Crypto asset manager Bitwise is dialing back expectations that Ethereum’s Fusaka upgrade would meaningfully lift network revenue, according to a new research report from the firm, published on Jan. 28. The findings fall short of earlier bullish projections from Bitwise’s own chief investment officer, Matt Hougan.

In November, Hougan wrote in an X thread that Fusaka could drive a “5-10x” increase in Ethereum’s revenue capture, calling it “under-appreciated catalyst and one reason ETH could lead the crypto rebound.” However, new data from Bitwise tells a far less bullish story.

Positive Impact

Fusaka — which went live in December — added a minimum fee for “blob” data, the cheap data Layer 2s use to post transactions back to mainnet. Blobs were meant to lower costs, but prices often swung between near zero and sudden spikes. The upgrade set a floor to make those fees more stable.

In practice, the revenue boost many expected hasn’t shown up.

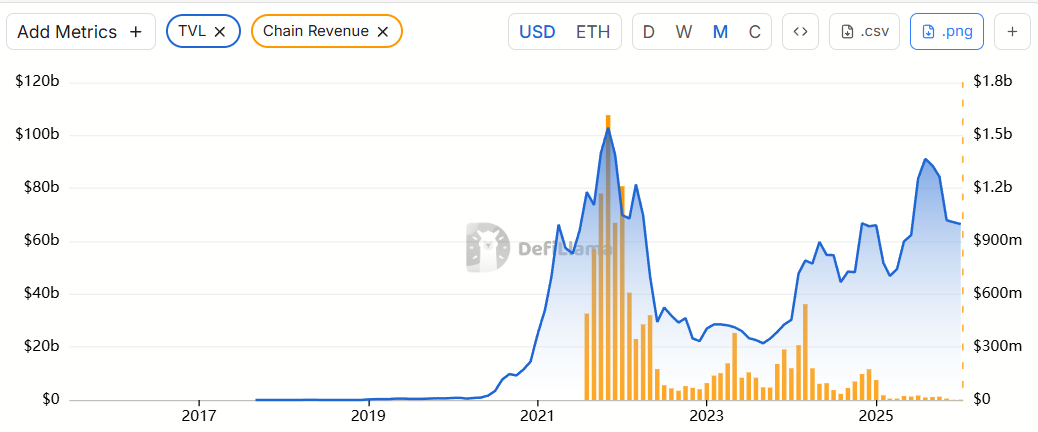

Bitwise’s Jan. 28 research, led by senior research associate Max Shannon, found that while the fee floor did raise blob prices, Ethereum’s fast-growing capacity more than canceled it out.

“As a result, we forecast that next-twelve-month blob fees will barely contribute to Ethereum’s overall revenue,” Shannon wrote, adding that Fusaka’s impact is “more positive for user experience and L2 margins than it is on Ethereum’s revenue generation.”

According to DefiLlama data, Ethereum’s monthly revenue has been sliding since its peak of about $1.6 billion in November 2021 and is now down more than 99% to roughly $1.8 million as of December 2025. The network is on track for a slightly better month in January, which over $2 million in revenue to date.

Multi-Input Question

Speaking with The Defiant, Shannon clarified that Fusaka’s effect on net blob fee revenue “was always going to be a multi-input question.” He explained that while minimum fees can lift revenue, higher throughput still pulls it down, and so far, throughput has clearly won out.

“What we’ve observed in practice is that the enhancements to throughput have outweighed the higher base fee,” he said.

Over a longer time frame, Shannon believes that the fee floor should still allow Ethereum to capture some value generated by Layer 2 activity, but he stressed that this hasn’t materialized yet.

In a recent report, independent researcher Andrey Sergeenkov argued that Fusaka made fees low enough to enable make a particular type of scam using the network — address poisoning — profitable.