Ethereum shows potential for reversal with mixed momentum indicators and tokenization dominance signaling strength.

Ethereum ($ETH) has seen a modest 1.1% increase in the past day, currently trading around $3,011.90. The price action has seen significant intraday fluctuations, with Ethereum testing a daily range between $2,872.06 and $3,052.58.

This movement shows a recovery trend, as the price surged from a low of $2,872 yesterday to hit the daily high of $3,052. However, some resistance formed near the $3,050 mark while the price held steady above $3,000, making it a crucial support zone.

Ethereum’s longer-term performance also shows a positive upward trend. Over the past 30 days, the coin has increased by 1.8%, reflecting a modest yet consistent momentum. Can $ETH maintain its bullish momentum above $3,000?

Ethereum’s Momentum Indicators

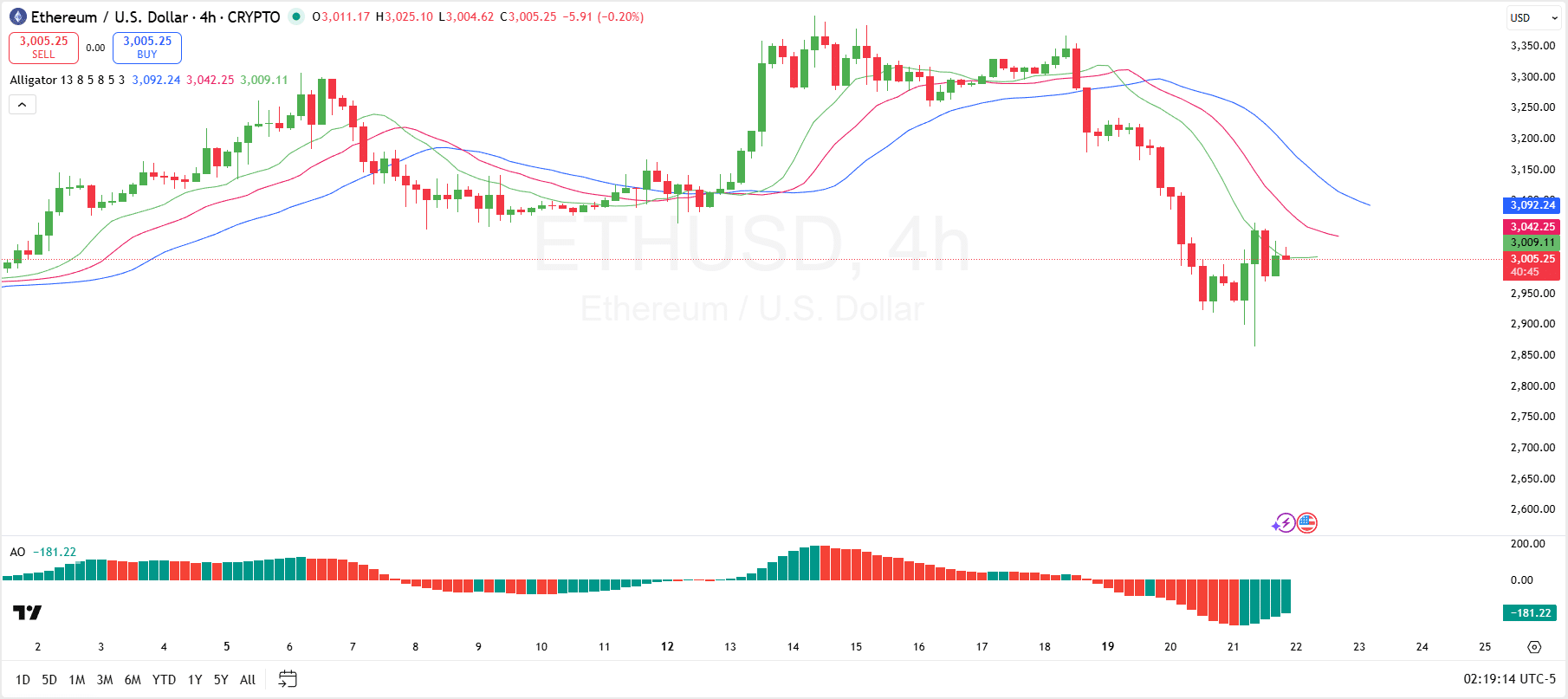

However, the William’s Alligator indicator from TradingView, which consists of three green, red, and blue lines, signals a downtrend on the 4-hour chart. This is because the green line is still below the red and blue lines.

For a bullish reversal, the green line must cross above both the red and blue lines, and the moving averages must diverge further. This crossover would signal the “eating” phase of the Alligator, which occurs during a trending market.

Additionally, the Awesome Oscillator, currently in the negative zone, shows that momentum is bearish, although the bars have flipped to green. For a confirmed bullish trend and a recovery in momentum, the oscillator needs to move into positive territory.

If the green line fails to surge above, the immediate support for Ethereum sits around $2,940, where the price has recently bounced. If Ethereum holds above this level, and the green line moves above blue and red, it could potentially start moving upwards.

On the upside, the next resistance level lies above $3,060, as shown by the recent price rejection in this range. If Ethereum breaks above $3,060 and sustains it, the next resistance could emerge around the $3,230 area, where previous price action shows resistance.

Ethereum Dominates Tokenization Market

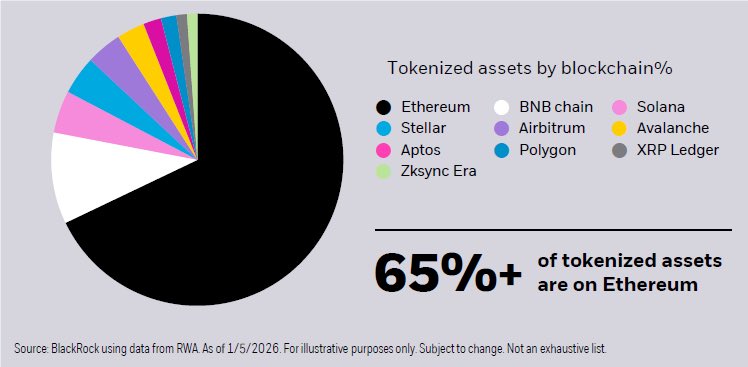

On the fundamentals side, Ethereum continues to dominate the tokenization market, holding over 65% of the market share. Joseph Young, a self-proclaimed part-time Ethereum narrator, revealed this, citing charts from Nate Geraci, Host of ETF Prime.

Young points out that this dominance underscores the trust institutions place in Ethereum’s track record and the strong network effect the blockchain has built over time. According to him, it remains unlikely that other platforms could replicate this position.

thecryptobasic.com

thecryptobasic.com