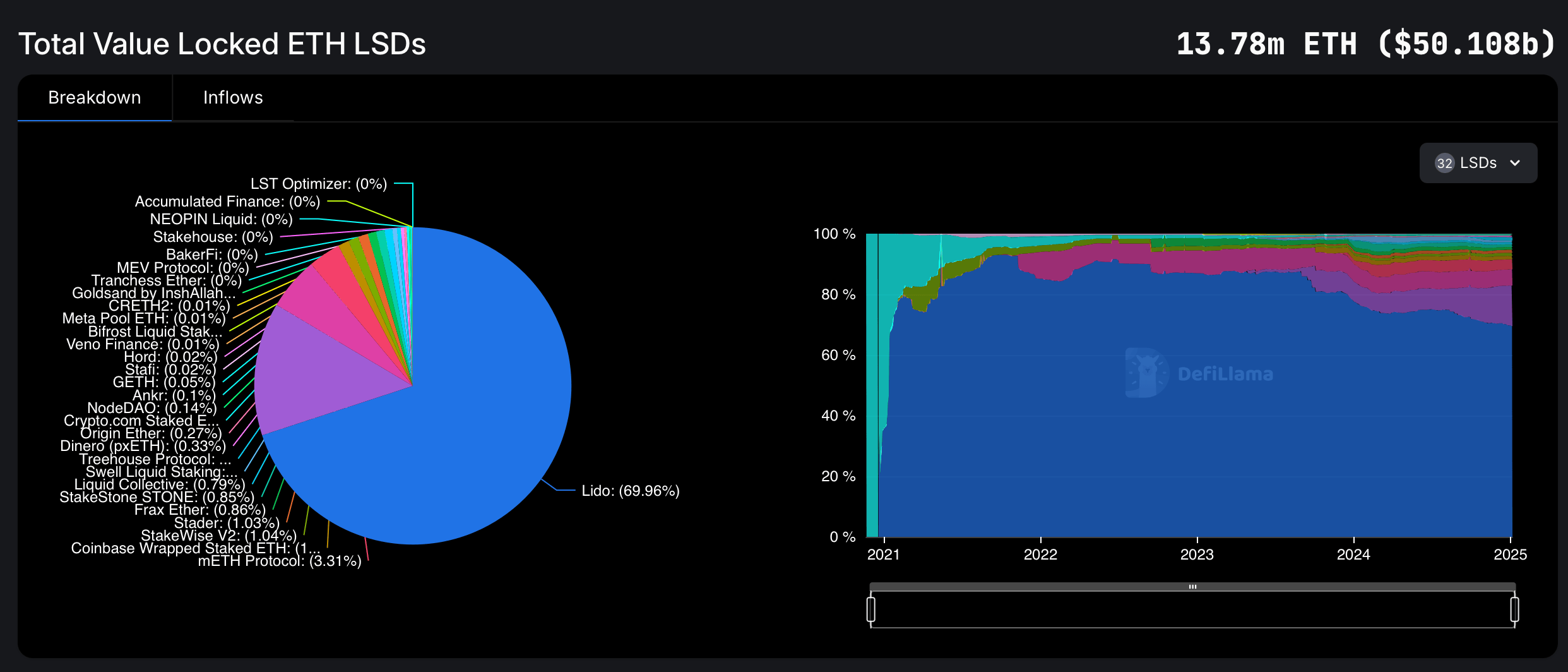

In October 2024, the volume of ethereum locked into liquid staking platforms surpassed the 14 million ether threshold. However, as of 2025, the total ETH held in these protocols has fallen below the levels recorded at the end of November. As of Sunday, Jan. 5, 2025, approximately 13.78 million ether remains tied up in liquid staking platforms.

Decreasing Confidence? Liquid Staking Platforms Hold Less ETH in 2025

At the close of November 2024, Bitcoin.com News detailed that liquid staking protocols collectively secured 13.85 million ETH. Since that report, holdings in these platforms have declined by 70,000 ether. Liquid staking derivatives (LSDs) have emerged as a transformative tool within decentralized finance (defi), enabling users to stake cryptocurrencies while maintaining liquidity.

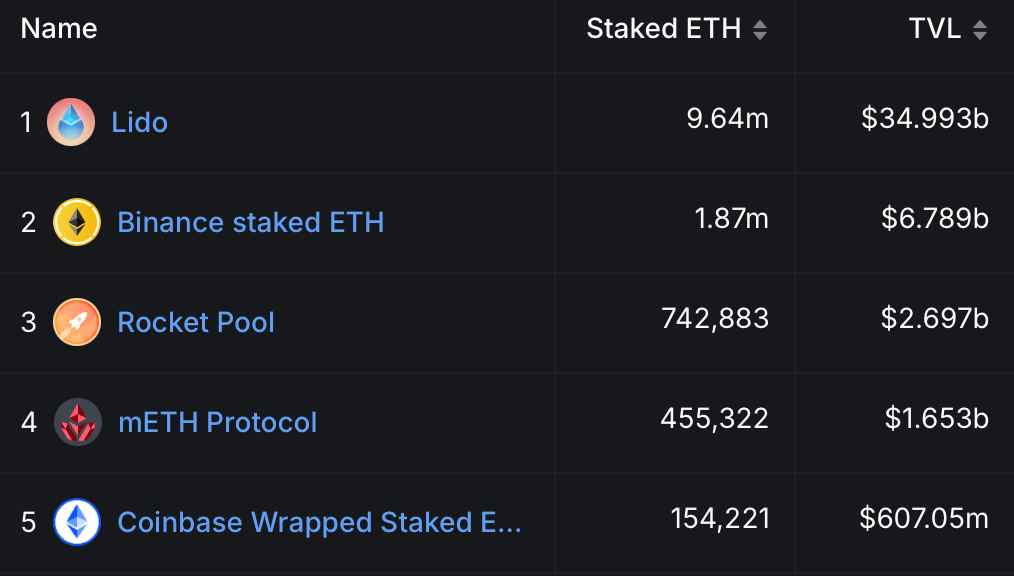

Traditional staking often required locking up assets, rendering them unavailable for other financial activities. LSDs solve this limitation by creating derivative tokens that represent the staked assets, granting users the ability to earn staking rewards without relinquishing access to their funds. Among these platforms, Lido reigns supreme, currently accounting for 69.96% of the 13.78 million ether held in LSD protocols.

This dominance translates to 9.64 million ETH, valued at $34.9 billion. Yet, Lido’s holdings have dipped—down 160,000 ether since Nov. 30, 2024, when it once controlled 9.8 million ETH. Meanwhile, Binance’s liquid staking platform has gained a great deal of traction, accumulating 150,000 ether over the past 36 days. Rocket Pool, however, has experienced persistent outflows, shedding 479,374 ether between Oct. 29 to the end of November, and now an additional 7,743 ether in the last 36 days.

The 13.78 million ether currently locked in LSD platforms represents 11.44% of the circulating supply of 120,474,080 ethereum. This decline prompts reflection on the evolving preferences of current defi participants. While Lido remains the dominant force, its reduced holdings suggest even market leaders are not immune to shifting user priorities or external factors. Binance’s growth, on the other hand, spotlights intensifying competition, but the overall decrease in locked ether could indicate broader hesitation within the community.

news.bitcoin.com

news.bitcoin.com