A cryptocurrency trader has incurred massive losses of over $2 million after holding Ethereum ($ETH) for nearly a year.

The long-term Ethereum investor capitulated, locking in a staggering $2.6 million loss in a transaction initiated within 30 minutes, according to the latest on-chain data retrieved by Finbold from Arkham Intel on April 16.

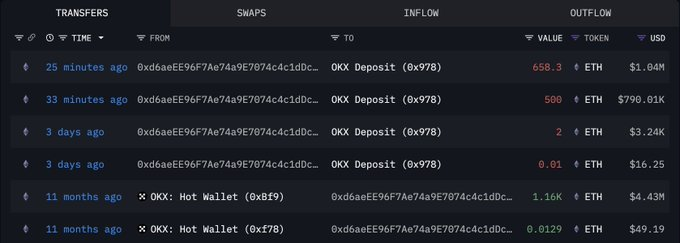

The unidentified trader initially withdrew 1,160 $ETH valued at $4.43 million from the OKX cryptocurrency exchange 11 months ago. At the time, Ethereum was changing hands at $3,816.

The $ETH was then transferred to a self-custody wallet, suggesting a long-term investment strategy or an anticipation of higher prices.

30 mins of capitulation

However, on April 16, within just 30 minutes, the same wallet sent the full amount of $ETH back to OKX in three major deposits, 658.3 $ETH, 500 $ETH, and 2 $ETH, at an average exit price of around $1,580, totaling $1.83 million.

Arkham’s analysis indicated that this fire-sale level price represented a 58.6% drop from the entry point, resulting in a realized loss of approximately $2.6 million.

Adding to the trail of capitulation, a small fraction of 0.01 $ETH was also sent, likely as a test transaction. As of press time, the investor’s wallet held Ethereum valued at just $2.56.

it remains unclear what triggered the sudden liquidation, whether fear of further losses or a strategic portfolio rebalancing, the scale and speed of the sale are notable.

This comes when Ethereum has mostly faced sustained downward pressure after losing the $2,000 support level.

At the time of reporting, the second-ranked cryptocurrency by market cap was trading at $1,571, having dropped 2.5% on the day, though $ETH remains up 6.5% over the past seven days.

Ethereum is currently trading significantly below its 50-day and 200-day simple moving averages (SMA). This positioning beneath key moving averages signals a strong bearish trend, with the asset underperforming its medium, and long-term price momentum.

Featured image via Shutterstock

finbold.com

finbold.com