Ethereum continues to face pressure following its rejection from the $2,100 region, with the price now breaking below key support levels and testing lower demand zones.

Technical Analysis

By Edris Derakhshi

The Daily Chart

On the daily timeframe, ETH remains firmly in a bearish structure, consistently printing lower highs and lower lows. The rejection from the $2,200 region and a subsequent breakdown below $1,900 has re-established bearish momentum, with the price now heading toward the next major demand zone around $1,600.

The 200-day moving average also trends slightly downward and sits far above price action, reinforcing long-term bearish bias. Moreover, the RSI is hovering near the oversold region, but without any bullish divergence or momentum shift, there’s little sign of a reversal. Unless ETH reclaims $2,200 with strong conviction, the path of least resistance remains to the downside.

The 4-Hour Chart

The 4-hour chart confirms the breakdown of the rising channel that supported ETH’s previous recovery attempts. The price failed to hold above the $1,900 level, which had acted as support during consolidation, and is now grinding lower, at nearly $1,800.

The clean rejection from $2,100 and the sharp selloff suggest that buyers lost momentum quickly, and sellers stepped in with force. The RSI is also currently in deep oversold territory, but without a strong bounce or bullish structure forming, there’s little evidence of dip-buying interest. For now, ETH looks weak, and even if a short-term bounce occurs, it may be capped at $1,900 unless stronger buyers step in.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

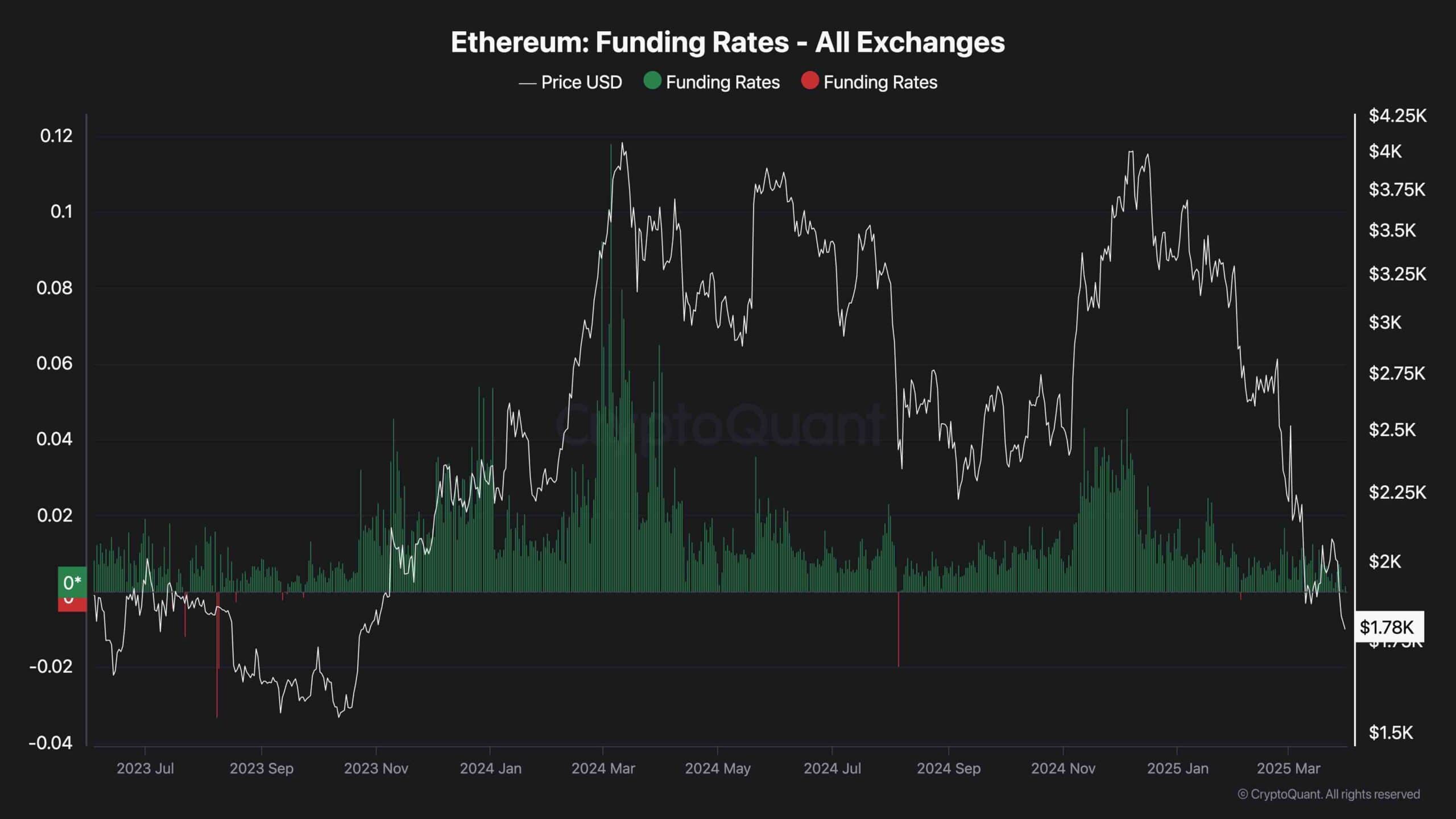

Funding Rates

Ethereum funding rates across all major exchanges have flipped to neutral or slightly negative, signaling a significant reduction in aggressive long positioning. This shift suggests that traders have become more defensive and less willing to chase upside, which typically aligns with a cooling-off period or continued downside drift.

While neutral funding may reduce the likelihood of a liquidation cascade, it also indicates that confidence is lacking for a strong bullish reversal. Sentiment remains cautious, and unless there is a resurgence of positive funding coupled with reclaiming key technical levels, the market is likely to stay under pressure.

cryptopotato.com

cryptopotato.com