- The Ethereum price is poised for a 6% drop before retesting the neckline support of head and shoulders pattern.

- Coinglass data shows ETH futures open interest rising from $35.2B to $38.4B

- A bearish crossover between the 100-and-200-day exponential moving average, reinforming the potential downtrend in price.

On Tuesday, December 23rd, the Ethereum price showed a slight downtick of 1.65% to reach its current trading value of $2,964. The bearish pullback followed the continued correction trend in the broader crypto market as Bitcoin projects another reversal from the $90,000 market. Despite the mounting selling pressure in the market, the corporate firms are continuing their ETH accumulation as on-chain shows that altcoins are outperforming BTC.

ETH Futures OI Rebounds as Traders Position for Next Big Move

Since last weekend, the Ethereum price has witnessed low volatility trading below the $3,000 psychological level. The daily chart shows multiple short-bodied candles with low volume indicating a lack of initiation from buyers or sellers.

Amid this consolidation, the coin price showed an attempt to breach the overhead resistance driven by the bullish spur from the future momentum. According to Coinglass data, the open interest tied to Ethereum futures rebounded from $35.2 billion to $38.4 billion, registering a 9% surge.

This jump indicates that traders are entering new contracts in the futures market, in anticipation of a dynamic move in the near future.

Meanwhile, institutional demand for Ethereum is continuing to pick up pace towards the end of 2025, both in the form of traditional funds and dedicated treasury strategies.

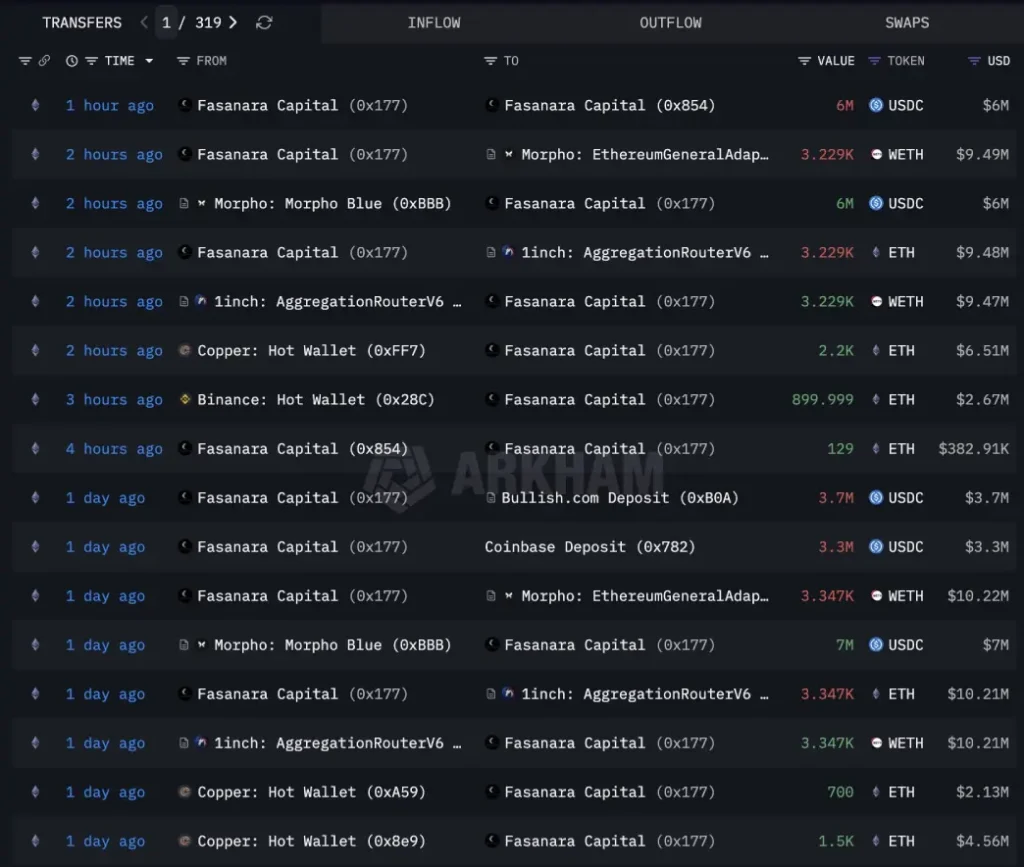

London-based Fasanara Capital executed a leveraged play in the past two days, buying up to 6,569 ETH ([?] $19.72 million). The firm then used the tokens as collateral on the Morpho DeFi lending protocol, borrowing about $13 million in USDC as collateral to obtain more ETH.

Simultaneously, BitMine Immersion Technologies, the Ethereum treasury company that is chaired by Fundstrat’s Tom Lee added 29,462 ETH worth around $88.1 million. The tokens were received as transfers from BitGo and Kraken in BitMine’s sustained accumulation program. The purchase brings its holdings well beyond 4 million ETH, keeping the company well on its way to its long-term goal of holding 5% of the total supply..

Institution buying and futures market support could bolster Ethereum price for renewed recovery.

Bearish Chart Pattern Sets Ethereum Price for Deeper Correction

Over the past month, the Ethereum price recorded a sideways trend, resonating around the $3,000 range. The consolidation aligns with broader market uncertainty and macroeconomic development in the U.S. market.

A deeper analysis of the 4-hours shows that the price action developed into a traditional bearish reversal pattern called head and shoulders. Theoretically, the chart setup displays three peaks i.e., a left shoulder, a tall head and right shoulder, before price gives a decisive breakdown from the pattern’s neckline support.

The chart pattern has developed as a fresh lower high formation in ETH’s daily chart indicating an intact sell-the-bounced sentiment in the market. With today’s market decline, the Ethereum price is heading close to the neckline support at $2,800 for potential breakdown.

The momentum indicator RSI at 48% shows neutral to bearish market sentiment, bolstering the potential for support breakdown. If materialized, the Ethereum price could plunge another 6% to hit immediate support of $2,600, followed by a keep to $2,400.

On the contrary note, the coin price could witness renewed demand pressure at the neckline support amid the increasing buying from institutional and futures traders. If the support holds, the buyers could drive a fresh recovery attempt to reclaim the $3,000 mark.

cryptonewsz.com

cryptonewsz.com