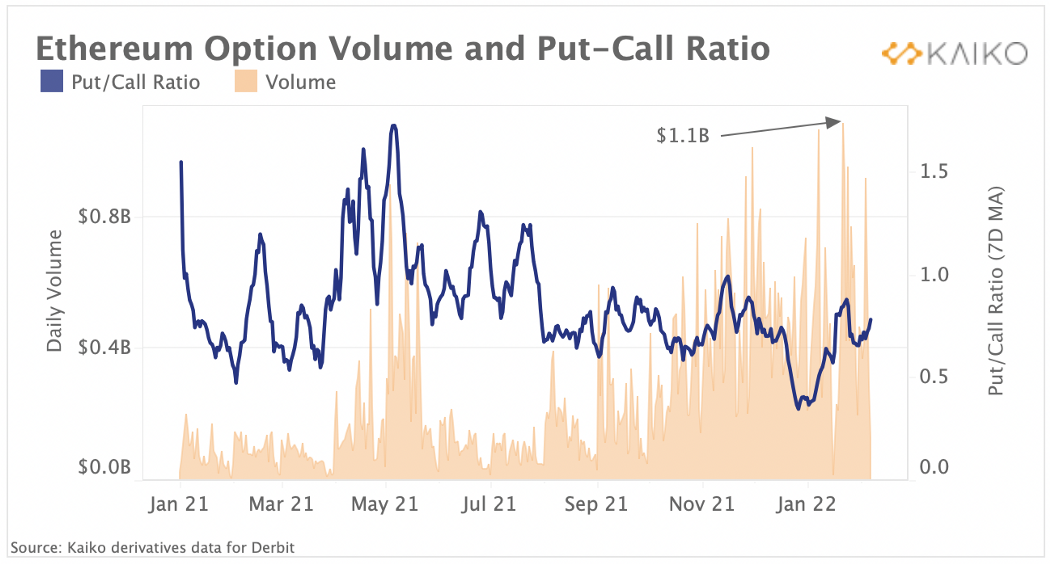

According to on-chain data, Ethereum’s daily options trading volume has equaled Bitcoin for the first time. The second-largest cryptocurrency by market cap saw its options trade volume surpass all-time highs above the $1.1 billion mark. The increase in options volume occurred even as spot volumes remained muted amidst the slump in the price for the digital asset.

Ether’s options volume on Deribit, the biggest crypto options exchange, rose to $5.4 million in January, a 36% increase from December. Bitcoin’s options volume also grew by 10% to $498,000. This sees Ethereum add another feather to its cap after outperforming Bitcoin last year and becoming the platform with the highest asset flow globally.

Cryptocurrency Options Markets Shows Signs of Maturity

In cryptocurrency, the options markets are still not yet fully matured, compared to futures and perpetual futures. Last December, Wall Street heavyweight Goldman Sachs predicted that the next significant step for cryptocurrencies would be more liquid options markets. This came after the investment bank reopened its cryptocurrency trading desk earlier in 2021, following a three-year pause.

While speaking at a panel discussion, Andrei Kazantsev, Goldman’s Global Head of Crypto Trading, described derivatives trading as still being in the infancy stage of its development. He further highlighted the growing demand for derivative-type hedging, with that naturally being the next step in options trading evolution. He said,

“We are seeing a lot of demand for more derivative-type hedging. The next big step that we are envisioning is the development of options markets.”

There is still uncertainty in the market despite the increasing volume, as revealed by the on-chain data. Since November, the daily transaction volume has increased alongside Ethereum’s volatile put-call ratio. This ratio is computed by dividing the traded volumes of ‘puts’ by ‘calls.’

Usually, a growing ratio is considered bearish since it indicates that traders are buying more puts (bearish bets) than calls (bullish bets). The chart shows the put-call fraction increased to 0.85 in the first half of January before falling to 0.78. This indicates that options traders are unsure of future price moves.

Join our Telegram group and never miss a breaking digital asset story.

Traders Prefer Linear Contracts to Inverse Contracts

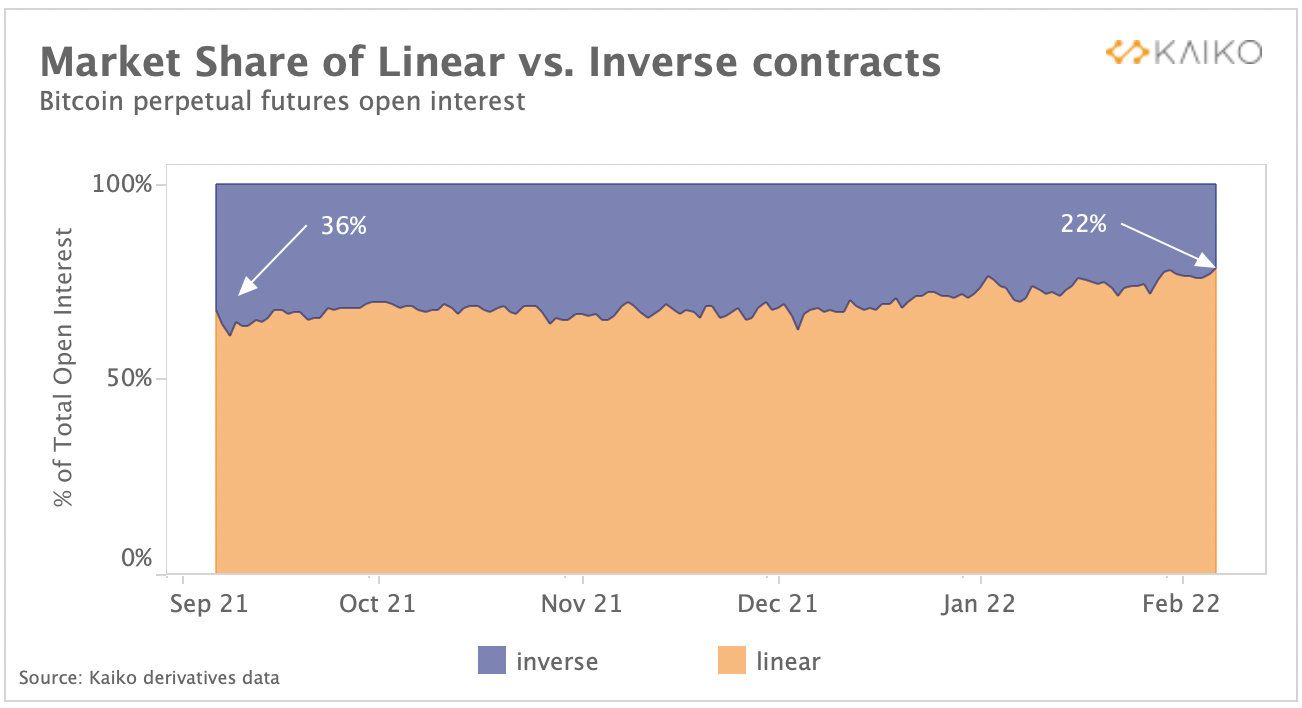

Kaiko’s report further underscored the growing preference of traders for linear derivative contracts against inverse contracts. This newfound bias has resulted in lessening leveraged shakeouts in the derivatives market.

Inverse contracts are margined and paid in the base currency, while the value of the margin fluctuates with the asset’s price changes. This makes them more liquidation-prone. However, price volatility does not affect the collateral’s value in linear contracts since they are margined in stable coins.

As seen in the chart, the market proportion of inverse contracts of open interest has dropped from 36% to 22% since September. This fall, together with lower leverage restrictions on crypto exchanges, could explain why price volatility in futures markets has been restrained in recent months.

Finally, the data does not suggest the direction of price movements for either Ethereum or Bitcoin. Instead, it indicates that the options market is still developing and is gradually maturing.

Do you think Ethereum options will flip Bitcoin options in the long run? Let us know your thoughts in the comments below.

tokenist.com

tokenist.com