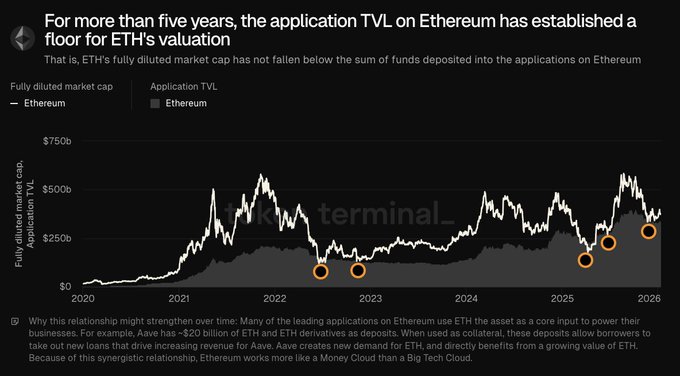

Ethereum apps now have $337B of capital actively deployed across lending, trading, and settlement. Historically, when this level of activity has existed on Ethereum, the network’s valuation has not stayed far below it for long. That’s because many of these applications require

Ethereum price held steady on Wednesday, continuing a trend that has been going on in the past few weeks. $ETH token rose to $3,340, and this trend may accelerate in the coming months as it has formed the highly bullish inverse head-and-shoulders pattern, and the spot $ETH ETF inflows have continued.

Ethereum price technical analysis points to a surge

Copy link to section

The weekly timeframe chart shows that the $ETH price tumbled to a low of $1.360 in April last year and then rebounded to a record high of $4,965 in August.

It has now retreated and moved into a technical bear market as it moved to the current $3,335.

A closer look shows that the coin has formed the highly bullish inverted head-and-shoulders pattern. In this case, the head section was at $1,360, and it has just completed the formation of the right shoulder.

At the same time, the Relative Strength Index (RSI) has started to point upwards and crossed the important neutral point at 50. The two lines of the Percentage Price Oscillator (PPO) indicator have also flat lined at the neutral level.

There are also signs that the coin has invalidated the recently forming bearish flag chart pattern. Therefore, the most likely $ETH price forecast is bullish as long as it remains above the right shoulder at $2,663. If this happens, the coin may rebound soon and hit the key resistance level at $4,000, followed by the all-time high of $4,965.

$ETH price has numerous bullish catalysts

Copy link to section

In addition to its strong technicals, the reality is that Ethereum has some of the best fundamentals in the crypto industry.

First, data shows that American investors have started buying spot $ETH ETFs this week. Spot Ethereum ETFs had over $129 million in inflows on Tuesday and $5 million a day before that. The funds have now had over $12.57 billion in cumulative inflows, with their total assets rising to nearly $20 billion.

Second, Ethereum has continued to gain its market share across all areas in the crypto industry, including decentralized finance (DeFi) and Real-World Asset (RWA) tokenization, which most analysts believe is the future of finance.

Ethereum has of $152 billion locked in its DeFi ecosystem and $473 billion in its bridged TVL. Its market dominance has jumped to 76%, even as new chains have been launched in the past few years. They include networks like Base, Berachain, Katana, and Monad.

Ethereum has become the most popular chain for handling stablecoin transactions, with the volume rising to over $8 trillion in the last quarter. Its RWA ecosystem has also continued to boom, with top companies like Franklin Templeton and JPMorgan using its chain.

Additionally, BitMine has continued to accumulate the token in the past few months. It has bought over 4 million tokens since July last year and is on track to hit its target of holding 6 million tokens over time.

BitMine has a vote to increase the number of authorized shares from 500 million to 50 billion. This raises the possibility that the company will change its goalpost and decide to accumulate more Ethereum over time.

There are also signs that Ethereum is undervalued. For example, it has a market capitalization to DeFi TVL ratio of 2.64, much lower than Solana’s 3.85 and BSC’s 3.85.

Ethereum price will also likely rebound as the developers work on the upcoming Glamsterdam and Hegota upgrades later this year. These upgrades will boost Ethereum’s speed, making it a faster network. Indeed, there are now questions on the role of general-purpose layer-2 networks as Ethereum will soon match their speeds.

invezz.com

invezz.com