While institutional interest in altcoins continues to increase after Bitcoin, Ethereum ($ETH) is one of the most preferred altcoins.

As institutional $ETH purchases continue, institutions and companies' Ethereum holdings have surpassed 10% of the total supply. Experts believe this is an indication that the institutionalization of the Ethereum market is progressing rapidly.

According to data from StrategicETHReserve, Ethereum treasuries hold approximately 5.66 million $ETH, while spot Ethereum ETFs hold approximately 6.81 million $ETH. Total institutional holdings, according to the data, have risen to 12.48 million $ETH, representing 10.31% of the Ethereum supply.

The surge in ETF inflows in recent months has coincided with a surge in companies modeled after the largest institutional bull, Strategy (formerly MicroStrategy), and public companies like BitMine and SharpLink adding large amounts of $ETH to their balance sheets.

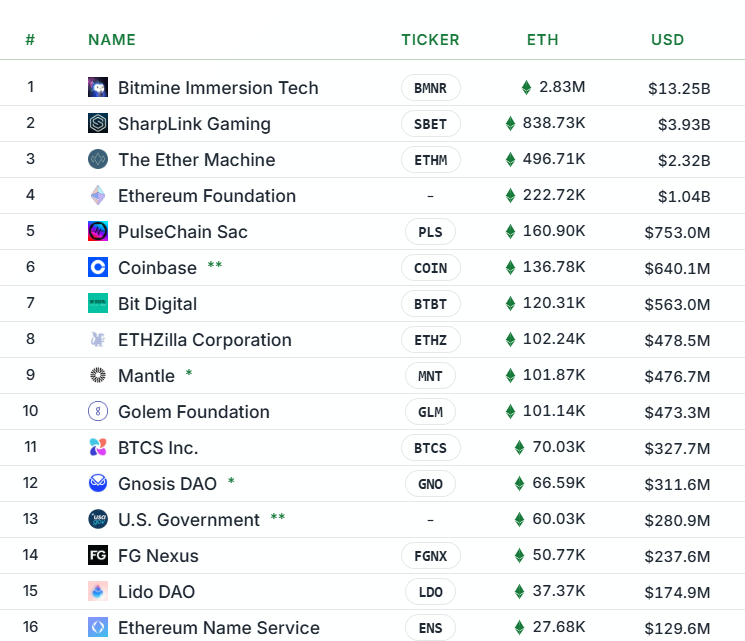

According to StrategicETHReserve data, the largest institutional Ethereum company is Bitmine, headed by Tom Lee, with 2.83 million $ETH in its possession, worth $13.25 billion.

Sharplink Gaming comes in second place with 838.7 thousand $ETH worth $3.93 billion, and The Ether Machine comes in third with 496.7 thousand $ETH worth $2.3 billion.

*This is not investment advice.