Ethereum’s spot price hovered at $3,087 per coin on Saturday, while derivatives traders quietly stacked risk across futures and options markets. The data shows leverage building even as price action stays choppy, a setup that has a habit of punishing crowded positions.

Ethereum Futures and Options Signal Trader Tension Near $3,100

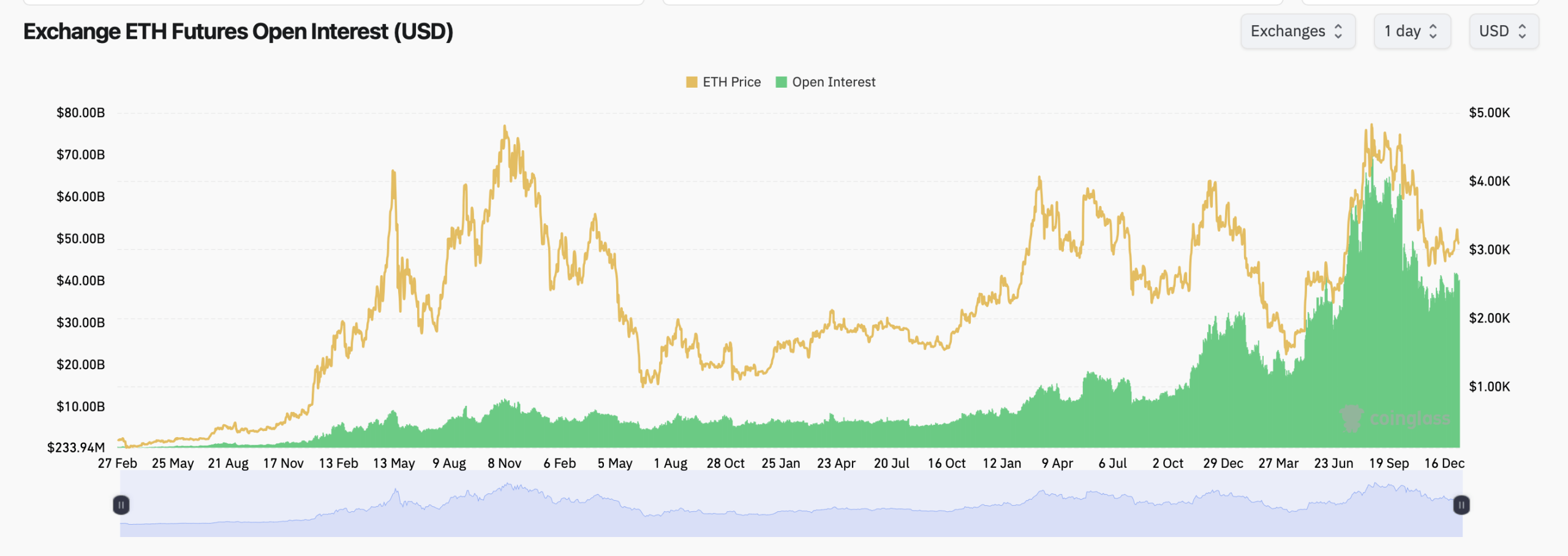

Ethereum futures open interest climbed to 13.01 million $ETH, representing roughly $40.22 billion in notional value across major exchanges. Despite minor pullbacks in the past hour and four-hour windows, open interest posted a 0.69% increase over 24 hours, signaling that traders are adding exposure rather than stepping away.

Binance remains the heavyweight in ethereum futures, controlling 22.62% of total open interest, or about $9.10 billion. CME follows with $5.86 billion, a notable figure that highlights continued institutional participation. Gate, Bybit, OKX, and Bitget round out the top tier, each carrying multi-billion-dollar positions that collectively keep leverage elevated.

Short-term market action looks uneven. Most exchanges recorded small one-hour and four-hour declines in open interest, suggesting tactical de-risking. However, the broader 24-hour picture tells a different story, with Gate posting a 4.34% jump and OKX rising 2.47%, indicating selective accumulation rather than panic exits.

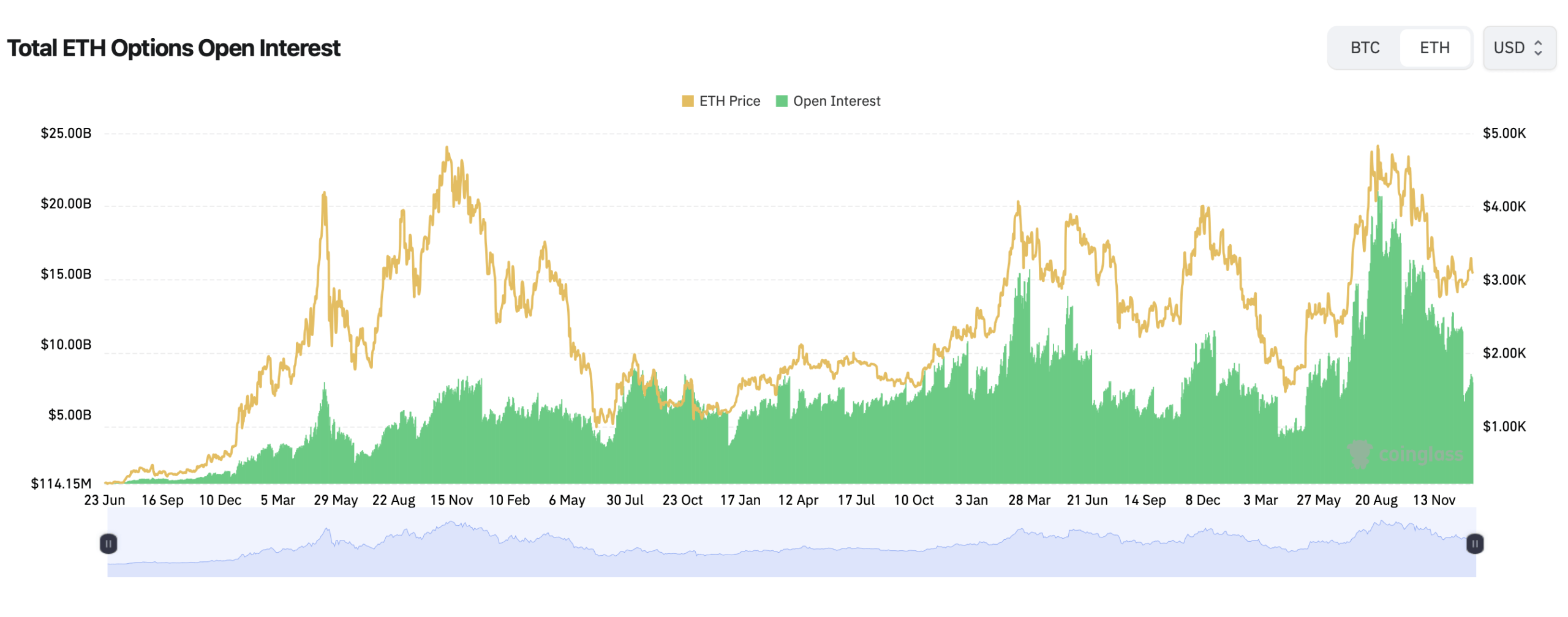

Options markets lean decisively toward optimism. Total ethereum options open interest shows calls accounting for 60.40%, compared with 39.60% in puts, translating to roughly 1.29 million $ETH in calls versus 843,794 $ETH in puts. Volume over the past 24 hours echoes that bias, with calls making up 52.83% of traded contracts.

The most crowded options strikes sit far above spot. On Deribit, the largest open interest contracts include $ETH-$6,500 calls expiring March 27 and $5,500 calls expiring March 27 and June 26, suggesting traders are betting on extended upside later in the year rather than immediate fireworks.

Yet the max pain data adds a twist. On Deribit, ethereum’s max pain level clusters near $3,100, uncomfortably close to the current spot price. Binance and OKX show similar profiles, with max pain curves dipping toward the $3,000–$3,100 range, a zone that historically acts like a magnet as expiration approaches.

Also read: ‘Running Bitcoin’: BTC Holds $90K on 17th Anniversary of Hal Finney’s Iconic Tweet

That tension creates an awkward standoff. Futures traders are adding leverage, options traders are loading calls, and max pain quietly lurks below the most popular bullish strikes. It’s the kind of setup where patience, not bravado, usually wins.

Historically, periods where futures open interest rises faster than spot price tend to precede sharper moves. Direction is never guaranteed, but crowded positioning reduces the margin for error. When everyone leans the same way, the market has a habit of testing resolve.

For now, ethereum derivatives markets reflect conviction without confirmation. Leverage is building, optimism is visible, and risk remains finely balanced near a psychologically charged price level. Whether traders get rewarded or rinsed will depend on who blinks first.

FAQ ❓

-

What is ethereum futures open interest right now?

Ethereum futures open interest stands at roughly $40.22 billion across major exchanges. -

Are ethereum options traders more bullish or bearish?

Options data shows a bullish tilt, with calls making up about 60% of open interest. -

Where is ethereum’s max pain level?

Max pain clusters near the $3,000–$3,100 range on Binance, OKX, and Deribit. -

Which exchange dominates ethereum futures trading?

Binance leads with more than 22% of total ethereum futures open interest.

news.bitcoin.com

news.bitcoin.com