Ethereum ($ETH) is grappling with fading bullish strength as its recent attempt to surpass critical resistance zones has faltered. Trading at $3,119, the $ETH token hovers just below its 100-day Simple Moving Average (SMA) at $3,312, caught in a delicate consolidation phase that could dictate its next big move.

One-Day Chart Analysis

According to the daily chart analysis, a notable effort was made to break through the $3,500 resistance level, where key technical factors converged. This included the upper boundary of a symmetrical triangle pattern and the 50% Fibonacci retracement level at $3,517. Yet, the push was met with stiff selling pressure, forcing a retreat and leaving bulls unable to capitalize on the momentum.

Ethereum’s failure to maintain momentum above key resistance levels has revealed weakness in buying pressure, triggering a corrective move to its current level of around $3,119. At present, the $3,000 support level stands as a critical line of defense, providing stability amidst mounting bearish pressure.

However, should this support break, the cryptocurrency risks a further drop toward $2,927, a pivotal Fibonacci retracement zone that could serve as a key battleground between bulls and bears. Such a breakdown would likely reinforce bearish sentiment, pushing the $ETH token into deeper corrections and reshaping its short-term market trajectory.

On the upside, the 100-day moving average (MA) acts as a formidable resistance, capping any bullish recovery attempts as long as the $ETH cryptocurrency trades below it. Meanwhile, the symmetrical triangle pattern on the chart adds an element of suspense, suggesting the prospect of a sharp and decisive move in either direction.

A breakout above $3,500 could reignite optimism and open the door to higher price targets. However, a breach below $3,000 might accelerate selling pressure, leaving bulls on the defensive and potentially tipping the balance in favor of bears. With the Ethereum token at a critical juncture, its next move will likely define the immediate market outlook, keeping traders on edge.

Profitability and Transaction Analysis

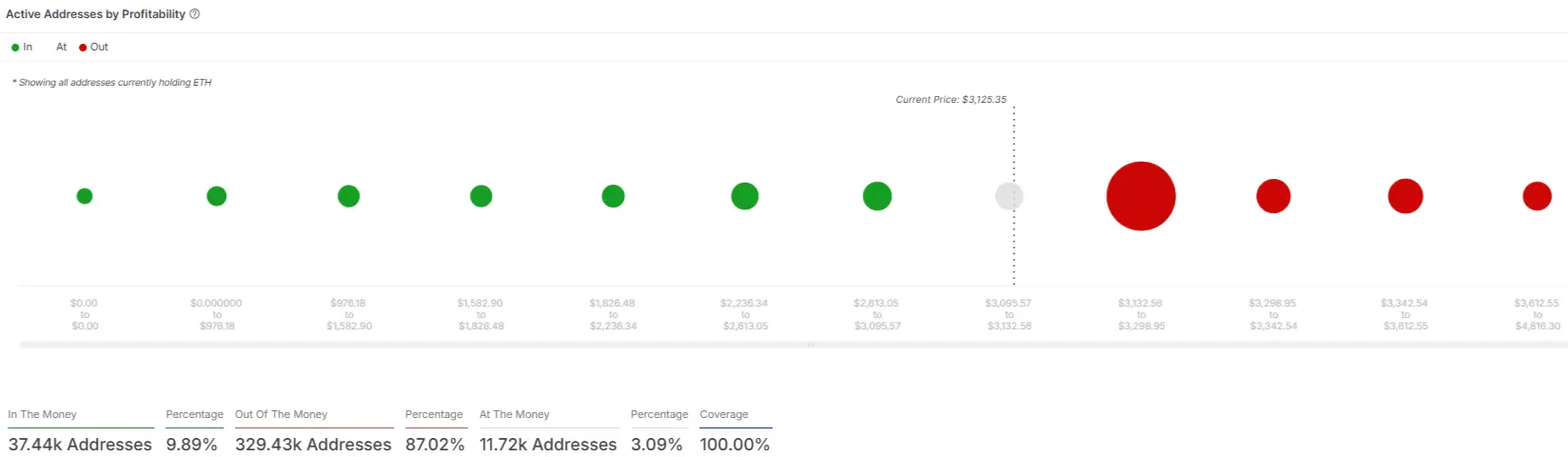

Ethereum’s current price level, hovering around $3,119, paints a complex picture for traders and investors. According to the profitability chart, 87.02% of addresses holding $ETH tokens are “out of the money,” indicating that most holders are experiencing unrealized losses at the current price.

Only 9.89% of addresses are “in the money,” signaling a steep uphill battle for bulls to regain momentum. Meanwhile, 3.09% of addresses are “at the money,” reflecting the delicate equilibrium in the market. This stark disparity underscores the importance of the $3,000 support zone, as its failure could intensify bearish sentiment, driving prices toward the next key Fibonacci retracement level of $2,927.

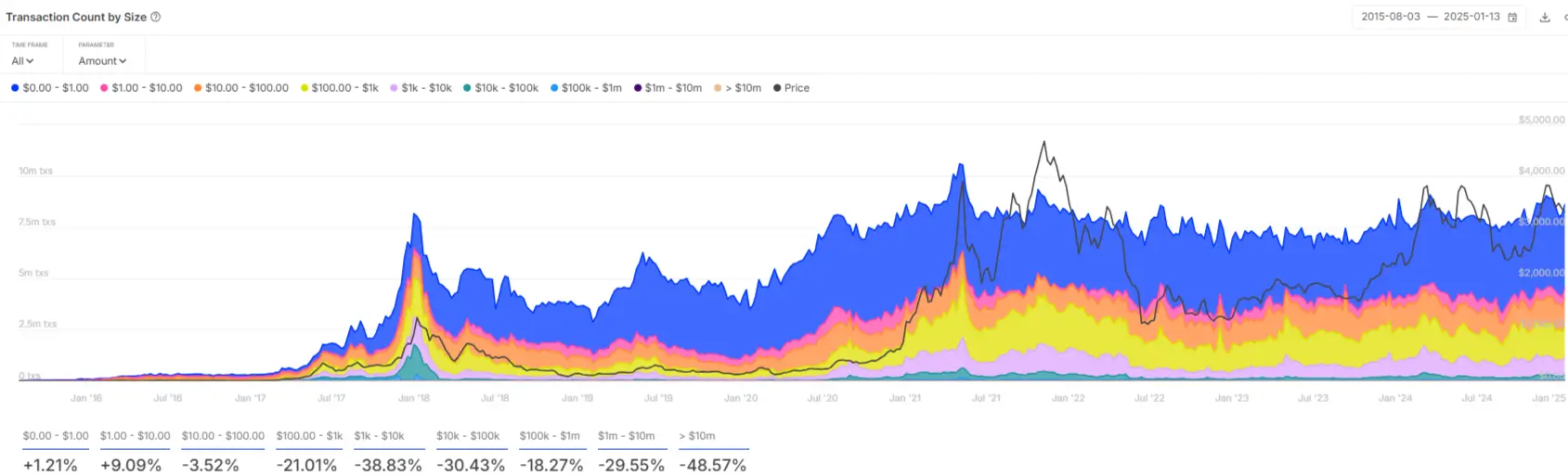

Conversely, a decisive push above the $3,132-$3,500 resistance range would likely provide much-needed relief for struggling investors. On the other hand, the transaction count data by size reveals further insights into market behavior. Small-scale transactions under $1,000 have seen marginal growth, with increases of +1.21% and +9.09%, respectively, for transactions under $1 and between $1 and $10.

However, larger transactions are on a steep decline. For instance:

- Transactions between $10,000 and $100,000 have dropped by -30.43%.

- Transactions in the $1 million-$10 million range have plummeted by -29.55%.

- Institutional-sized transactions exceeding $10 million have taken the hardest hit, declining by -48.57%.

This downward trend in large-scale transactions suggests waning confidence among institutional players, further weighing the cryptocurrency’s short-term outlook.

Also Read: AAVE Price Targets $400 as Whale Activity Surges

cryptonewsz.com

cryptonewsz.com