Ethereum ($ETH) trading volumes remain elevated, with growing activity on Binance. $ETH activity is becoming more speculative, as the token provides directional trading and boosts derivative markets.

Ethereum is becoming a speculative asset, with a rise in Binance activity and overall growth of derivative markets. Compared to previous cycles for Ether, the effect of derivative volumes is more notable. Previously, $ETH spot demand drove the price, directly reflecting the ecosystem’s growth.

The token recovered to $3,615.63 after a dip to the $3,000 level. Ether also showed a trend of quickly rebuilding its open interest. After a low of $18B in early November, Ethereum open interest recovered to over $18B. In the past 24 hours, $ETH open interest recovered faster than $BTC, rising by 5.5%.

$ETH still has 11.9% in market cap dominance, while trading at 0.034 $BTC.

$ETH quickly recovers open interest

The current $ETH market cycle far surpasses the 2021 bull market in terms of derivative open interest. Growing derivative infrastructure and demand for hedging through options have changed the $ETH market, leading to more speculative price moves.

Binance remained the biggest market with $7.1B in open interest. However, the exchange is yet to recover its open interest peak from August 2025.

$ETH is more volatile compared to $BTC, and also reflects more quickly the general recovery for altcoins. However, the price recovery does not necessarily reflect Ethereum adoption or on-chain activity, as during past cycles. This time, $ETH valuations may depend on derivative exchanges, with renewed influence for Binance.

Binance has emerged as the main venue for high-volume trading, including spot and derivative markets. The exchange absorbs most of the new token activity, as well as speculative $ETH activity. Hyperliquid is influential, but carries just $1.8B of Ether open interest.

At the same time, the concentration of open interest on one exchange can lead to more dramatic liquidations. As a result, in the past 24 hours, Ethereum saw $90.64M in short liquidations. Binance also led the liquidation activity for the day with $7.8M in total liquidations.

Can $ETH revisit $4,000?

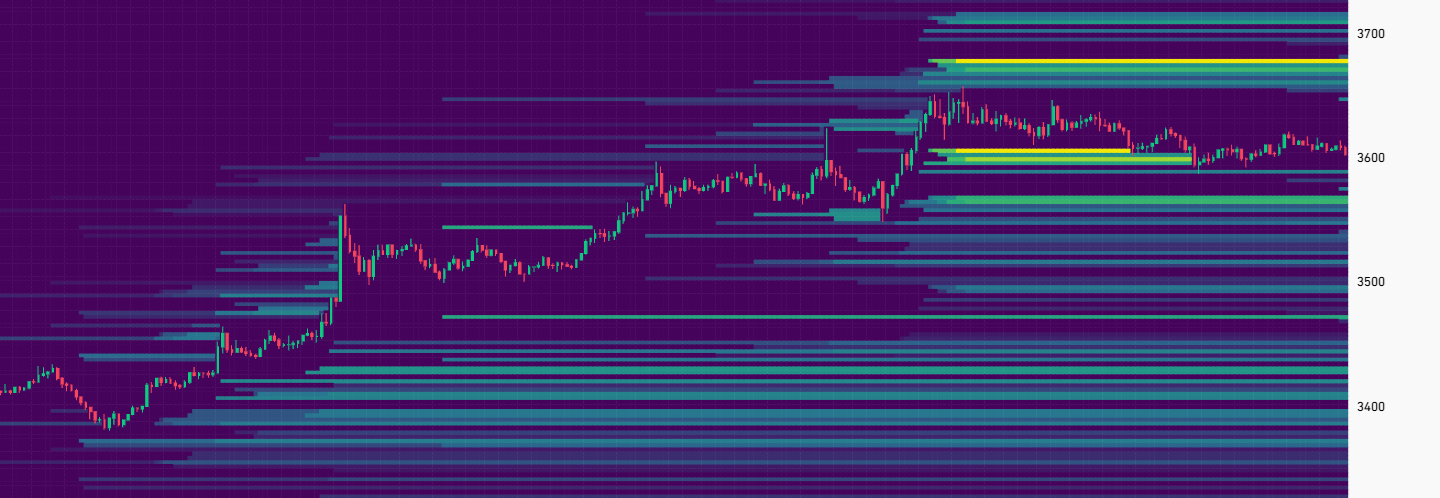

Based on derivative market liquidity, $ETH is locked in a range, with re-accumulation of long liquidity.

On the downside, $ETH has positions down to $3,300. Short positions, however, are going up to around $3,700, signaling a move to $4,000 is unlikely in the short term.

At its current price range, $ETH sets up expectations for both a rally to a new price range, and a short-term crash.

Ether traded at a slight premium on futures markets, signaling a potential breakout. On perpetual futures, $ETH had a small discount and traded closer to $3,600.

cryptopolitan.com

cryptopolitan.com