At the time of writing, Ethereum trades at $3,446, struggling to reclaim the rising trendline that has defined higher lows since April. The recent breakdown below this structure invalidates the previous trendline support, suggesting a potential shift in market momentum.

While derivatives data shows renewed long positioning, the move now reflects attempts to defend post-breakdown levels rather than a clean bounce from trendline support. The market will need to reclaim the trendline to confirm a short-term recovery and negate further downside pressure.

Ethereum trades below all major EMAs on the daily chart:

- 20-day EMA: $3,720

- 50-day EMA: $3,935

- 100-day EMA: $3,900

- 200-day EMA: $3,597

The immediate resistance is at the 200 EMA. The price needs to hold above this level to confirm a more bullish move. The Supertrend remains red, indicating that the trend bias has not yet turned positive.

A daily close above $3,935 would flip the Supertrend and reclaim the 50-day EMA, signaling the first clean trend reversal since October.

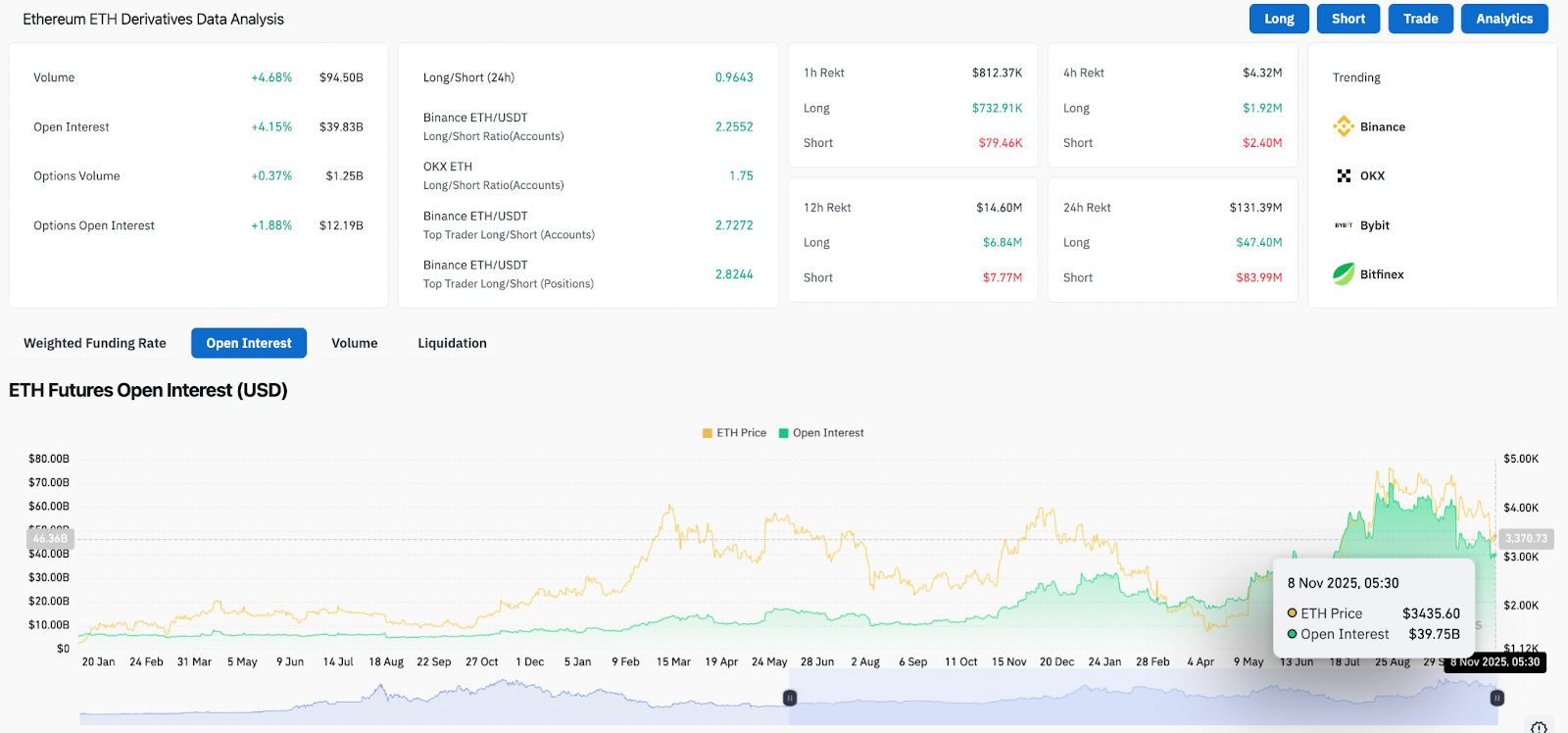

Derivatives Data Shows Real Positioning, Not Short-Covering

Derivatives flows confirm aggressive positioning toward longs:

- Open interest: up 4.15% to $39.83B

- Futures volume: up 4.68% to $94.50B

- Options OI: up 1.88% to $12.19B

The increase across all metrics reflects growing speculative activity and confidence in a potential upside move. Notably, a high-profile whale who correctly shorted ahead of tariff volatility has now flipped direction and opened a $138 million long on ETH, with an entry near $3,445. The size of that magnitude is rarely taken at random; large participants typically position near inflection points, not after confirmation.

The whale who shorted before Trump tariffs is now going long on $ETH.

— BitBull (@AkaBull_) November 8, 2025

Ethereum long position: $138 million

He definitely knows something. pic.twitter.com/HQ8BUzVVGQ

Intraday Momentum Turns Constructive

On the 30-minute chart, ETH holds above VWAP.

- RSI sits near 55, indicating strengthening intraday momentum

- Higher lows continue to form, showing buyers stepping up on dips

- Immediate micro support sits at $3,431

A move above $3,500 unlocks a retest of the 200-day EMA at $3,597. A breakout above the 200-day EMA would show buyers regaining trend control.

Key Levels To Watch

| Zone | Level | Importance |

| Support | $3,300 | Rising trendline and structural higher-low |

| First resistance | $3,597 | 200-day EMA |

| Breakout zone | $3,935 | 50-day EMA + descending trendline + Supertrend flip |

| Upside target | $4,400 then $4,800 | Continuation toward prior swing highs |

| Invalidation | Below $3,300 | Break of higher-low structure |

Will Ethereum Go Up?

ETH failed to defend the rising trendline that has guided its uptrend since April. The focus now shifts to whether the price can reclaim this level and establish a base for recovery.

- Bullish case: A daily close above $3,935 breaks the compression and confirms bullish continuation toward $4,400 and $4,800.

- Bearish case: Losing $3,300 invalidates the trendline and exposes $3,000 – $2,800, the prior accumulation range.

Related: Ethereum Price Prediction: Breakdown Accelerates As Bulls Lose $3,400 Level

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com