The ongoing cryptocurrency market selloff is prompting renewed caution among retail traders, but on-chain data suggests large investors are moving in the opposite direction.

As prices slide across major digital assets, Ethereum ($ETH) is emerging as a clear accumulation target for whales and institutional players.

Blockchain data shows that Trend Research, a well-known institutional wallet, has aggressively increased its Ethereum exposure during the downturn.

The firm borrowed roughly $70 million in USDT from Aave and deployed the funds to purchase 24,555 $ETH, valued at approximately $75.5 million at current prices, according to on-chain data retrieved from Arkham on January 21.

Following these transactions, Trend Research now holds an estimated 651,310 $ETH, worth about $1.92 billion, underscoring strong conviction despite broader market weakness.

The accumulation pattern appears methodical. On-chain records indicate repeated movements between Aave, Binance, and Trend Research, linked wallets, suggesting leveraged positioning and strategic capital rotation rather than short-term speculation.

Crypto market correction

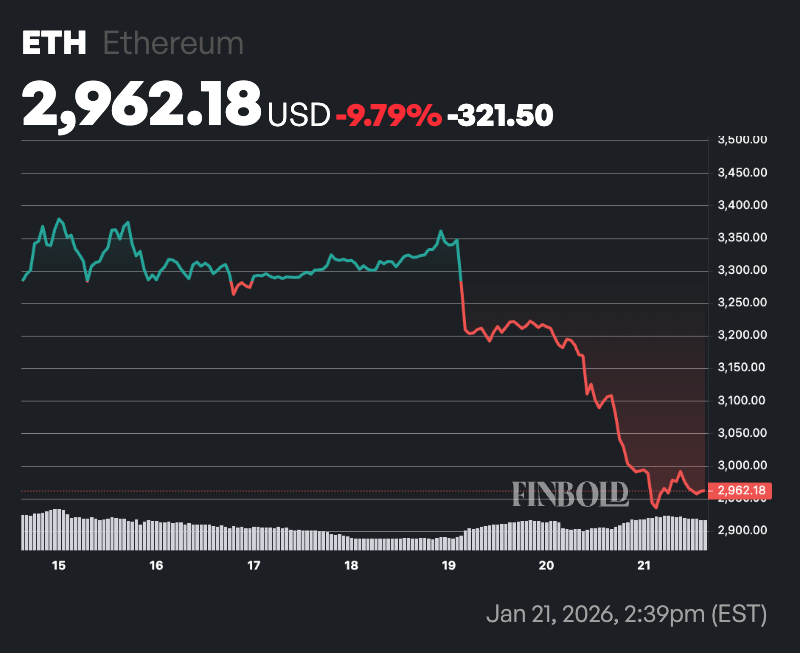

These transactions occurred as Ethereum prices retreated alongside Bitcoin (BTC) and the wider market, reinforcing the view that large players are using the pullback to build long-term positions.

Notably, as of press time, Ethereum had declined more than 4% over the past 24 hours, trading at $2,962. Over the past week, the asset has fallen nearly 10%.

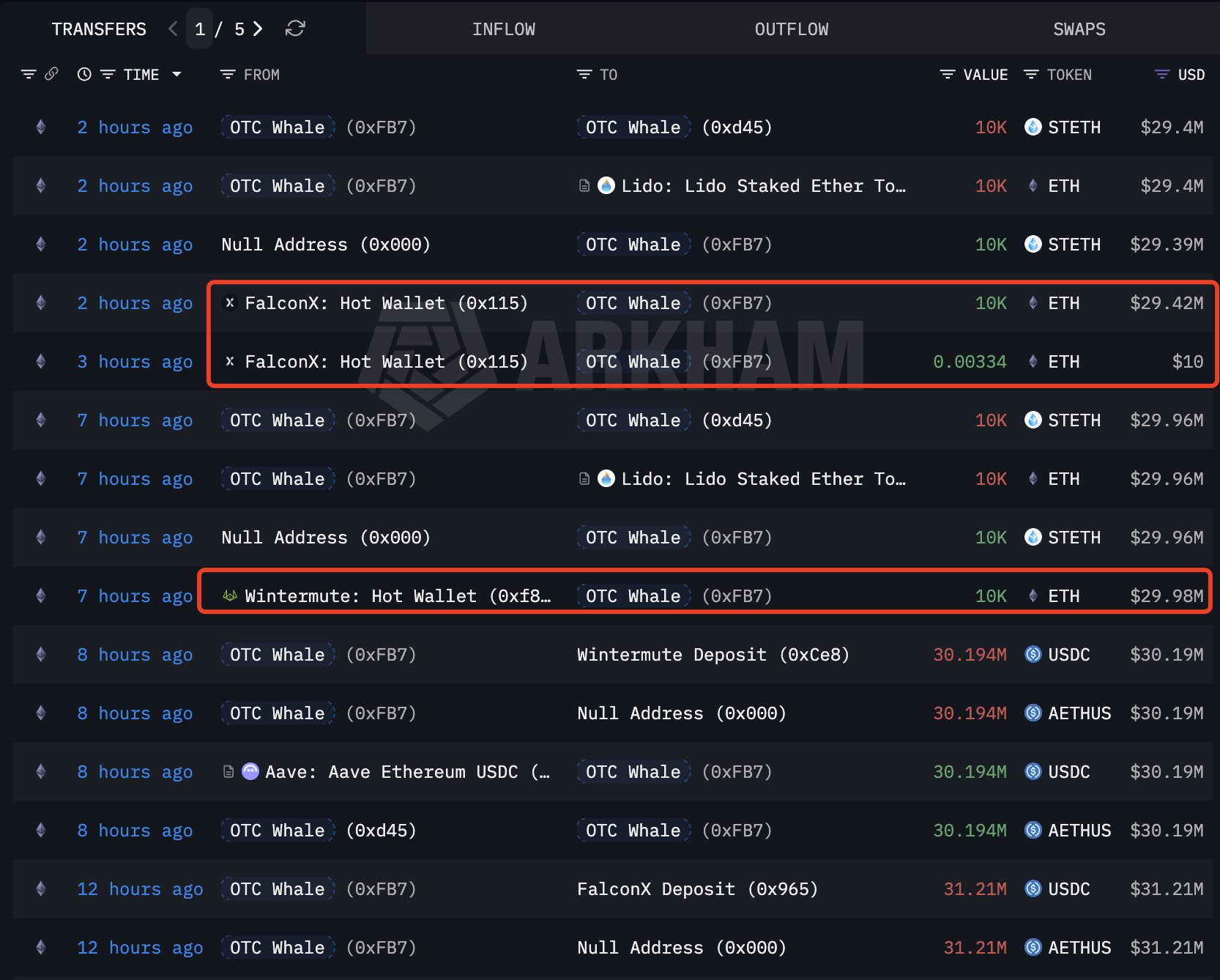

Institutional buying has also extended beyond Trend Research. An over-the-counter whale wallet labeled 0xFB7 acquired 20,000 $ETH worth about $58.8 million through liquidity providers FalconX and Wintermute, signaling sustained institutional demand despite weak spot market sentiment.

The divergence between falling prices and rising whale accumulation is becoming increasingly clear. As retail participation softens amid elevated volatility and risk-off macro conditions, large investors appear to be viewing the selloff as an opportunity rather than a warning.

Ethereum’s role across decentralized finance, staking, and layer-two scaling continues to support its appeal during periods of market stress.

Historically, sustained whale accumulation during drawdowns has often preceded market stabilization or recovery, though timing remains uncertain.

Featured image via Shutterstock

finbold.com

finbold.com