Sharplink Gaming, Inc. has significantly expanded its ethereum ( ETH) holdings, reporting a total of 740,760 ETH in its corporate treasury as of Aug. 17.

Sharplink’s Ether Buying Spree Continues

The company disclosed that it acquired 143,593 ETH last week, spending a net average of $4,648 per token. This aggressive purchasing was funded by substantial capital raises totaling $537 million in net proceeds.

A registered direct offering closed on Aug. 11, contributing $390 million, while the company’s at-the-market facility generated an additional $146.5 million between Aug. 10 and Aug. 15. Sharplink’s strategy, initiated on June 2, 2025, also includes staking its ether assets.

To date, this has yielded 1,388 ETH in staking rewards, which are included in the total holding figure. The company introduced a new metric, “ ETH Concentration,” which has increased 94% since the program’s start to a value of 3.87, indicating a growing allocation of ETH per share.

Despite these large purchases, the company reported that over $84 million in cash remains on hand and is designated for future acquisitions of ethereum. Sharplink has positioned itself as one of the largest corporate holders of Ether, adopting it as a primary treasury reserve asset.

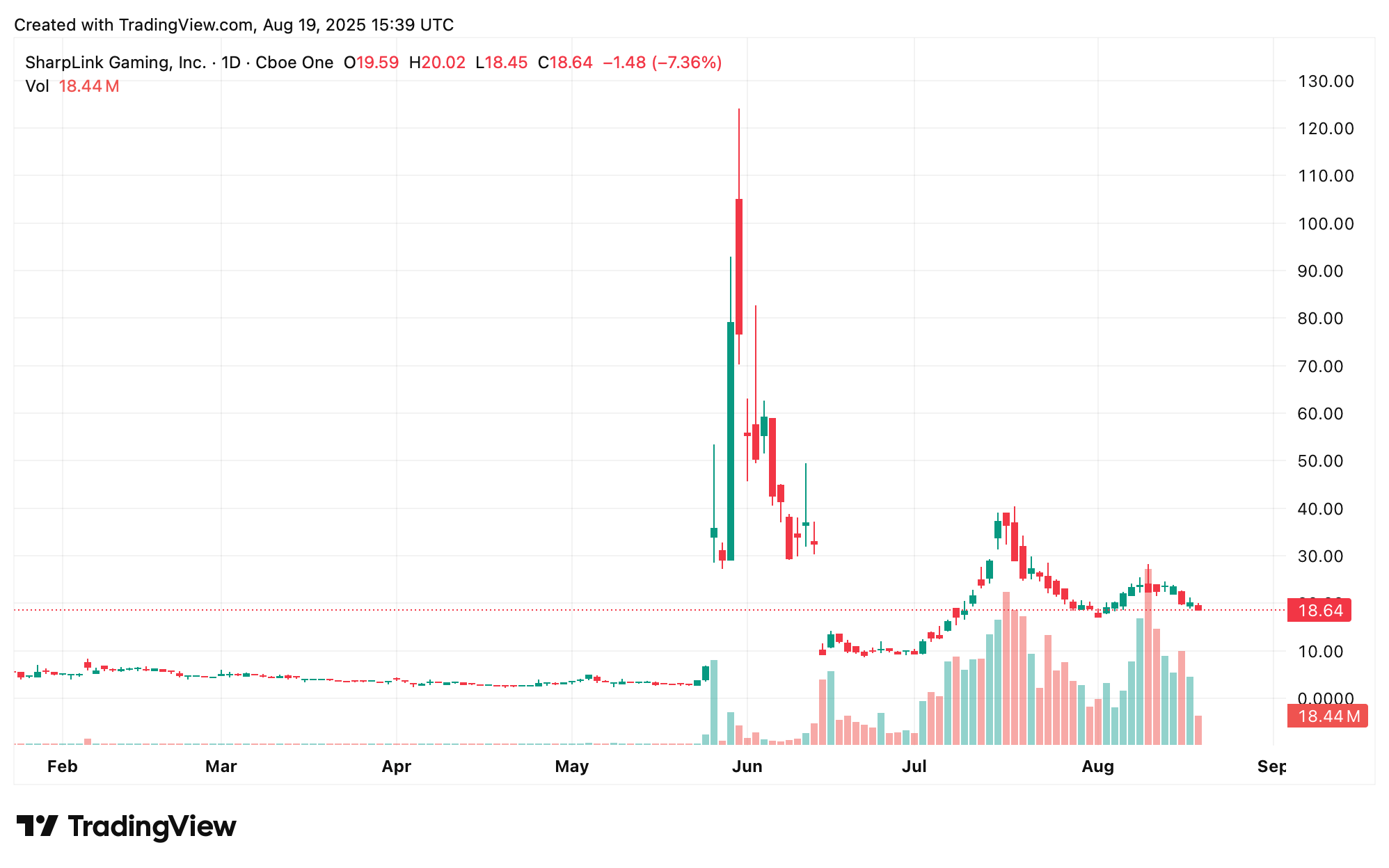

On the other hand, the company’s shares, SBET, have fallen by over 7.5% in value on Tuesday during the day’s trading session. Moreover, over the five-day run, SBET is down more than 15% and since July 19, the stock has lost 49% of its value.

The company’s stated goal is to align its treasury with the future of digital capital, providing investors with direct exposure to ethereum ( ETH). Sharplink is also known for its work in developing online gaming solutions. The firm’s competitor Bitmine (BMNR) is the largest publicly-traded ETH treasury firm, and its shares have had a rough week too. However, unlike SBET, BMNR is up 6% over the 30-day run.

news.bitcoin.com

news.bitcoin.com