Ethereum would need to be able to hold key support levels for a potential rebound amid massive long liquidations.

Ethereum has experienced some moderate volatility over the past 24 hours, currently trading at $2,943. The crypto asset has shown a 0.7% increase in price within the last 24 hours, with the daily price range fluctuating between $2,902 and $2,971. Ethereum’s performance has been somewhat muted over the last week, down by 11.4%.

Looking at the past 14 days, Ethereum has experienced a 3.7% drop, reflecting broader market trends and sentiment. The market capitalization stands strong at $355.8 billion, highlighting Ethereum’s prominent position as a market leader. In the next sessions, traders will explore how Ethereum is navigating its long-term price trends and where $ETH is headed.

Ethereum Price Prediction

Ethereum’s recent price movement has featured some key technical signals, indicating a period of retreat. Currently, the support level holds strong around $2,800, with the price finding a bounce at this level in recent sessions. This suggests that if Ethereum maintains this support, it could attempt a rebound, potentially testing resistance above $3,300. Breaking this resistance could pave the way for a further rally toward $3,500.

Moreover, the Relative Strength Index (RSI) is currently at 41.20, signaling neutral conditions. This indicates that Ethereum isn’t overbought or oversold but is nearing the lower end of the RSI range, which could suggest a reversal if buying pressure picks up. However, if the RSI continues to move lower, it could indicate that bearish momentum will persist, testing the support level more aggressively.

Further, the Moving Average Convergence Divergence (MACD) is signaling a bearish trend, with the MACD line at -44.47 and below the signal line at -38.24. This bearish crossover indicates that the downward momentum is currently stronger, as reflected by the negative histogram. A potential shift in momentum could occur if the MACD line crosses back above the signal line.

Ethereum Liquidation Data

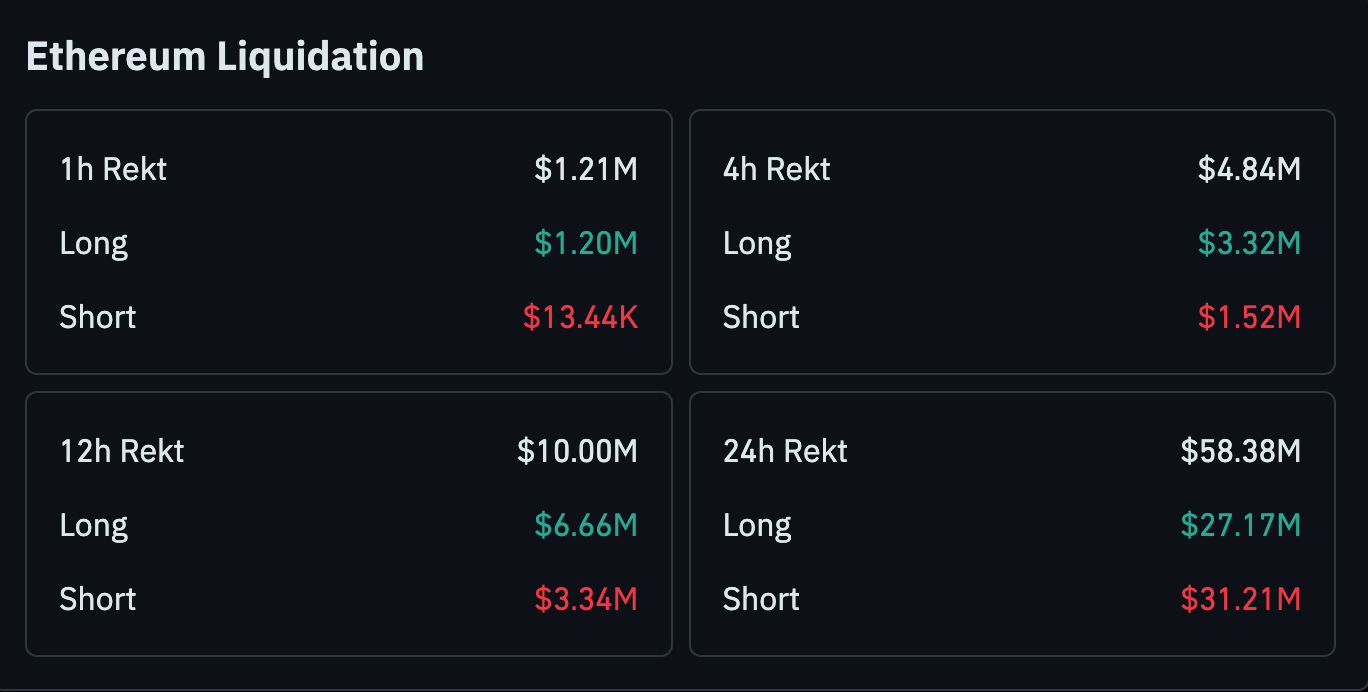

Meanwhile, the Ethereum market has seen a significant amount of liquidation across different time frames, highlighting the volatility and the pressure on both long and short positions. The 12-hour liquidation figure reached $10 million, with long positions at $6.66 million and shorts at $3.34 million.

The 24-hour liquidation data is even more striking, showing $58.38 million in total liquidations, with long positions making up a significant portion at $27.17 million, while shorts accounted for $31.21 million. This imbalance suggests heightened market volatility, with long positions suffering the most.

thecryptobasic.com

thecryptobasic.com