A major crypto whale added to a large Ether long as Ethereum’s market share held a key level on chart data. Together, the moves kept attention on whether $ETH can keep gaining traction against the wider market.

Arkham says Hyperunit Whale added to a large Ether long

Arkham said the “$10B Hyperunit Whale,” which it links to Garrett Jin, increased an existing Ether long by another $66.2 million. In the same post on X, Arkham said the whale’s $ETH long now totals about $733.3 million, while the combined long exposure across $ETH, SOL, and $BTC tops $900 million.

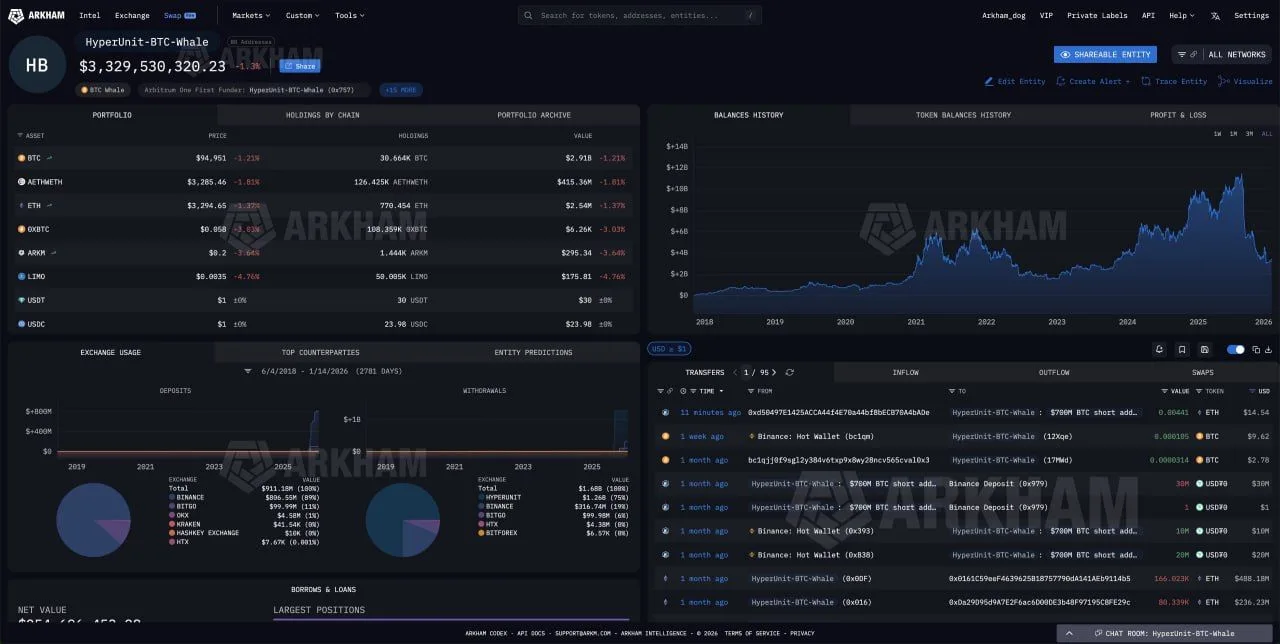

Hyperunit Whale $ETH Long. Source: Arkham Intelligence

The Arkham dashboard for the labeled entity “HyperUnit $BTC Whale” showed a portfolio value of about $3.33 billion at the time of the screenshot. The holdings table listed roughly 30.664K $BTC valued near $2.91 billion, alongside about 126.425K AETHWETH worth roughly $415.36 million, with smaller balances shown in other tokens.

Arkham also highlighted the scale of the position by asking whether this could become the first $1 billion long since James Wynn. Arkham did not publish additional details in the post about venue, leverage, or liquidation levels for the reported long exposure. Source: Arkham Intelligence, X.

$ETH dominance holds a key level as momentum indicators turn positive

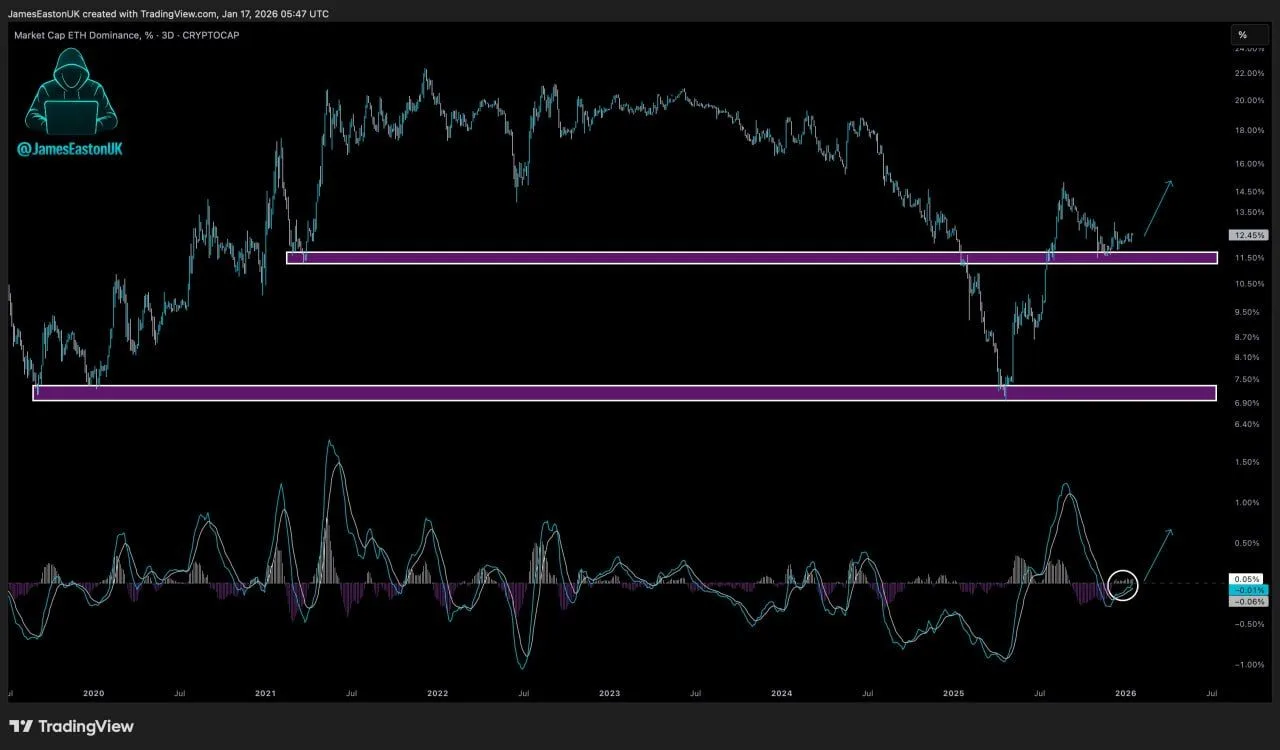

Ethereum’s share of the total crypto market capitalization held a key support zone, according to a chart shared by X user JamesEastonUK. The TradingView data showed $ETH dominance stabilizing near the mid range after a sharp rebound from early 2025 lows, with price structure remaining above a long watched horizontal level.

$ETH Dominance 3 Day Chart. Source: TradingView, JamesEastonUK

At the same time, momentum indicators shifted. The MACD on the $ETH dominance chart flipped bullish, signaling a change in trend strength after a prolonged negative phase. Meanwhile, histogram bars expanded, which reflected improving momentum rather than a flat or fading move.

In addition, volume increased alongside the recent push higher. That rise suggested broader participation as $ETH dominance recovered from the lower band marked on the chart. As a result, Ethereum’s market share remained near 12.5% at the time of the snapshot, keeping the key level intact while technical signals aligned to the upside.