During Tuesday’s U.S. market session, the crypto market experienced a slight relief rally as Bitcoin bounced back above $95k. The surge in buying pressure bolstered most major altcoins, including Ethereum, to seek stable support. However, onchain data shows significant ETH transfer to exchange by major firms, signaling a potential sell-off and prolonging correction ahead.

Currently, the ETH price trades at $3,492 with an intraday gain of 2.18%. According to Coingecko, the global crypto market cap is at $419.5 Billion, while the 24-hour trading volume is at $28.2 Billion.

Key Highlights:

- Ethereum price breakdown from a double-top reversal pattern signals a possible correction to $2,900.

- Cumberland and Nexo have collectively deposited over $435 million worth of Ethereum to centralized exchanges (Coinbase and Binance) in December.

- The price sustainability above the 50% Fibonacci retracement level indicates that buyers are the dominant player in the market.

Institutional ETH Transfers Spark Concerns of Bearish Market Trends

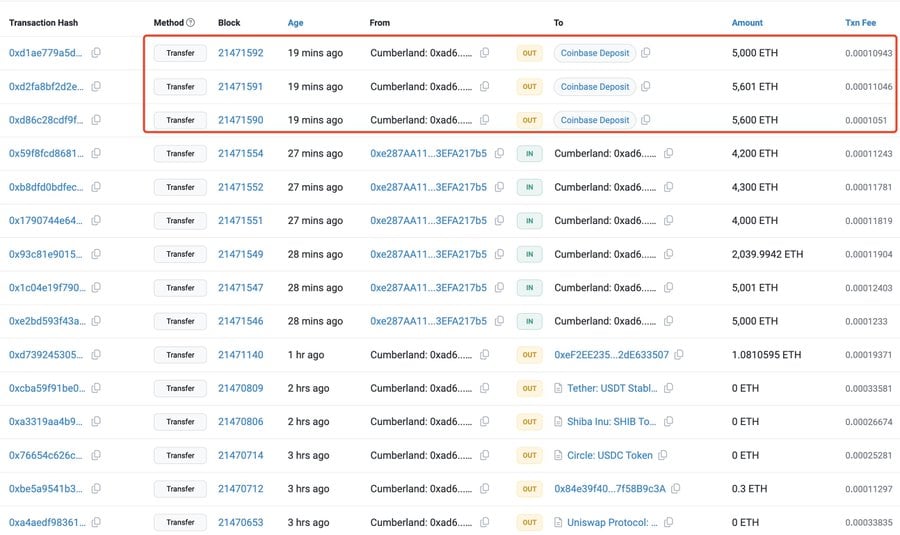

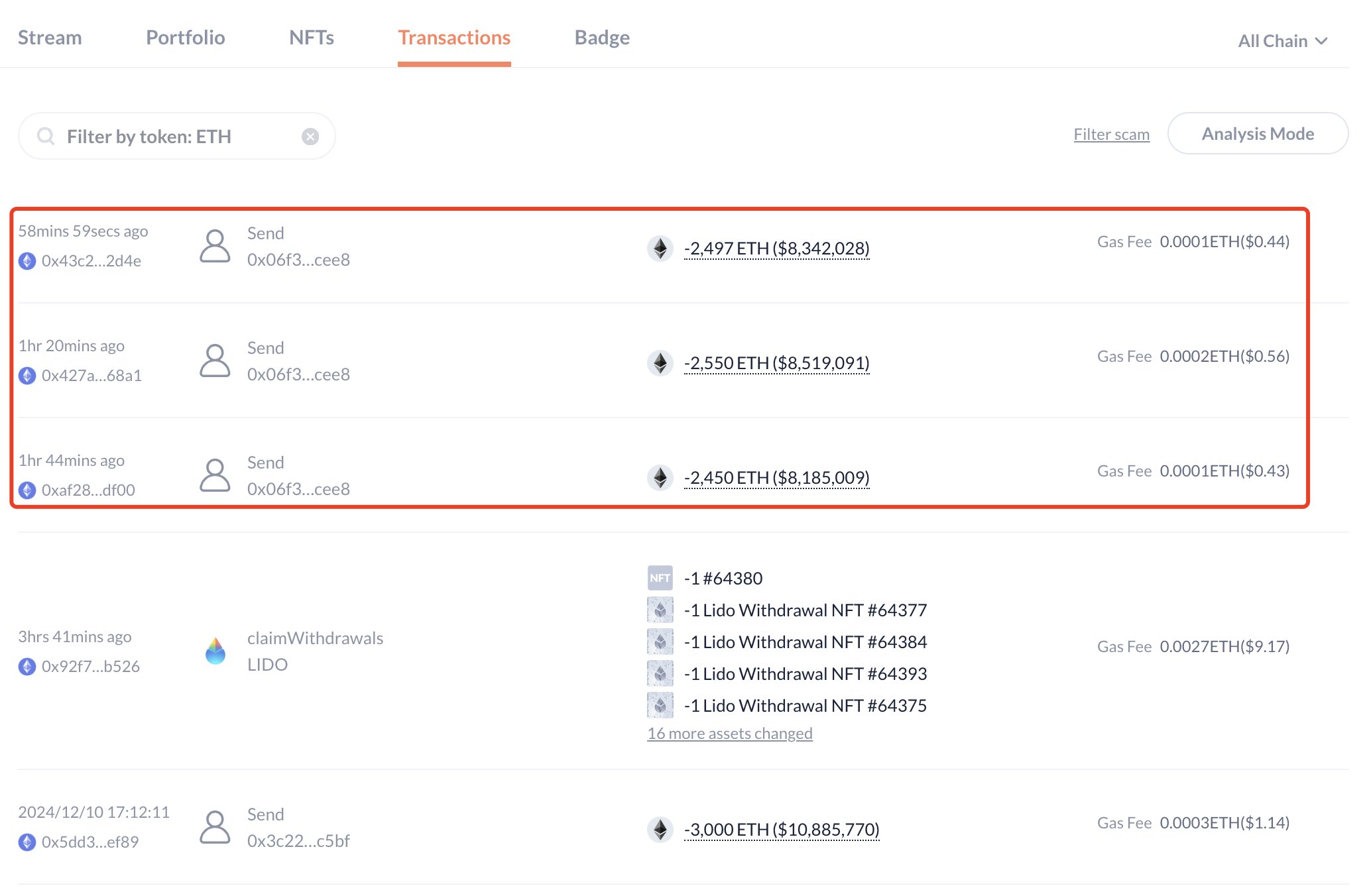

Blockchain analytics platform Lookonchain reported that Cumberland, a renowned trading firm, deposited 16,201 ETH (valued at $55 million) to Coinbase in a series of transactions on December 24.

The transaction breakdown shows multiple deposits, including 5,000 ETH, 5,601 ETH, and 5,600 ETH.

Another onchain data shows crypto lending platform Nexo has deposited a staggering total of 101,756 ETH (approximately $380 million) into Binance since December 2. The average price of these deposits is reported at $3,737 per ETH. As of today, Nexo added another 7,495 ETH (valued at $25 million) to Binance.

This significant movement of assets into a centralized exchange suggests that major institutions might be positioned to sell or trade these assets, potentially accelerating a bearish market sentiment.

Ethereum Price Faces Key Decision Point at $3,500 Neckline

On December 19th, the Ethereum price gave a bearish breakdown of the $3,500 neckline of the double top pattern. The chart setup is commonly spotted at a major market top, showcasing two sharp reversals as a signal for intense overhead supply.

However, the breakdown fall tested 50% FIB level and 100-day EMA at $3,200 before reverting to the neckline for potential resistance. If the daily chart price action shows sustainability below $3,500, the ETH price could plunge 16.8% to seek support at $2,900.

On the contrary, the Ethereum price bounce back above $3,500 will invalidate the bearish thesis and reattempt for a $4,000 breakout.

Also Read: Ethereum, XRP & Other Altcoins Poised For Major Rally as BTC Consolidates

cryptonewsz.com

cryptonewsz.com