- Ethereum bearish pressure strengthened following recent selling activity across long-term and short-term holders.

- Whales have been weathering the selling pressure after increasing their holdings by 410K $ETH.

- $ETH could decline toward the $3,000 psychological level if it breaches the $3,250 support.

Ethereum ($ETH) is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, $ETH risks a decline below $3,000.

Ethereum investors step up selling pressure, whales buy the dip

Ethereum has been witnessing a surge in bearish sentiment after experiencing double-digit losses last week.

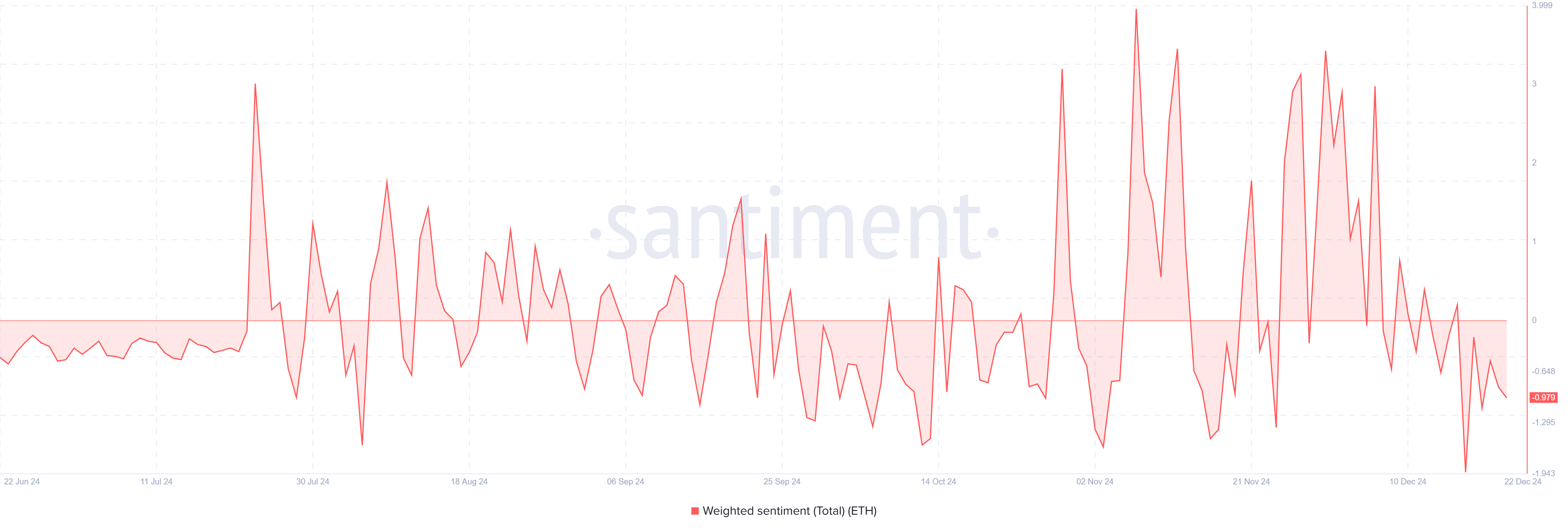

$ETH's Weighted Sentiment, which measures the social volume of an asset and its overall sentiment, has remained below its neutral level, indicating high negative sentiment.

Ethereum Weighted Sentiment. Source: Santiment

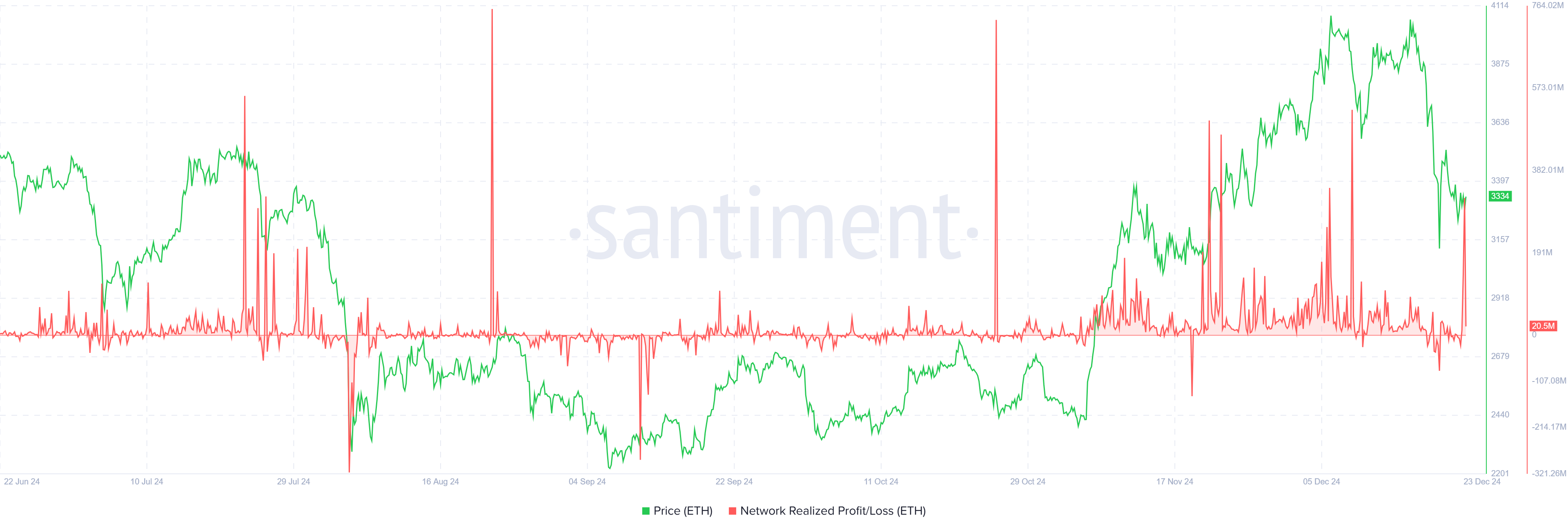

The bearish sentiment is also evident in the Network Realized Profit/Loss metric, which shows that most investors have been selling off their assets to book profits and losses in the past 24 hours. Notably, investors have realized over $340 million in profits and $30 million in losses.

Ethereum Network Realized Profit/Loss. Source: Santiment

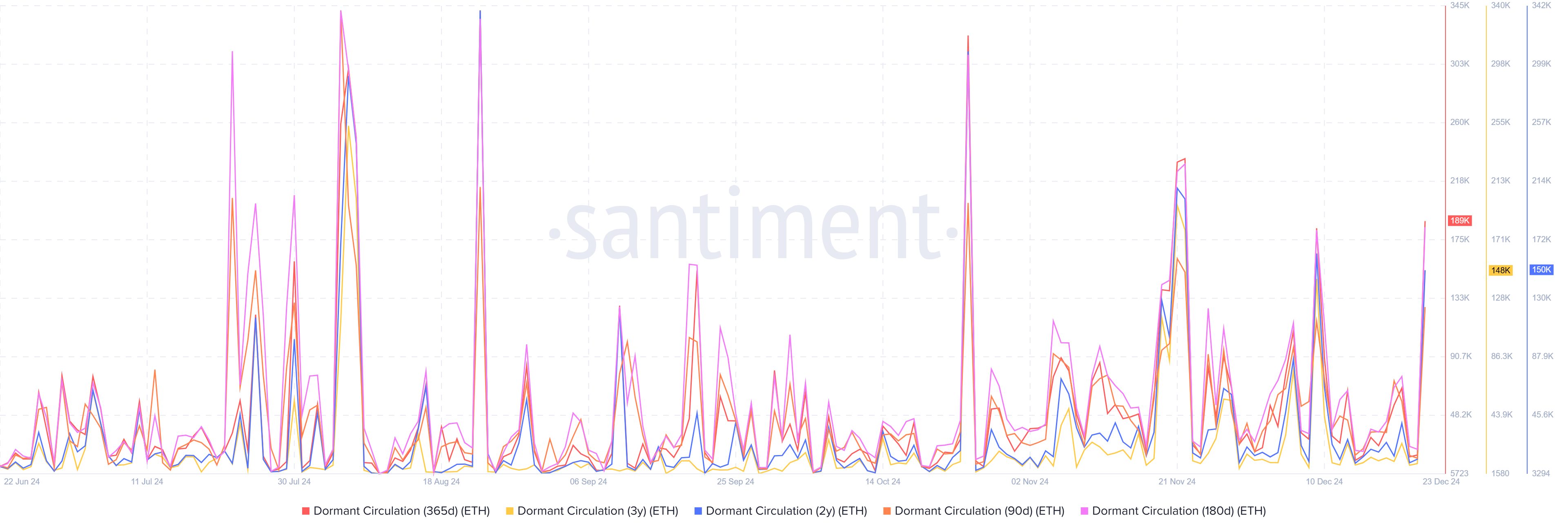

The Dormant Circulation metric reveals the recent selling activity is from both long-term and short-term holders, as evidenced by spikes in the chart below. This indicates that the bearish trend is gradually gaining strength.

Ethereum Dormant Circulation. Source: Santiment

Despite the selling activity, Ethereum exchange reserve has maintained a downtrend, with investors withdrawing.

Most of these withdrawals came from whales holding between 100K to 1M $ETH. This class of whales ended a two-week consistent selling activity after they increased their holdings by 410K $ETH in the past two days. The move signifies confidence in a potential uptrend resumption after the holidays.

$ETH Whale Holdings (100K to 1M $ETH)" src="https://cnews24.ru/uploads/c98/c982c24b6ad5736aca2e7bcfa862272f099ac34e.png" size="3840x1300">

$ETH Whale Holdings (100K to 1M $ETH). Source: Santiment

Meanwhile, US spot Ethereum ETFs managed to maintain their weekly net inflow streak even after seeing outflows on Thursday and Friday. The products recorded net inflows of $62.7 million last week, stretching their inflow streak to four consecutive weeks, per Coinglass data.

Ethereum Price Forecast: $ETH could find support at $3,000 psychological level if it declines below $3,250

After extending its decline below the 50-day Simple Moving Average (SMA), $ETH hovered within the $3,250 support and $3,423 resistance levels over the weekend as prices appear to be stabilizing due to the holiday season.

$ETH/$USDT daily chart" src="https://cnews24.ru/uploads/9eb/9eb6282c539efc106180fbd7f289e33111306969.png" size="1793x740">

$ETH/$USDT daily chart

The $3,250 level is crucial even as prices move range bound. $ETH could decline toward the $3,000 psychological level if it breaks the $3,250 support.

The $3,000 target is obtained by measuring the height of a double top pattern that $ETH posted within the first two weeks of December, down to its neckline support level. The 100-day and 200-day SMAs could strengthen the $3,000 psychological level as a key support zone.

However, a further breach of the $3,000 support level will validate a rounding top pattern that could send $ETH toward the $2,000 psychological level. The $2,817 key support level could help cushion such a decline.

On the way up, $ETH has to recover the $3,550 support level with a high volume move to resume its uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) indicators are below their neutral levels, indicating the market is tilted toward bearish momentum.

A daily candlestick close above $4,093 will invalidate the bearish thesis.

fxstreet.com

fxstreet.com