Ethereum (ETH) has experienced significant price fluctuations in recent weeks, with bearish pressure mounting amid macroeconomic factors and investor sentiment shifts. At the same time, the U.S. Securities and Exchange Commission (SEC) has approved the first spot Bitcoin and Ethereum combo ETFs, further impacting the crypto landscape. This article delves into the latest Ethereum price movements, key resistance levels, and the potential impact of these landmark ETFs.

1- SEC Approves Spot Bitcoin and Ethereum ETFs

The U.S. SEC has recently approved the first-ever spot Bitcoin and Ethereum combo ETFs from Hashdex and Franklin Templeton. This historic decision is set to further impact the Ethereum market. These ETFs will hold spot Bitcoin and Ethereum based on market capitalization, with an approximate 80/20 split favoring Bitcoin.

According to Bloomberg analyst Eric Balchunas, the Hashdex Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF will launch in January. These ETFs are expected to increase market accessibility for retail and institutional investors, possibly leading to greater liquidity and price stability in the Ethereum market.

Hashdex’s ETF, trading under the ticker NCIQ, will be managed by custodians such as BitGo, Coinbase, Fidelity, and Gemini. Franklin Templeton’s ETF, trading under the ticker EZPZ, will have similar custodians. The SEC’s approval may signal a shift in regulatory attitudes toward crypto-based financial products, increasing mainstream adoption of cryptocurrencies like Ethereum.

2- Impact of Spot ETFs on Ethereum’s Price

Historically, ETF approvals have driven positive sentiment in the crypto market. However, the current macroeconomic environment could limit Ethereum’s price recovery. While Bitcoin ETFs have seen significant success, Ethereum-based ETFs have yet to achieve comparable inflows. U.S. spot Bitcoin ETFs have amassed over $36 billion in net inflows, while Ethereum ETFs have gathered around $2.4 billion since their inception.

Hashdex’s decision to avoid launching a dedicated Ethereum ETF indicates caution within the asset management community regarding demand for Ethereum-specific products. Nonetheless, the combination of Bitcoin and Ethereum in a single ETF could enhance exposure and demand for Ethereum in the broader market.

3- Futures Traders Turn Bearish on Ethereum

Data from CoinGlass shows a shift in Ethereum’s futures market sentiment. Open interest for Ethereum futures hit a new all-time high of $28.70 billion on December 17. However, the long/short ratio dropped to 0.9, indicating that more traders are betting on a decline in ETH prices. This shift from long to short positions reflects growing bearish sentiment in the market.

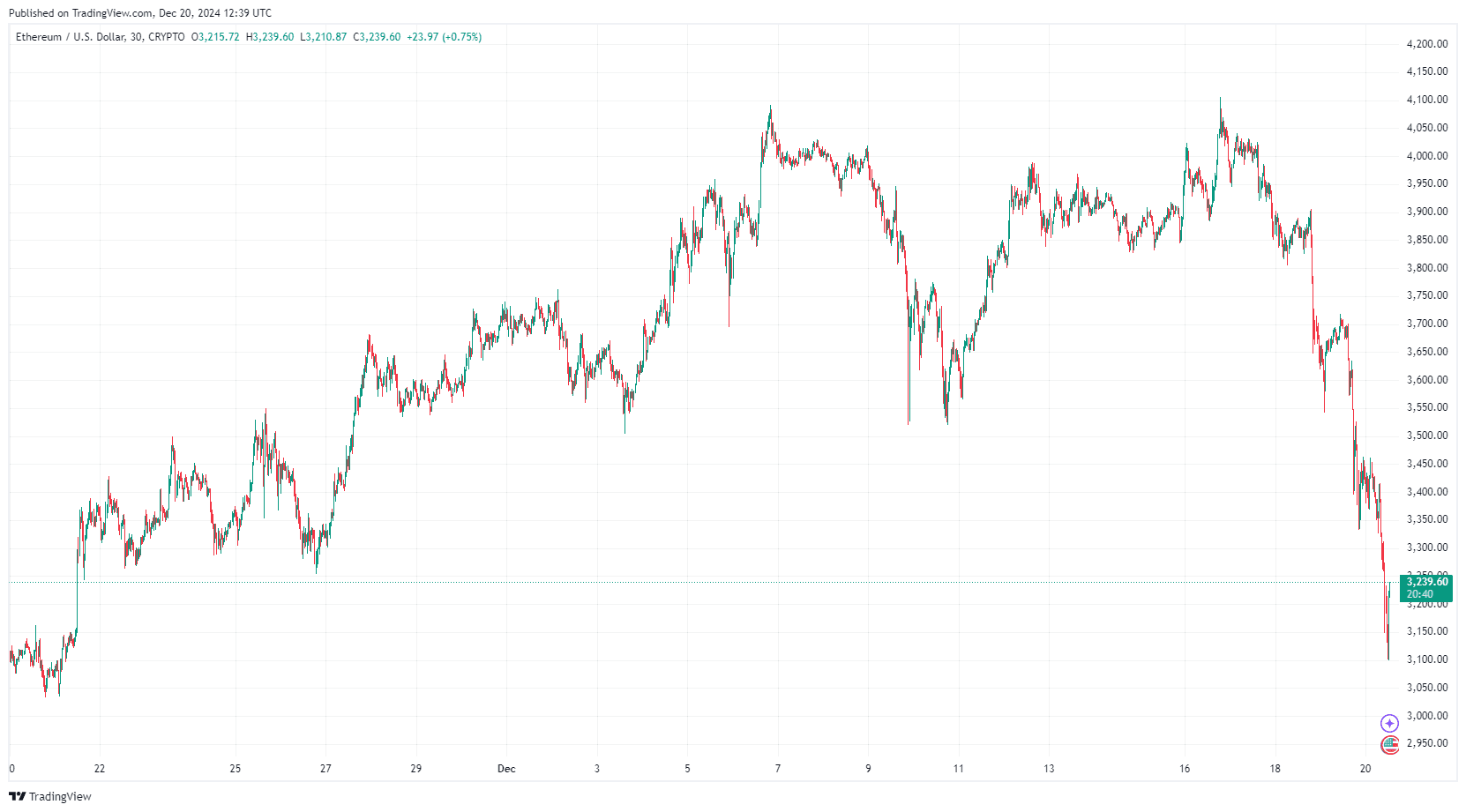

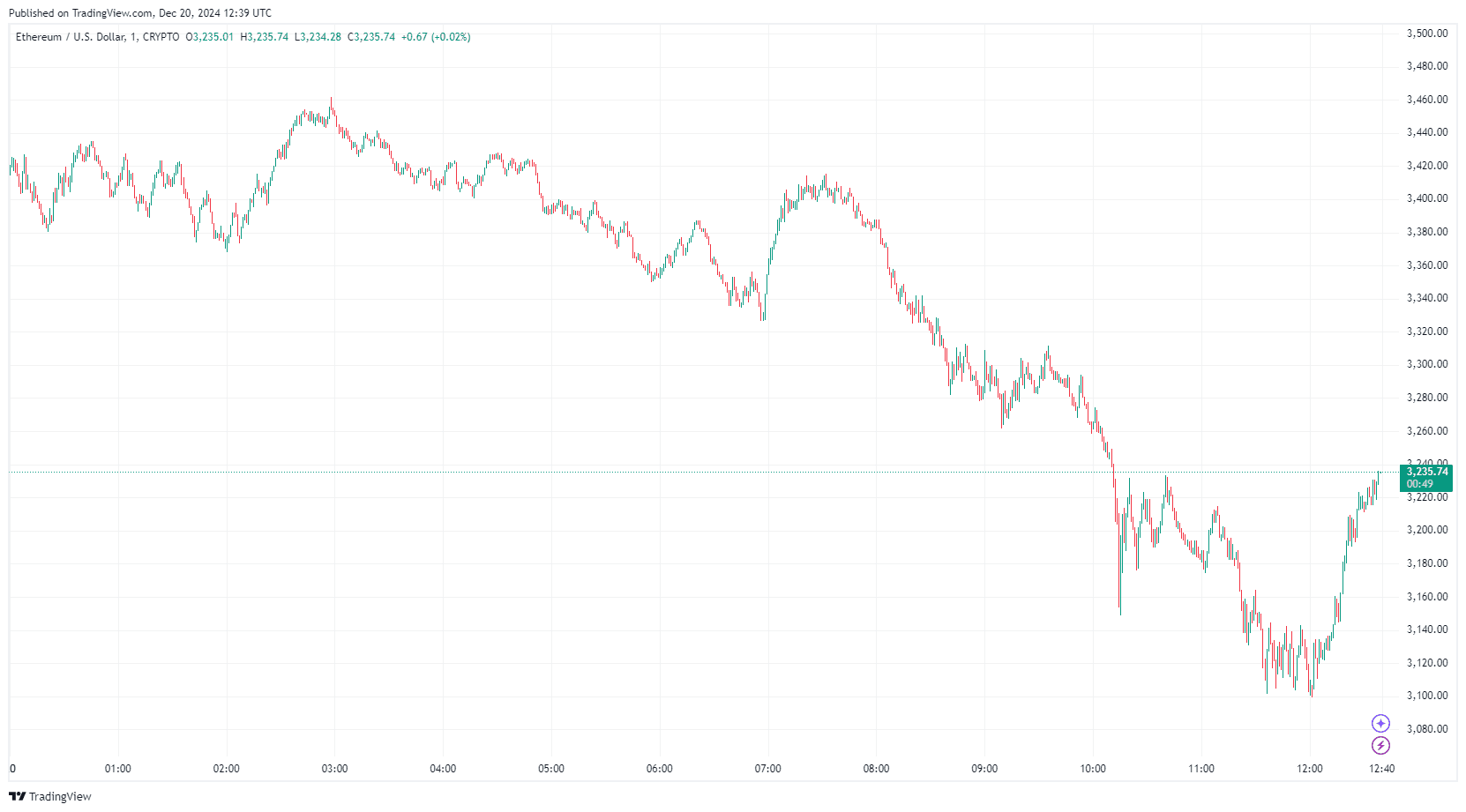

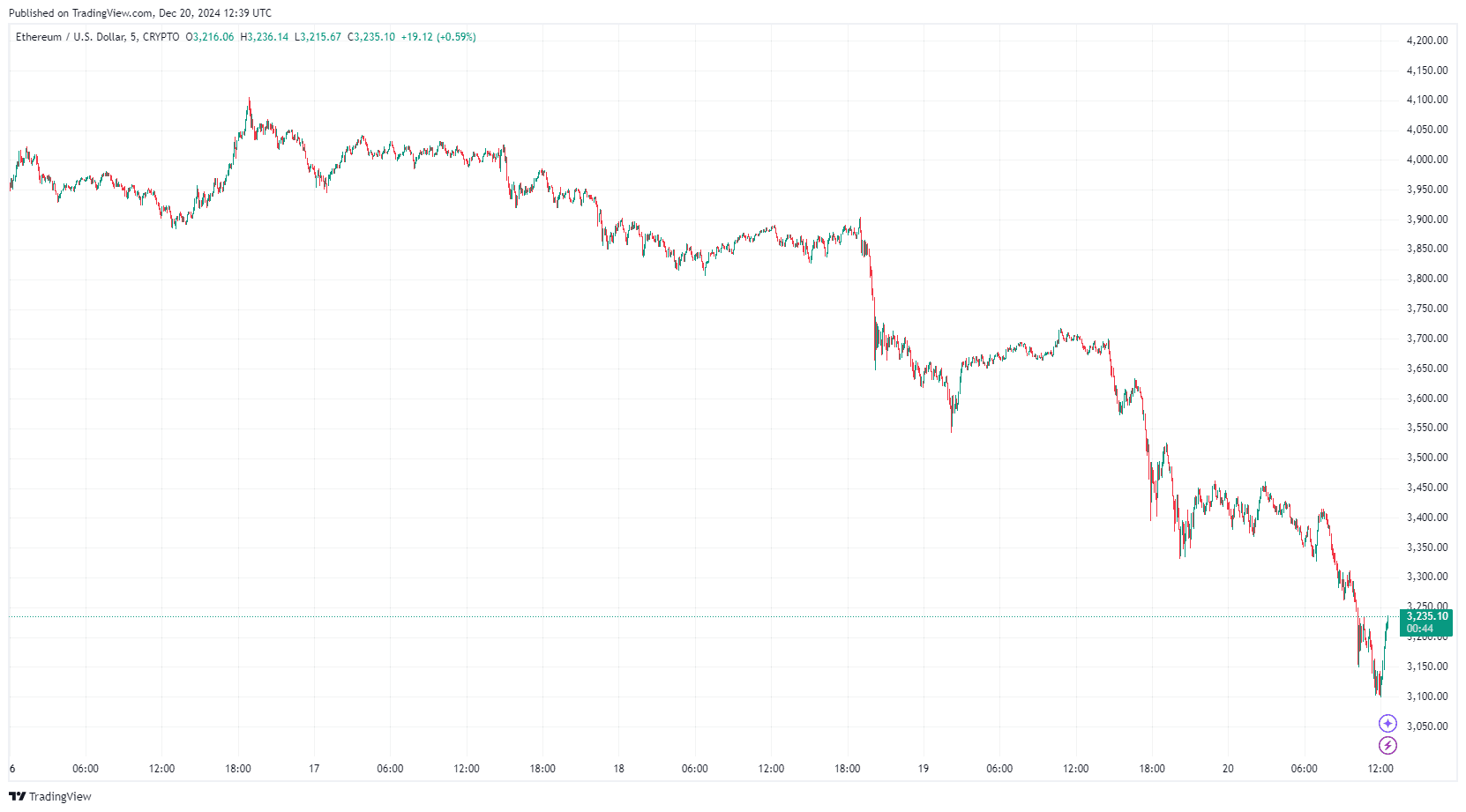

For the first time since November 6, the aggregated premium of futures positions turned negative, further highlighting the shift toward bearish sentiment. Traders have increased short positions, pushing the ETH price below the crucial $4,000 mark. Given these trends, Ethereum’s price could see continued fluctuations in the $3,500 to $4,000 range, as noted by market analyst Byzantine General, who predicted ongoing price action in this zone.

4- Ethereum Key Support and Resistance Levels

Despite the bearish outlook, Ethereum’s market structure still shows signs of higher highs (HHs) and higher lows (HLs). From a technical perspective, ETH may retest the region between $3,715 and $3,628. This range holds significant support from a 200-day Exponential Moving Average (EMA) and coincides with a fair value gap (FVG). If the price breaks below this zone, it could trigger further declines, with support near $3,500.

The cumulative liquidation of long positions between $3,700 and $3,800 has exceeded $500 million, making this range crucial for bullish recovery. On the flip side, short-leveraged positions are concentrated between $3,850 and $4,200, adding further resistance. If Ethereum’s price breaches these key levels, volatility is likely to persist.

5- Ethereum Price Performance – Why is ETH Price Down?

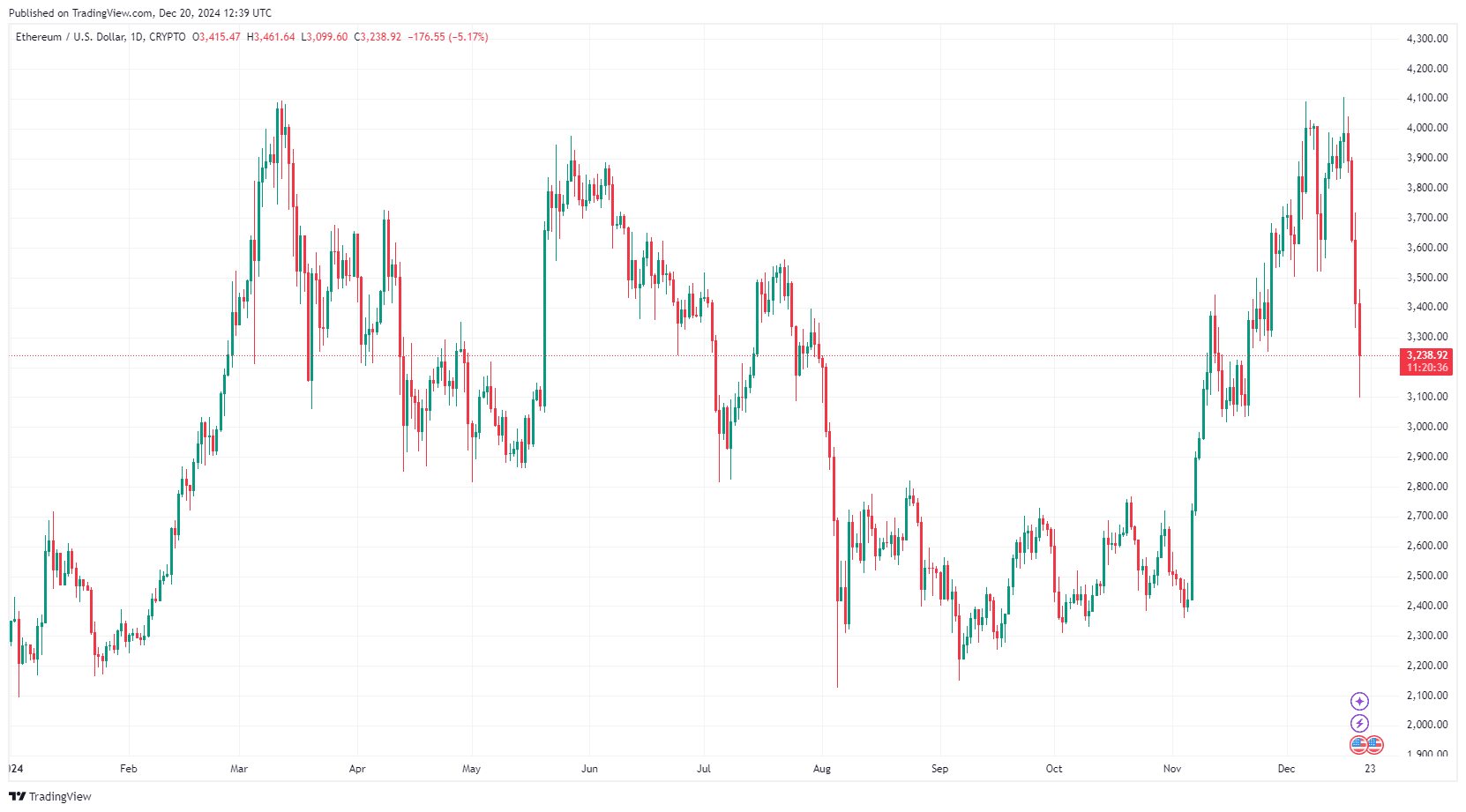

Ethereum’s price recently plunged from a high of $4,109 to a low of $3,260, marking a sharp 20% decline. The decline was triggered by increased market pressure following guidance from the U.S. Federal Reserve. The Fed’s announcement to limit interest rate cuts to only two in 2025 raised investor concerns about liquidity in the market, causing a broad selloff in the crypto sector.

This is not the first time Ethereum’s price has faced resistance at the $4,000 mark. Since 2021, this key level has been tested five times but remains a strong resistance point. In 2024 alone, Ethereum failed to sustain a breakout above $4,000 on three occasions. Analysts suggest this level remains a significant hurdle for any future bullish momentum.

Ethereum price decline, driven by Federal Reserve policy shifts and bearish futures market sentiment, has tested key support levels. The $4,000 resistance continues to act as a critical threshold for future bullish momentum. Meanwhile, the approval of spot Bitcoin and Ethereum combo ETFs by the SEC introduces new potential for mainstream crypto adoption and market stability.

With both bullish and bearish forces at play, Ethereum’s future price movement hinges on broader market sentiment, regulatory developments, and technical analysis. Investors will be watching how the launch of ETFs impacts Ethereum’s liquidity and demand.

cryptoticker.io

cryptoticker.io