Amid the ongoing crypto market crash, will Ethereum (ETH) maintain dominance at the $3,000 psychological support level?

With Bitcoin retreating to the $95,000 range, Ethereum has fallen by nearly 10% over the past 24 hours. It is currently trading below the $3,400 mark, maintaining a market capitalization of around $401 billion.

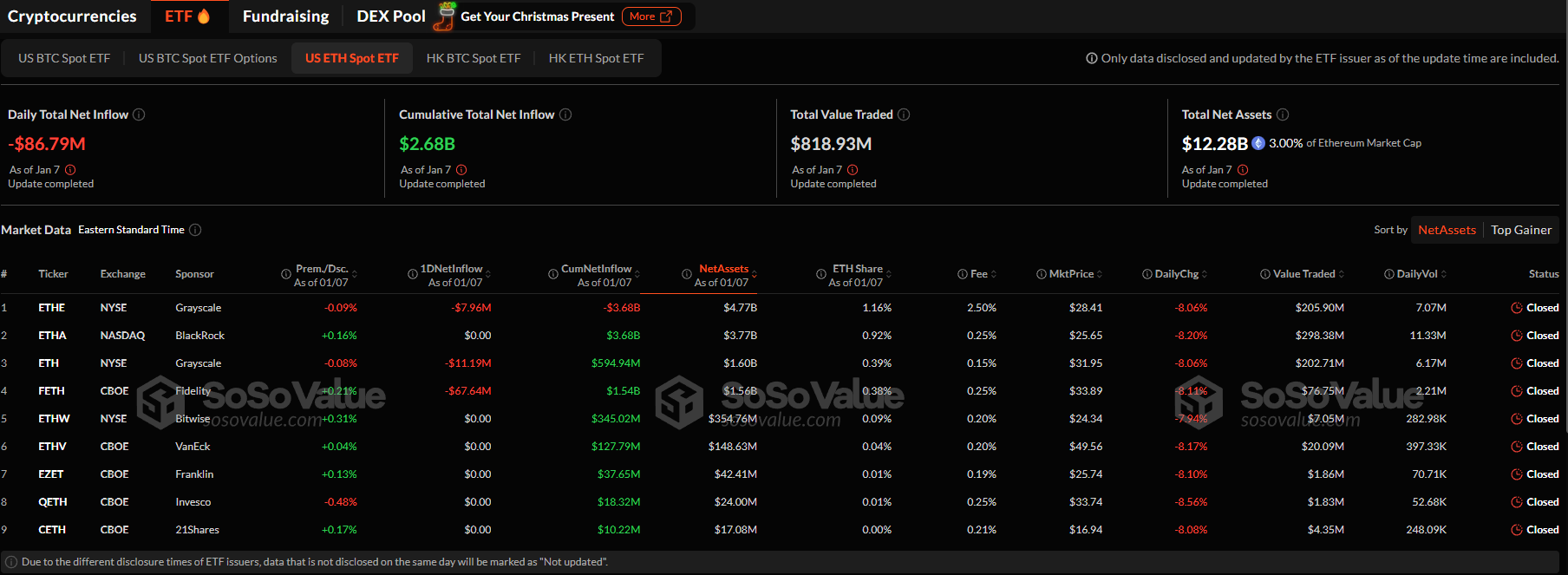

With massive liquidations and an outflow in the Ethereum spot ETF market, bears are gaining control of the trend.

Ethereum Price Analysis

On the 4-hour chart, the bullish breakout above the $3,500 zone failed to sustain momentum, reversing at the $3,700 level. This reversal coincided with the drop in Bitcoin prices, triggering a sharp decline.

Following a series of bearish candles, the Ethereum price has dropped to $3,333, falling below its 200 EMA line on the 4-hour chart. Ethereum is now back within its previous range, which spans from $3,400 to $3,150, with support at $3,244.

With frequent price rejections and a continuing streak of bearish candles, it is likely that bears will challenge the critical support level. Additionally, the increase in selling pressure has pushed the 4-hour RSI into the oversold region.

Moreover, the 50 and 200 EMA lines suggest a higher likelihood of a death cross, signaling further downside. As a result, the technical indicators are flashing a sell signal.

Ethereum ETFs Bleed Amid High Liquidations

In the wake of crypto market liquidations, Ethereum derivatives have experienced a 5.51% drop in open interest. Currently, it stands at $30.42 billion, with the long-to-short ratio turning notably bearish at 0.8968.

With $146 million in liquidations, bulls have lost $131.54 million. Additionally, funding rates have declined to 0.052% compared to 0.093% in the past 24 hours.

Furthermore, the daily net outflow from U.S. Ethereum Spot ETFs reached $86.79 million, contributing to a bearish trend. Notably, Fidelity saw $67 million in liquidations, while the Grayscale Ethereum Trust lost $11.19 million.

ETH Price Targets

Based on the current price action, the breakdown of the $3,244 support level will determine Ethereum’s next price movement. As the RSI enters the oversold region, there is a chance of a reversal due to bearish exhaustion.

This could drive a potential bounce back toward the $3,415 resistance level with a V-shaped reversal. However, with the broader market still under pressure, Ethereum’s next immediate bearish target is the $3,095 support level.

thecryptobasic.com

thecryptobasic.com