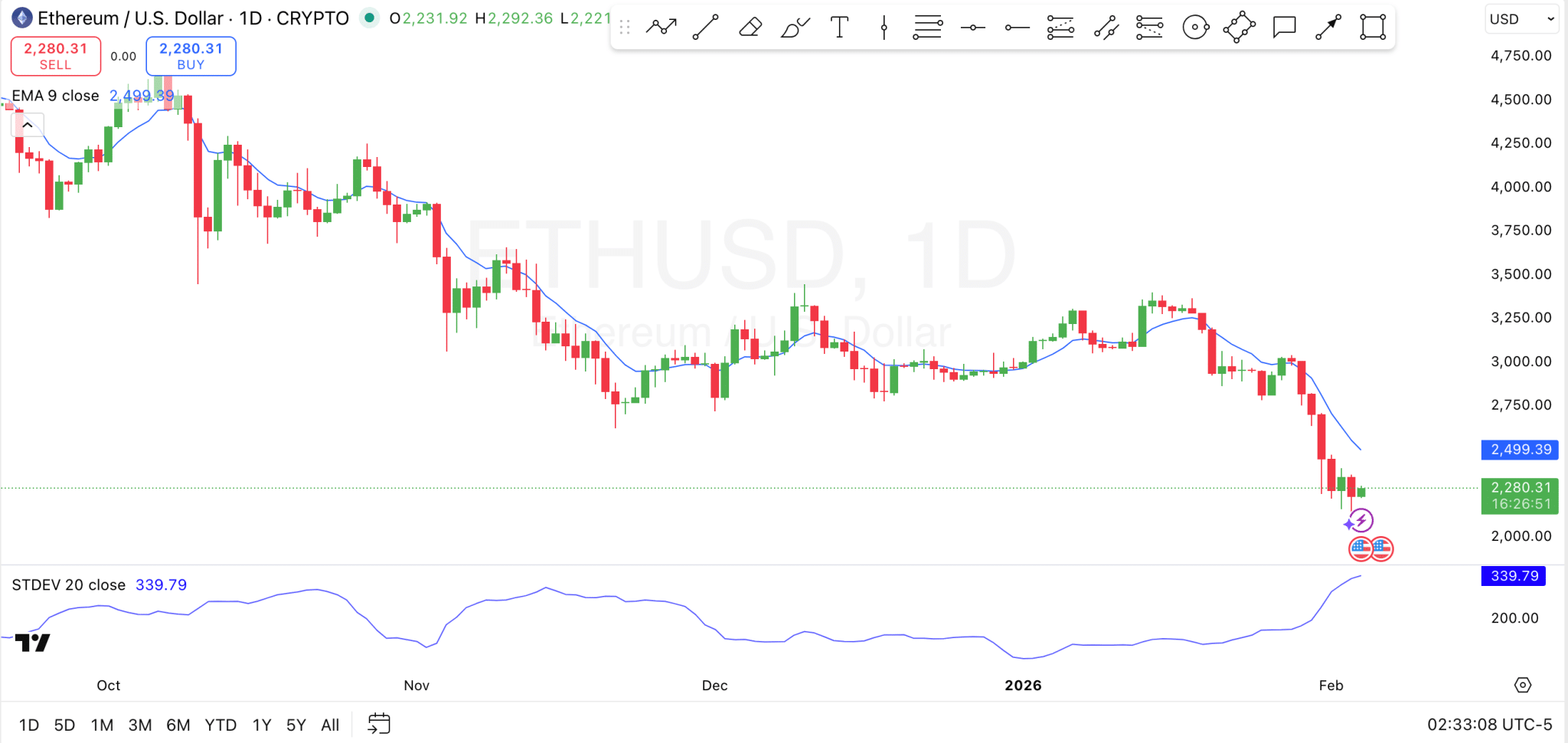

Ethereum Price Analysis

On the technicals, Ethereum is encountering a critical phase, with the price struggling to hold above support levels. Currently, $ETH is hovering near the $2,280 level, just above the $2,220 support zone. This support zone has been pivotal recently as $ETH attempts to stabilize after a downward trend.

If $ETH falls below this support level, traders could see a deeper pullback, targeting the next major support at $2,100. The 9-day exponential moving average at $2,499.39 is currently acting as a dynamic resistance, as the price remains well below this level, reinforcing the bearish bias. A break above this EMA could indicate a shift in momentum.

The price volatility is quite high, as seen from the standard deviation indicator, which is currently at 339.79, signaling an extended period of price fluctuations.

To turn the tide in favor of bulls, Ethereum needs to reclaim the $2,500 area and break above the 9-day EMA. If the price holds below the $2,250 support and fails to reclaim resistance, the downside could extend further.

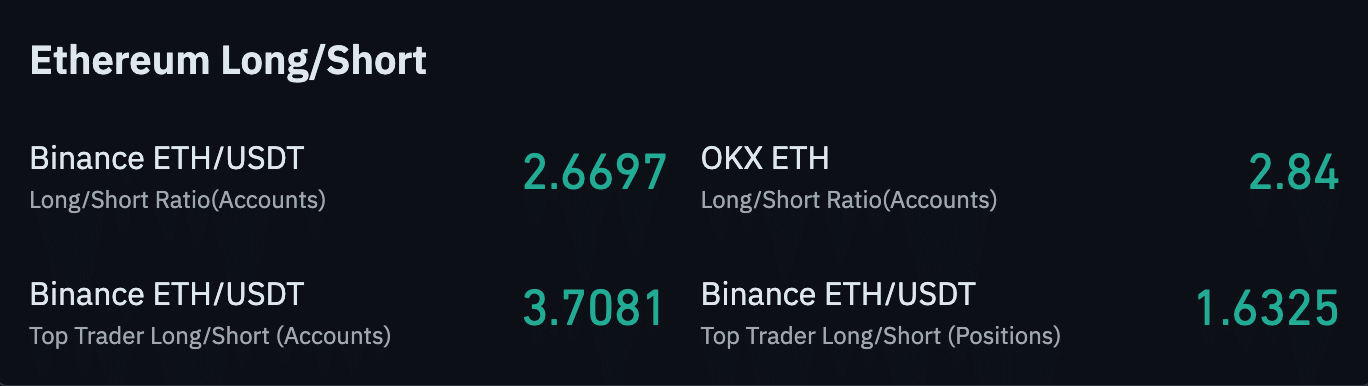

Ethereum Long vs Short

On the derivatives side, Ethereum’s market sentiment is currently leaning towards the long side, as reflected in the long/short ratios across different platforms.

Additionally, the top trader long/short ratio on Binance $ETH/USDT is 3.71, further supporting the view that professional accounts are also more inclined toward long positions at the moment. However, the long/short ratio on OKX $ETH is slightly lower at 2.84, still showing bullish sentiment, but with a more balanced outlook.

thecryptobasic.com

thecryptobasic.com