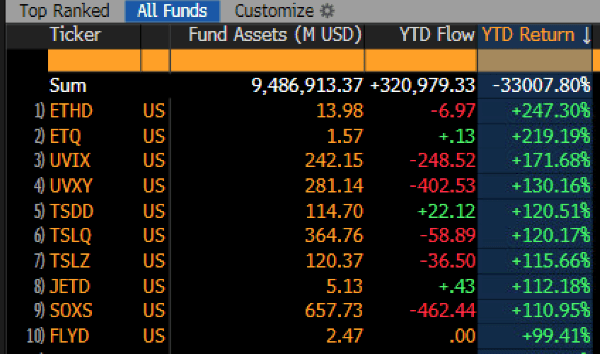

The two best performing exchange-traded funds (ETFs) in the U.S. both made leveraged bets against ether and racked up mind-blowing returns as a result.

The Year of the ETH Short: How Bearish Investors Are Raking in ETF Profits

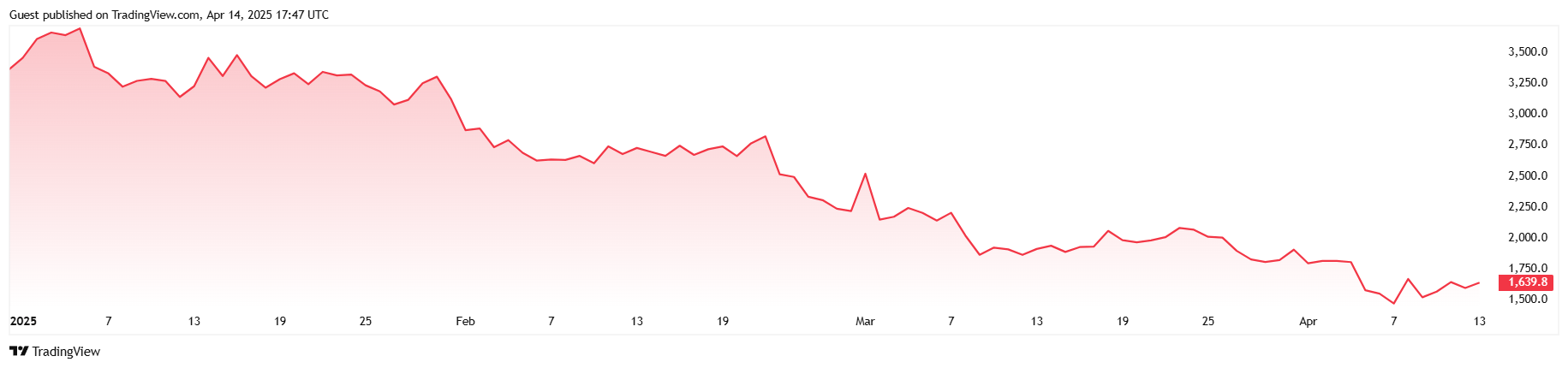

Ethereum’s ether ( ETH) has had a rough year, nosediving almost 51% since January. Savvy investors have taken advantage of the cryptocurrency’s demise, investing in the Proshares Ultrashort Ether ETF (ETHD) and reaping a year-to-date (YTD) return of almost 250%, according to Bloomberg ETF analyst Eric Balchunas.

The fund belongs to a class of high-risk investment vehicles that make leveraged bets on the price of an underlying asset. The Proshares ETHD is designed to return double the inverse performance of Bloomberg’s Ethereum Index on a daily basis. This year, that strategy has meant that as ether tanks, ETHD rises at twice the rate of the cryptocurrency’s depreciation.

To add insult to injury, another leveraged ETF, the T-REX 2X Inverse Ether Daily Target ETF from Rex Shares, which operates in a similar manner to ETHD except that it goes short on spot ether instead of the Bloomberg index, has also seen its YTD returns go through the roof at roughly 220%, making it the second best performing ETF in the U.S. so far this year. In other words, shorting ETH has been a winning strategy for American ETFs, at least for now.

“The best performing ETF this year is the -2x Ether ETF ETHD, up 247%,” Balchunas explained in a Friday post on X. “Number two is the other -2x Ether ETF,” he added. “Brutal.”

news.bitcoin.com

news.bitcoin.com