Prominent market analyst Dan Gambardello shared several data points showing that Ethereum and other major altcoins are mirroring the trend of the last cycle.

Notably, the analyst compared the current market conditions to those of the previous cycle, highlighting structural, technical, and macroeconomic similarities.

Interestingly, Gambardello’s analysis comes at a time when market enthusiasts are split on the next course of action for Bitcoin and altcoins. As a result, this straightens speculations and provides a clear context for the next market trajectory.

Key Points

- Prominent market analyst Dan Gambardello shared several data points showing that Ethereum and major altcoins are mirroring the trend of the last cycle.

- Gambardello’s analysis comes at a time when market enthusiasts are split on the next course of action for Bitcoin and altcoins.

- The analyst stated that the current Ethereum structure closely resembles a shape from the 2019/2020 cycle.

- Gambardello noted that the 2020 bull shared a similar storyline with the current market, including QE, black swan events, and PMI bottoming.

- This correlation between the two cycles provides historical context for investors to watch. While history does not always repeat, it tends to rhyme.

Ethereum Structure Echoes 2020 Formation

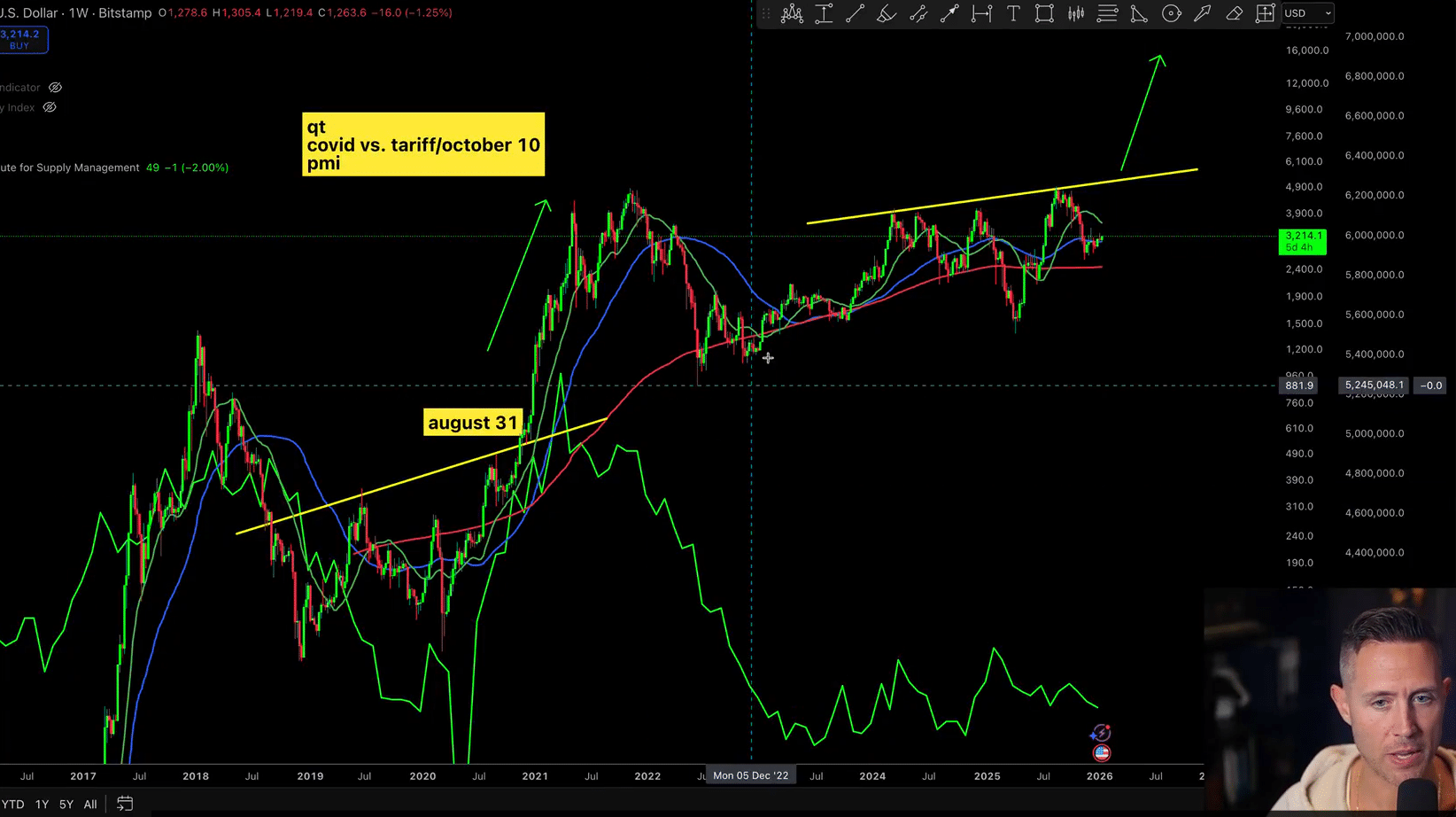

The analyst started with the current Ethereum structure, which closely resembles a shape from 2019/2020. He noted that Ether is forming an inverse head-and-shoulders pattern on the weekly chart.

The left shoulder formed from September 2024’s dip to $2,150, the head from April 2025’s low of $1,385, and the right shoulder is still in work after a dip to $2,620 in November 2025. Meanwhile, the breakout neckline lies around the $5,300 price level.

The accompanying chart highlighted a similar formation between 2019 and 2020. While he noted it was not a H&S pattern, the structure looked much like the current market structure.

Similar Stories Behind Both Cycles

Further, Gambardello noted that the 2020 bull shared a similar storyline with the current market. For context, the US Federal Reserve began quantitative easing in March 2020, injecting liquidity into the US market. In response, Ethereum started an impulsive move, breaking out from around $530 in December 2020 to a high of $4,646 in May 2021.

This time, the US Fed announced the end of quantitative tightening (QT) in December 2025, marking the start of its balance sheet expansion. According to the analyst, this strengthens the narrative that Ethereum could mirror its rally from the previous cycle.

Moreover, both cycles have also had their own black swan events. In the previous cycle, it was the COVID-19 pandemic and tariff fears. In this cycle, it is the October 10, 2025, market wipeout and the persisting tariff drama.

Additionally, the purchasing managers’ index (PMI) is bottoming out, as in the last cycle, adding to the analyst’s conviction. Gold and silver also topped around this time in the previous cycle, and analysts are suggesting that the end of the current bullish momentum would spark a rotation into cryptos.

Why Does This Matter for Ethereum and Altcoins

This correlation between the two cycles provides historical context for investors to make market predictions. While history does not always repeat, it tends to rhyme.

As a result, Ethereum may have more in the tank, with Gambardello suggesting an uptrend towards the $15,000 axis. It also clarifies the uncertainty around a possible extension of this bull market, a narrative that industry voices such as Bitwise CIO Matt Hougan and Binance co-founder Chanpeng “CZ” Zhao share.

For the mentioned assets, such as Cardano and Chainlink, it identifies the endless possibilities of holding them. Gambardello noted that these assets are like pre-bull levels, and a bullish wave would extensively benefit holders.

Risk Caveat

Notably, while Gambardello detailed these similarities, there is no guarantee that this cycle would mirror the 2020 bull run. The analysis is purely data-driven and, as such, investors should not confuse this as certainty as structures fail.

As a result, investors should conduct due diligence before taking any action, as this is not financial advice.

thecryptobasic.com

thecryptobasic.com