After trading at the same support level over past couple of years, Ethereum price broke down, below $2K for the first time since late 2023.

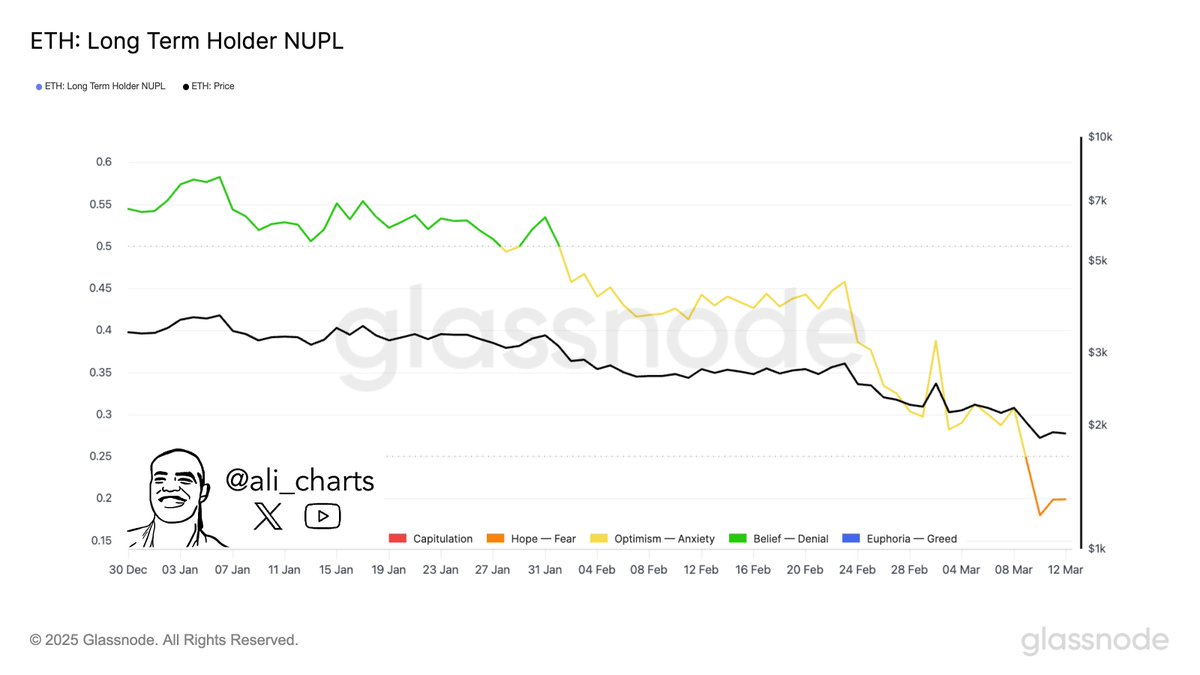

Analysis of Ethereum’s long-term holders showed a great deal of concern as the current Net Unrealized Profit/Loss (NUPL) level stood at 0.38, indicating a shift from hope to fear.

Previously, NUPL levels of the same size had indicated significant corrections, such as in May 2022 when NUPL dropped below 0.35 and led to $ETH dropping.

If the fear escalates and $ETH could continue falling below current levels of support headed towards next major supports, which will offer be long-term buying opportunities.

But if the mood is better and NUPL returns to 0.45, $ETH can retest levels above $2,500, with possible retest of levels above $3,000 in a continuation pattern.

The NUPL readings confirmed the market indecision, price being at a key level.

Another fall will confirm capitulation, but staying here may lead to a new rally.

Ethereum Price Breaking Long-term Support Level

Ethereum’s price breakdown dented investor confidence as points of historic support failed to sustain.

However, $ETH was supported at around $1,950, the October 2023 retest of breakout, which is still in place.

The $2K-$2.1K range is the key range for a reversal on the larger timeframes.

If $ETH is able to reclaim this range, momentum should take it up to $2,400-$2,500, rendering short-term bearish concerns moot.

Failing to hold above $2K, however, can leave $ETH open to further weakness, with $1,750 the next significant test.

A break down below $1,750 would more emphatically put in motion a serious correction, one that could reach the $1,500-$1,600 levels not seen since early 2023.

The region of $1,750-$2,100 is an awkward battleground range where price action is indeterminate.

Reloading $2K+ signals bullish momentum, but slipping below $1,750 could trigger hasty liquidations, which adds to bear momentum.

Meanwhile, Ethereum price finds itself in the clutches of reclaiming $2K. Turnaround already looms large if so.

Otherwise, below-$1,750 $ETH also a strong chance threat, constructing a bear trend lower.

Historical $ETH’s Performances for Q1

This comes as $ETH is set to finish its worst Q1 ever, reflecting dire investor fears.

$ETH has traditionally had excellent Q1 performances, such as 2021 with +120% and 2020 had +21%, while 2022 provided a modest loss.

Q1 2024 has been very different, with $ETH struggling to get back to key levels.

Now, $ETH has experienced a double-digit decline, an aberration of the prior years’ bull runs.

January, February, and March three-month rolling performance showed ongoing weakness, with failed breakouts and increasing selling pressure.

$ETH ending Q1 in the red will be the first in history with such a sharp beginning.

This suggests bearish sentiment for Q2 unless $ETH reverses higher above $2,100.

Otherwise, the stage is set for the testing of $1,750, confirming a long-term bearish trend.

However, if $ETH repeats historical Q2 reversals like 2020 with a +55% bounce in April, then there is still room for a recovery.

The next few weeks will determine if $ETH bounces back or if below $1,750 is a certainty.

thecoinrepublic.com

thecoinrepublic.com