Ethereum ($ETH) price seems to be ending August on a strong note, gaining over 23% and breaking a three-year streak of negative August performances. Unlike Bitcoin, which has struggled through the month, the $ETH price has shown resilience.

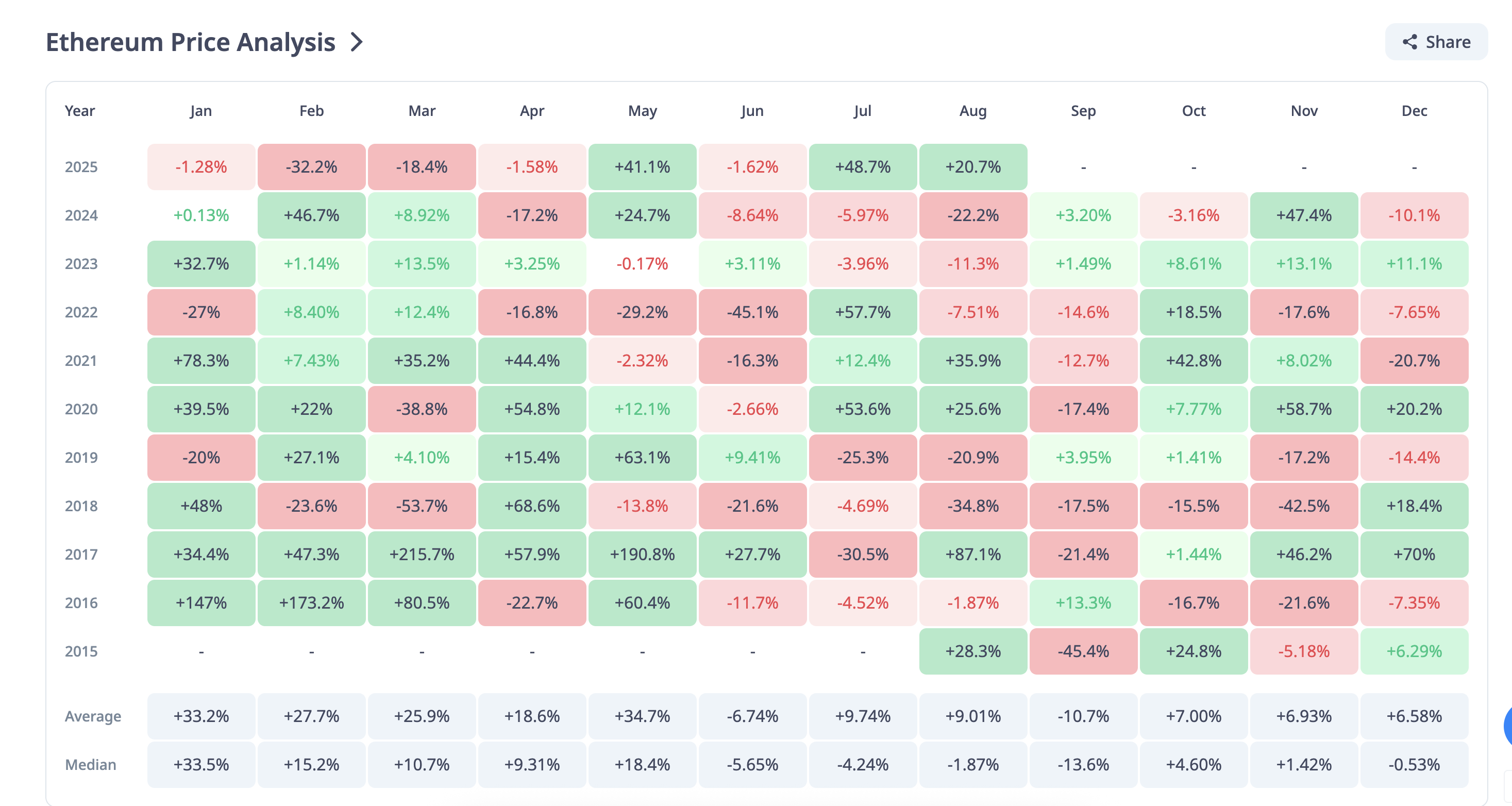

However, September has historically been one of Ethereum’s weaker months, with only marginal gains of 3.20% in 2024 and 1.49% in 2023 after a series of red Septembers before that. Now, with the charts flashing mixed signals, $ETH could be headed for a choppy month.

Long-Term Holders May Book Profits

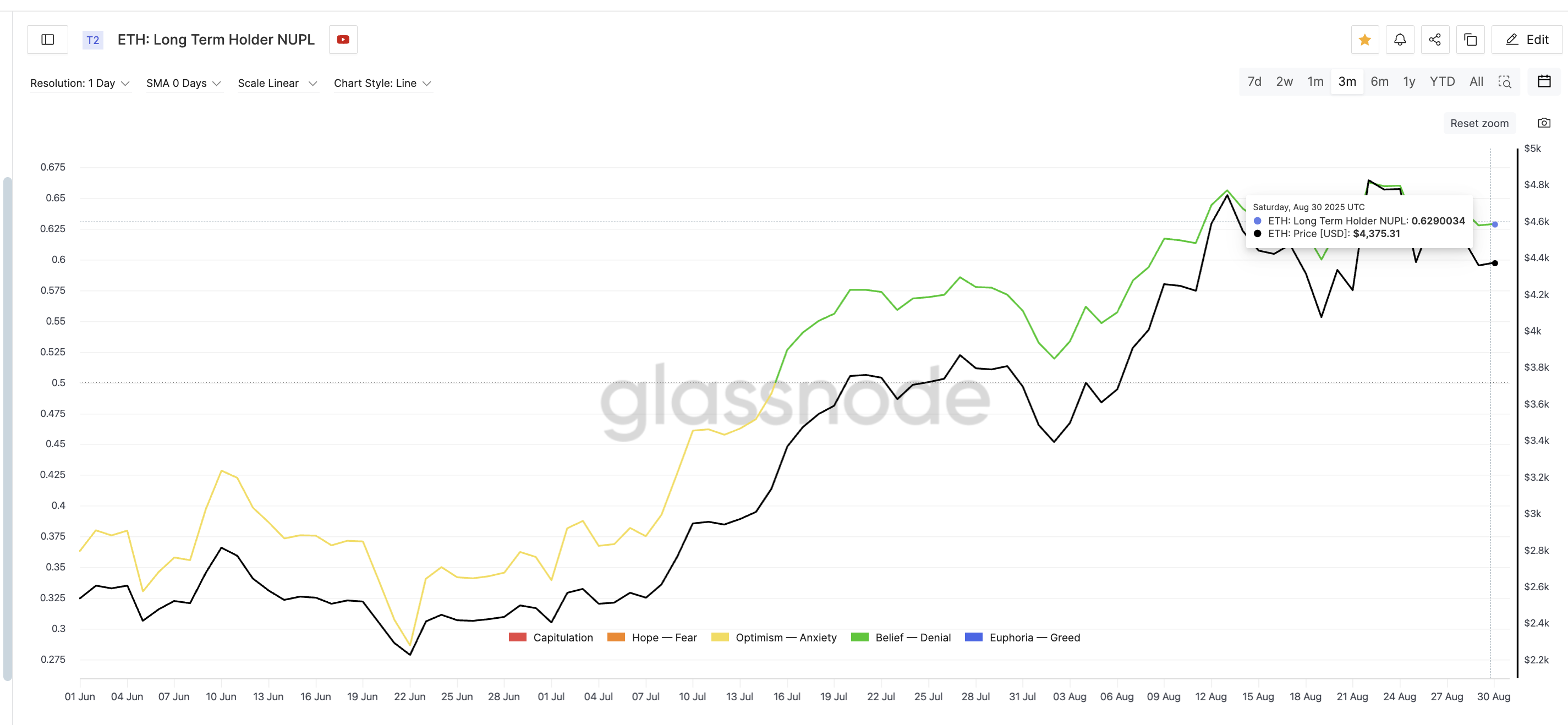

One key metric to watch is Ethereum’s Net Unrealized Profit/Loss (NUPL), which measures the overall profitability of holders.

A high NUPL means most wallets are sitting on profits, often a signal that some may take profit. Ethereum’s long-term holder NUPL currently sits at 0.62, close to its three-month high.

In the past, similar levels have triggered corrections. On August 17, when NUPL touched 0.63, $ETH fell from $4,475 to $4,077 (-8.9%). Later that month, at 0.66, $ETH dropped from $4,829 to $4,380 (-9.3%). This suggests that September could bring volatility or range-bound action.

Historically, September hasn’t been $ETH’s strongest month. That history, combined with high NUPL, supports the case for choppiness.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Still, long-term fundamentals remain supportive of a price surge. In an exclusive interview with BeInCrypto, Kevin Rusher, CEO of RAAC, explained:

“In September, I expect the drivers for Ethereum’s price to remain largely the same as they are today, key among these the growing trend of companies buying up $ETH for their treasuries. In fact, just this week, Standard Chartered named this as the main reason for increasing its $ETH price target to $7,500, he mentioned”

This treasury accumulation trend, alongside Ethereum’s role in DeFi and real-world asset (RWA) tokenization, could help cushion downside moves even if near-term volatility persists.

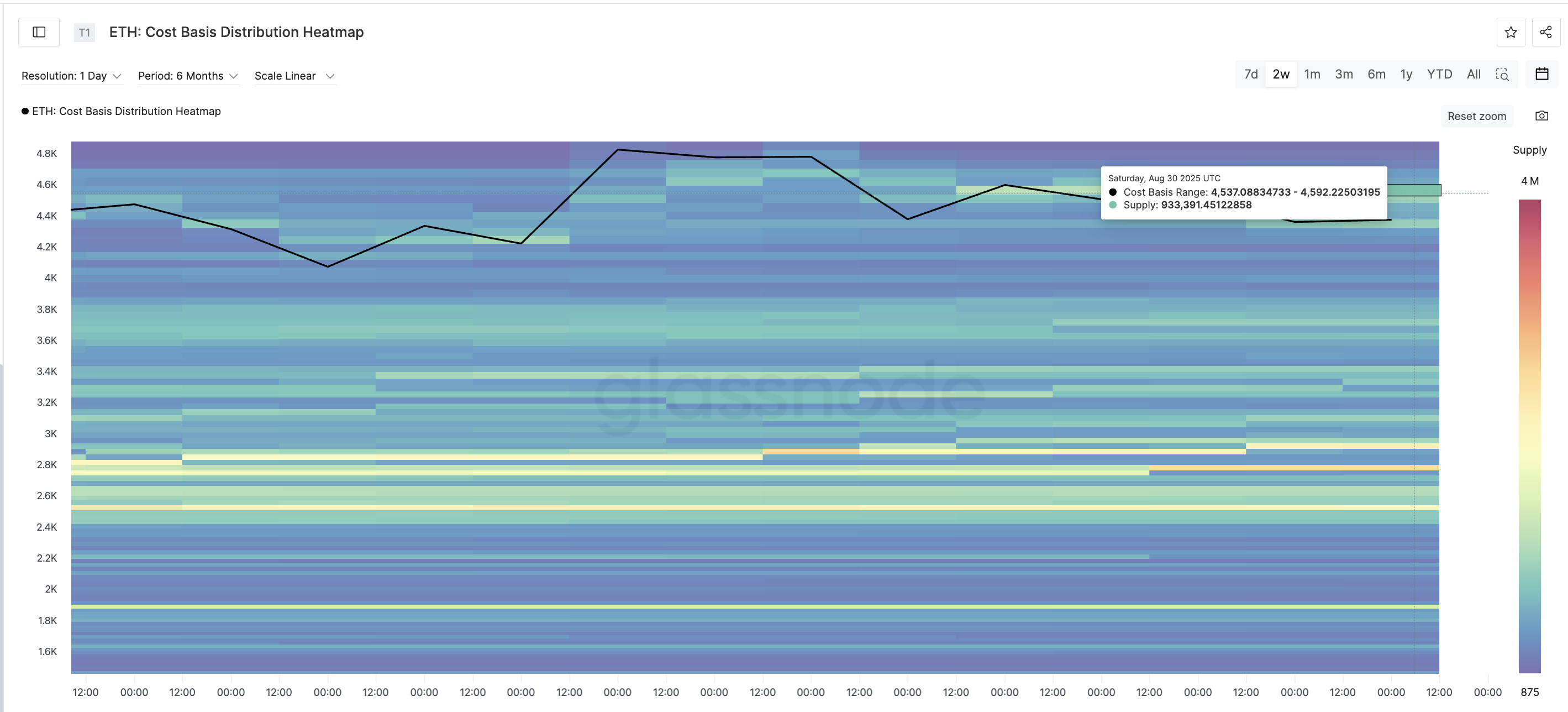

Cost Basis Heatmap Highlights Critical Resistance

Another important metric is the Cost Basis Heatmap, which shows where $ETH was last accumulated. These zones often act as natural support or resistance.

The strongest support cluster lies between $4,323 and $4,375, where more than 962,000 $ETH were accumulated. Below that, additional zones exist at $4,271–$4,323 (418,872 $ETH) and $4,219–$4,271 (329,451 $ETH), providing buffers in case the Ethereum price dips.

The heavier challenge lies higher. Between $4,482 and $4,592, nearly 1.9 million $ETH were accumulated, making this a formidable resistance zone.

If the $ETH price clears this, momentum could extend toward $4,956. More on this later when we discuss the Ethereum price action

Technical Charts Signal At Ethereum Price Choppiness

The 2-day Ethereum price chart shows that it has broken below an ascending trendline. This doesn’t confirm a bearish reversal, but it does suggest fading bullish momentum.

The Relative Strength Index (RSI), which measures the speed and strength of price movements, has formed a bearish divergence — with price making higher highs while RSI trended lower.

This typically signals weakening strength and a likelihood of range-bound trading, more so if it forms on a longer timeframe.

If $ETH reclaims $4,579 (almost breaking the cost basis resistance), upside momentum could return, with the key target at $4,956.

On the downside, watch $4,345 and $4,156 as important support levels. A break below $4,156 could open further downside risks, while a sustained hold above $4,579 keeps $4,956 (close to $5,000, which is a key psychological level) within reach.

However, for Ethereum, that level couldn’t just be the start of something bigger, as summed up by Rusher.

“Yes, $5,000 is still a meaningful milestone. Psychologically, investors like round numbers, plus it’s a fresh all-time high. Once $ETH gets past the $5,000 mark, it will eventually become a strongly defended support level, he added”

However, if the Ethereum price closes under $4,156 with a complete 2-day candle, the bullish narrative might take some more time to materialize.

And with the long-term holder NUPL closing in on 3-month highs, talks regarding choppiness find more weight.

The post What to Expect From Ethereum in September appeared first on BeInCrypto.

beincrypto.com

beincrypto.com