Ethereum (ETH) has captured the spotlight once again, currently trading at $3,346.08 after a 4% surge in the past 24 hours.

For nearly 10 months, the cryptocurrency has remained within a consolidation range, reflecting market indecision. However, its ability to hold steady amid fluctuations has reignited interest among investors eager to determine its next move.

As the world’s second-largest cryptocurrency shows renewed momentum, AI models set ambitious price targets for 2025, projecting significant growth fueled by a mix of market dynamics and Ethereum’s multifaceted ecosystem.

ChatGPT sets Ethereum price for 2025

To assess Ethereum’s future potential, Finbold analyzed market data and sought insights from OpenAI’s advanced ChatGPT-4o model. The AI provided a bullish outlook, projecting that Ethereum could reach $6,000 by mid-2025 and potentially climb to $10,000 by the end of the year, assuming bullish momentum persists based on current market dynamics.

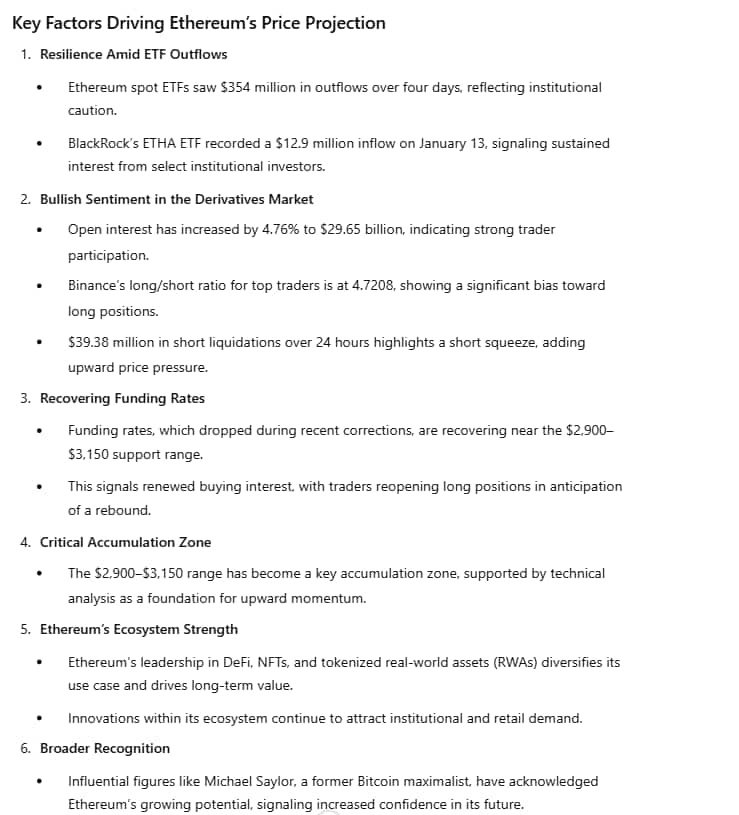

Key factors driving Ethereum’s price

On January 13, Ethereum spot ETFs recorded $39.43 million in net outflows, continuing a four-day streak totaling $354 million. ChatGPT sees these sustained outflows as indicative of short-term caution among institutional investors, likely influenced by the recent crypto market correction.

However, not all institutional sentiment is bearish. BlackRock’s ETHA ETF saw a net inflow of $12.9 million on the same day, suggesting that interest in Ethereum remains strong in some quarters, even as broader ETF outflows persist.

Ethereum’s ability to climb above $3,150 despite these outflows highlights robust support from traders in other segments of the market.

Strong bullish sentiment in the derivatives market

ChatGPT notes that the derivatives market is sending strong bullish signals. Open interest has risen 4.76% to $29.65 billion, reflecting growing trader participation and confidence. On Binance, the long/short ratio for top traders is at 4.7208, showing a clear bias toward long positions.

Additionally, $39.38 million in short liquidations over the past 24 hours suggests a short squeeze, where bearish traders were forced out of their positions, adding upward pressure to Ethereum’s price. ChatGPT sees these factors as evidence of increasing optimism among market participants, counterbalancing the bearish sentiment implied by ETF outflows.

Recovering funding rates signal renewed optimism

Funding rates, which fell sharply during the recent market correction, are now recovering as Ethereum holds its critical support range of $2,900 to $3,150. ChatGPT sees this recovery as a sign of renewed buying interest, with traders reopening long positions in anticipation of a rebound.

This accumulation zone has become a focal point for both short-term traders and long-term investors, offering a key opportunity to position for future gains.

Technical analysis supports this view, with the $2,900 to $3,150 range acting as a foundation for Ethereum’s upward momentum.

Furthermore, projections from other AI models, such as Grok 2, also acknowledge Ethereum’s multifaceted ecosystem, including its dominance in DeFi, NFTs, and the tokenization of real-world assets (RWAs), as a key driver of long-term value.

These insights reinforce Ethereum’s potential for growth, particularly as the recovery in funding rates, strong market participation, and its multifaceted ecosystem continue to drive momentum.

Featured image via Shutterstock

finbold.com

finbold.com