The Ethereum ($ETH) price outlook has been on investors’ radars for a while. Amid this sentiment, the cryptocurrency has rallied above $4,000 and, at one point, decreased below $3,200.

However, in the last 24 hours, Ethereum’s price has increased by 10%, with large transactions climbing to levels not seen in almost one week.

Ethereum Sees Notable Institutional Interest

Ethereum’s 10% surge has pushed the altcoin to $3,422. On-chain data reveals that increasing institutional interest is a key factor influencing Ethereum’s price outlook.

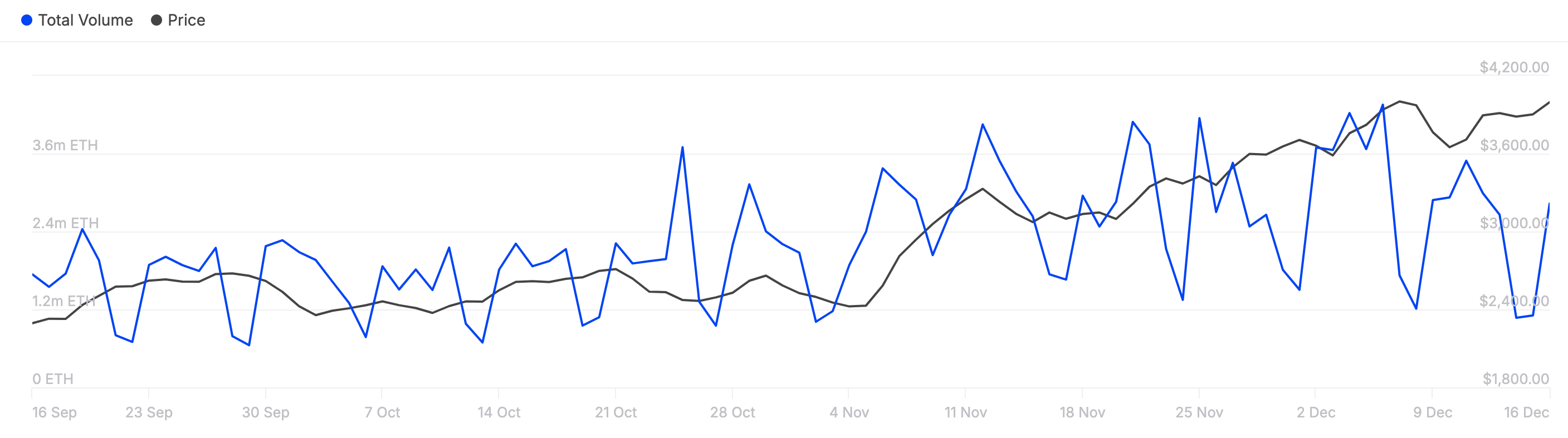

IntoTheBlock reports that Ethereum’s large transactions have climbed to 2.83 million $ETH. This increase suggests heightened trading activity among whales and key stakeholders.

On the other hand, a decline in this metric indicates dwindling interest. At the time of writing, these transactions are worth approximately $11 billion. Historically, when this metric rises alongside the price, it is a bullish sign. As such, the $ETH price could rise above $4,500 in the short term.

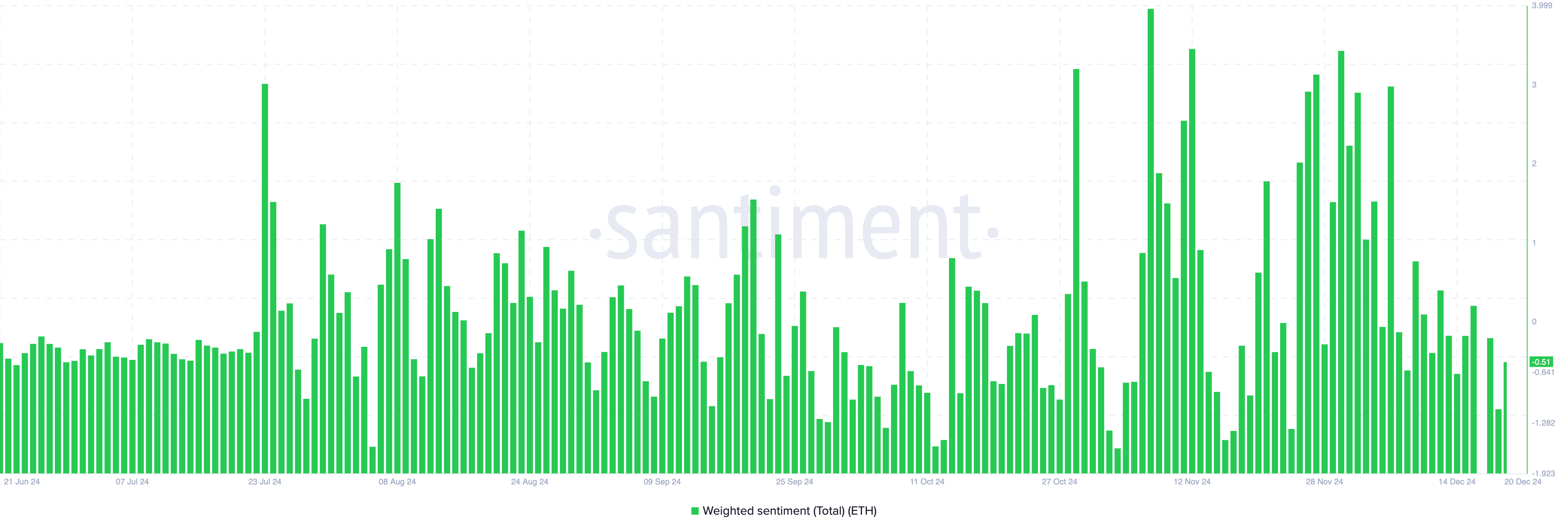

The Weighted Sentiment indicator suggests Ethereum’s price could keep rising. This metric measures overall market perception of a cryptocurrency, with positive readings reflecting bullish sentiment and negative readings indicating bearish sentiment.

Santiment data shows Ethereum’s Weighted Sentiment is nearing the positive zone. If it remains in this territory, $ETH’s value could continue to increase.

$ETH Price Prediction: Breakout Beyond $4,000 Still On the Cards

According to the 3-day $ETH/USD chart, the Accumulation/Distribution (A/D) line has continued to climb. A rising A/D line indicates that investors are buying, which could drive the price higher. When the indicator’s reading drops, it indicates that investors are distributing, which is a bearish sign.

Since it is the former for $ETH, it suggests that the cryptocurrency’s price might break the $3,982 resistance. If validated, the value could hit $4,110. However, if the broader market conditions become extremely bullish, Ethereum’s price could rally above $4,500.

But if the cryptocurrency fails to break above the resistance, the value might not experience such an upswing. Instead, the price might decline to $3,178.

beincrypto.com

beincrypto.com