Ethereum ($ETH) keeps flowing into whale wallets. On-chain data reveals whales added 800K $ETH in a single week, potentially leading to a breakout for $ETH.

Ethereum whales added 800K $ETH in the past week, in another round of strong accumulation. The buying extends the trend from the past weeks, where whales spent up to $1.19B on $ETH in a single day.

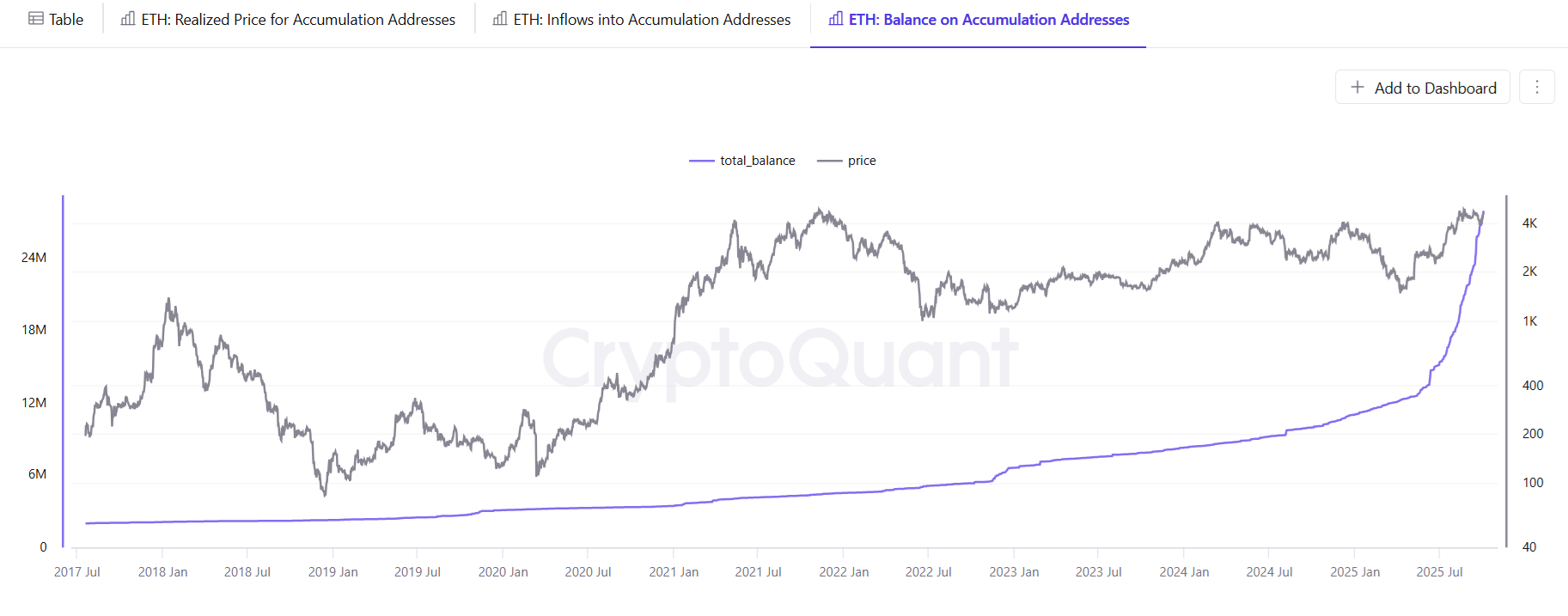

Whale accumulation increased in the second part of September and continued in October, potentially leading $ETH to a year-end rally. Historically, whale accumulation has preceded bullish market cycles. $ETH whales also strategically sell for profit-taking, but the overall trend for $ETH is to flow into no-sell accumulation wallets with a total balance of over 27M $ETH.

Spot accumulation and whale buying establish price floors for $ETH, showing a readiness to hold for the longer term. Most of the $ETH speculative activity happens on derivative markets, while spot traders rely on accumulation and staking.

The fastest trend of loading up on $ETH comes from wallets with 10K to 100K $ETH balances. The accumulation accelerated in the past month, taking more $ETH off the market. Whale activity became more notable in the third quarter, continuing into a potential year-end rally.

Will $ETH price follow the accumulation trend?

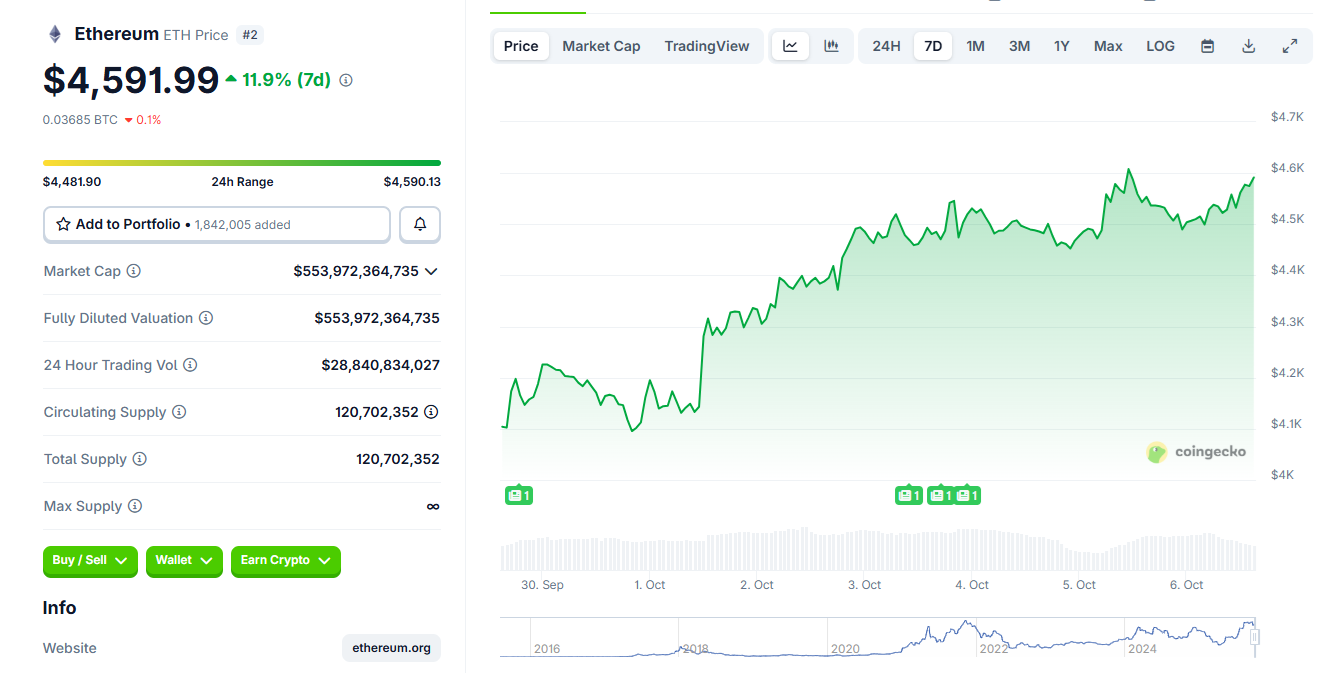

Despite the ongoing accumulation of $ETH, the token’s price remains stuck in a range. While BTC made new price records above $125,000, $ETH has remained below its peak.

$ETH traded at $4,573.13 as of October 6, still awaiting a breakout. $ETH expects a higher price range above $6,000 based on bullish predictions. However, short-term trading may cause a crash to $4,100 or lower.

Based on potential liquidatable positions, $ETH is in a range between $4,700 and $4,400 on the downside. $ETH is still rebuilding liquidity after a day of the highest liquidations since the 2021 bull market.

Whales also put selling pressure on $ETH

While accumulation is ongoing, short-term selling for profit may sway the market. Recently, Trends Research sent $ETH to Binance, presumably for sale.

Trend Research deposited another 77,491 $ETH($354.5M) into #Binance for sale in the past 10 hours.

Over the past 4 days, they have deposited 143,124 $ETH($642M) into #Binance.https://t.co/Oh2Nr7xOtG pic.twitter.com/yITKkuzykv

— Lookonchain (@lookonchain) October 5, 2025

Additional selling pressure came from an older $ETH wallet selling 1,800 tokens.

While large-scale wallets are buying, the market still has to absorb selling from retail. The overall bearish stance of retail has led to a turnover of $ETH. According to Market Prophit signals, crowd money is much more bearish on $ETH compared to smart money.

Retail selling puts additional pressure on the price, and whales cannot always compensate. $ETH is also facing demand from treasury companies and ETFs. In the short term, $ETH is facing a significant sell wall at prices leading up to $4,900 and above, with the potential for short-term price resistance.

cryptopolitan.com

cryptopolitan.com